Traders, I look forward to sharing some of my top intraday and swing focuses for the upcoming week with you all, including my entry and exit plans.

Last week, I observed several failed breakouts and leading names giving way to their 10- and 20-day SMAs, along with several other leading names beginning to extend to the upside. For the upcoming week, I will be more cautious and conservative than usual when considering new swing positions, until I see several names pull in and reset, including the overall market.

There was also been fantastic range and liquidity in small-cap gappers last week, so that will be a considerable focus intraday as well for the upcoming week.

Day 3 Exhaust in CRCL

First up is the recent hot IPO, CRCL, with incredible momentum to the upside over the previous two days. Arguably the best opportunity coming on Friday, with the long opp above Thursday’s high, a textbook consolidation and day 2 IPO breakout.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Going forward, however, I’ll be looking to switch biases soon and stalking a short position. Ideally, the stock gaps up near or above Friday’s high, or traps and pushes higher early Monday, only to fail to follow through.

Ultimately and ideally for an A+ setup, I’m looking for a day 3 blowout and exhaustion to the upside, along with a clear momentum shift. This would involve failing above Friday’s highs and holding below the intraday VWAP. For downside momentum intraday, multi-day VWAP, $108, and $104 will be key levels to keep an eye on.

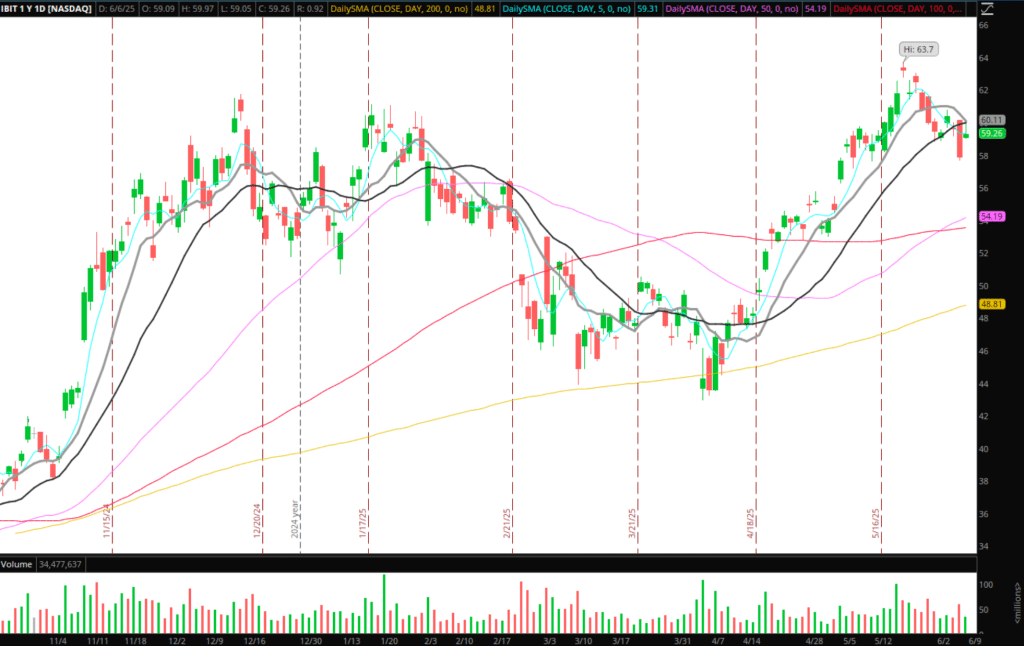

Continuation in Bitcoin

A nice steady pullback in Bitcoin, with a recent failure below key short-term moving averages. For a long to be considered, I would need to see IBIT break and hold back above $60, firmly reclaiming its 10 and 20-day moving averages. If Bitcoin can reclaim its relative levels, I’d consider going long IBIT against the LOD/10-day SMA for a swing long.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

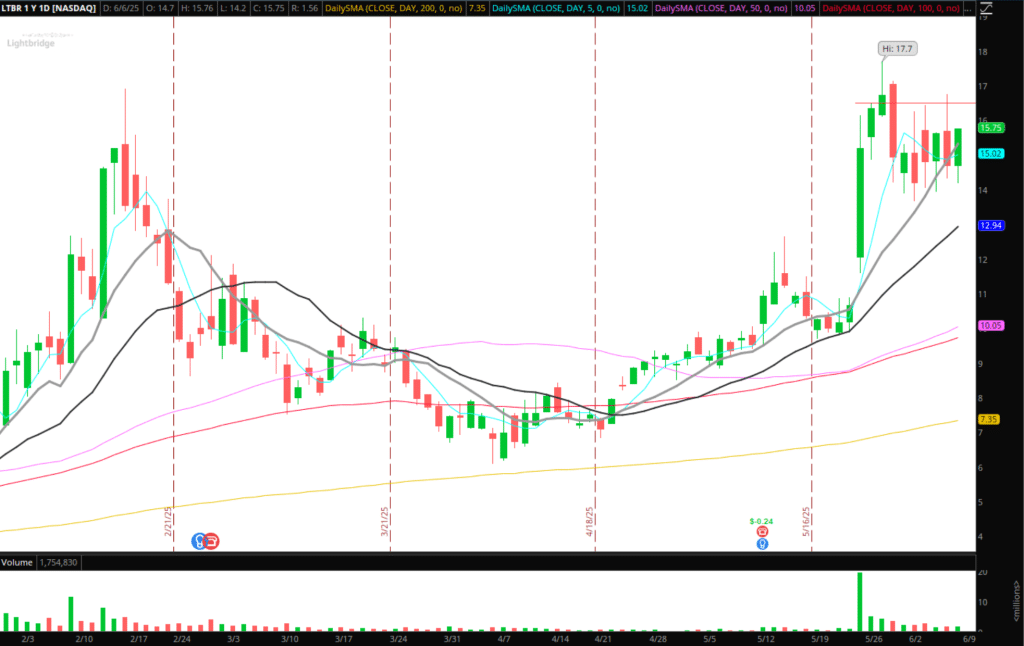

Continuation in LTBR

LTBR is a part of a red-hot theme right now, being nuclear power generation. Across the board, several names are positioning for momentum to the upside, including SMR, OKLO. The only reason I wouldn’t be aggressive on a swing entry here is that most of the names within the sector are extended from their mid- to long-term key SMAs.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Instead, I’d look to get long LTBR, for example, for an intraday breakout and potentially just hold a small core for continuation. So, if LTBR takes out $ 16.50 and displays some relative strength in its sector, I’d look to go long intraday against the 5-minute higher low, targeting continuation intraday and the recent high of $17.70s, or a measured ATR move. I’d be out of most into that area, and trail a small position.

Additional Names on Watch:

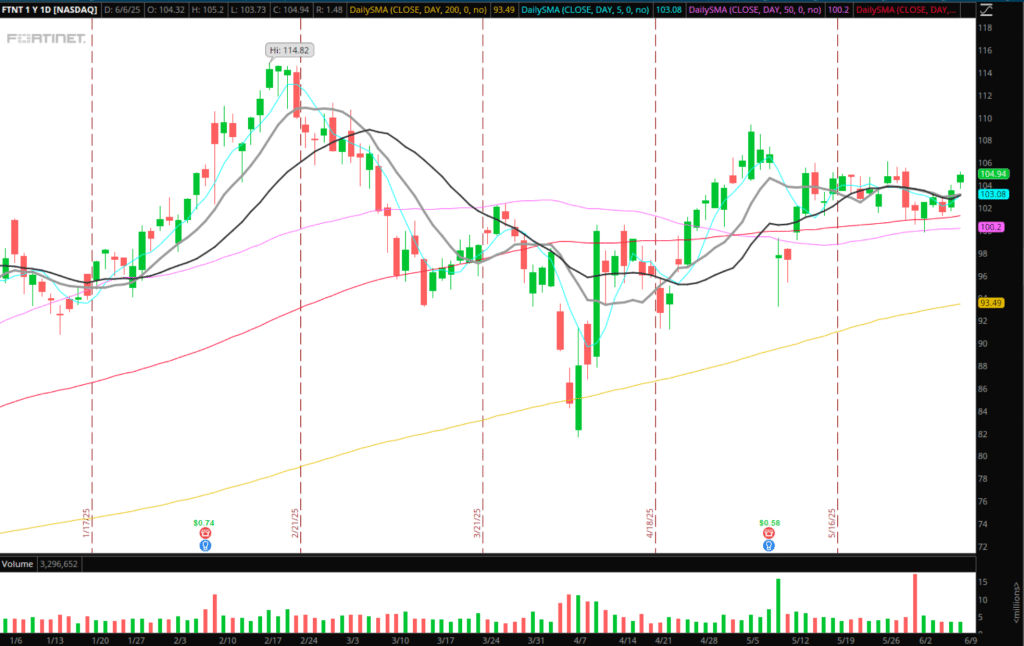

FTNT: Technical bullish formation, holding up firmly in a leading sector. Over $106, I’d consider going long against the LOD for a breakout.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

SEZL: Exceptional earnings continuation. However, like many other leading names, it is beginning to expand significantly. RSI approaching 90. Any failed continuation or failed follow-through on a gap or push higher or relative weakness and FRD, and I’d look for a pullback short. Ideally, $140+ first.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

RKLB: Potentially eyeing dip-buys against its 10-day SMA for a retest of 52-week highs.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.