Traders,

We’ve got a shortened week coming up, with an early close on Thursday and Friday, the markets are closed. Historically, during this period, I’ve seen several outlier moves with small caps, and in the latter part of the week, some lack of follow-through with large caps, for obvious reasons. Just something to keep in mind as we approach this shortened holiday week.

With that in mind, here are some of my top ideas for the week, along with outlines of ideal entry and exit scenarios.

A fairly lengthy list this week with a bunch of names on watch, so I’ll keep it briefer than usual under each idea.

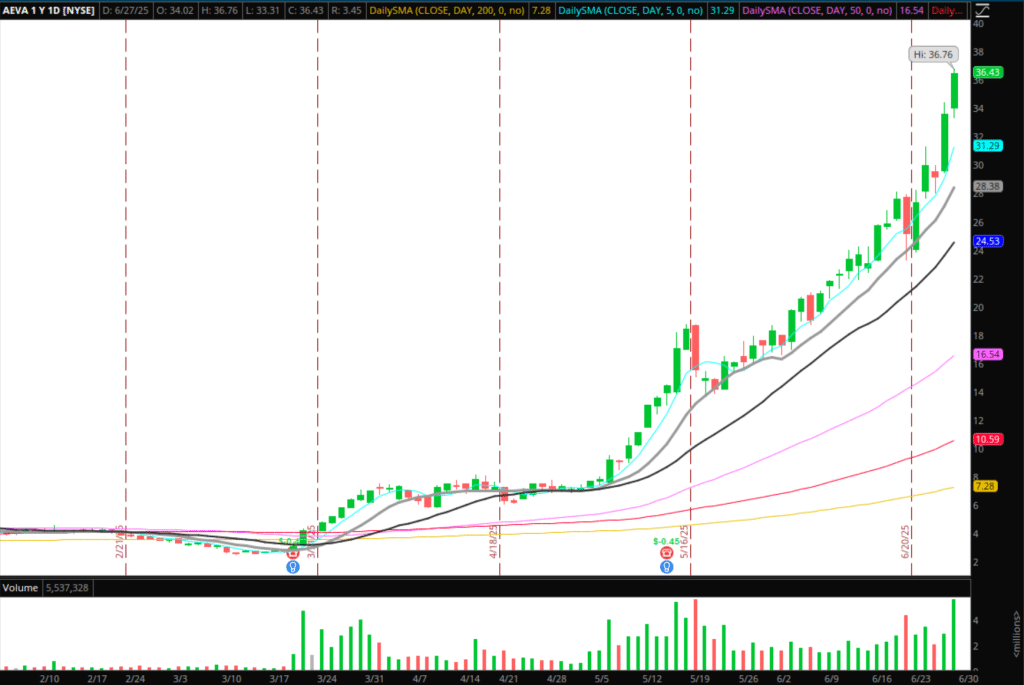

Exhaustion / Failed Follow-Through in AEVA

Exceptional move higher this year, up almost 700% on the year as of Friday’s close. Finally, with RSI in the 80s and volume and range expansion continuing into the end of last week, it’s nearing a potential short opportunity.

As always with such an opportunity, I’m not looking to be early. I’d like to see follow-through to the upside fail, as the stock gets vertical on a higher timeframe. What I mean by that is I’d like to see a gap fail to hold, and the stock open red for a FRD setup. Alternatively, I’d like to see a gap up, with exhaustion higher in the morning, targeting a lower high or a consolidation breakdown for a short entry. Lastly, an intraday parabolic and exhaustion move, where I would then look to short post a volume exchange. I wouldn’t be looking for a short position to last longer than up to two days here, potentially targeting a retracement toward the 5-day / low $30s, depending on the setup.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

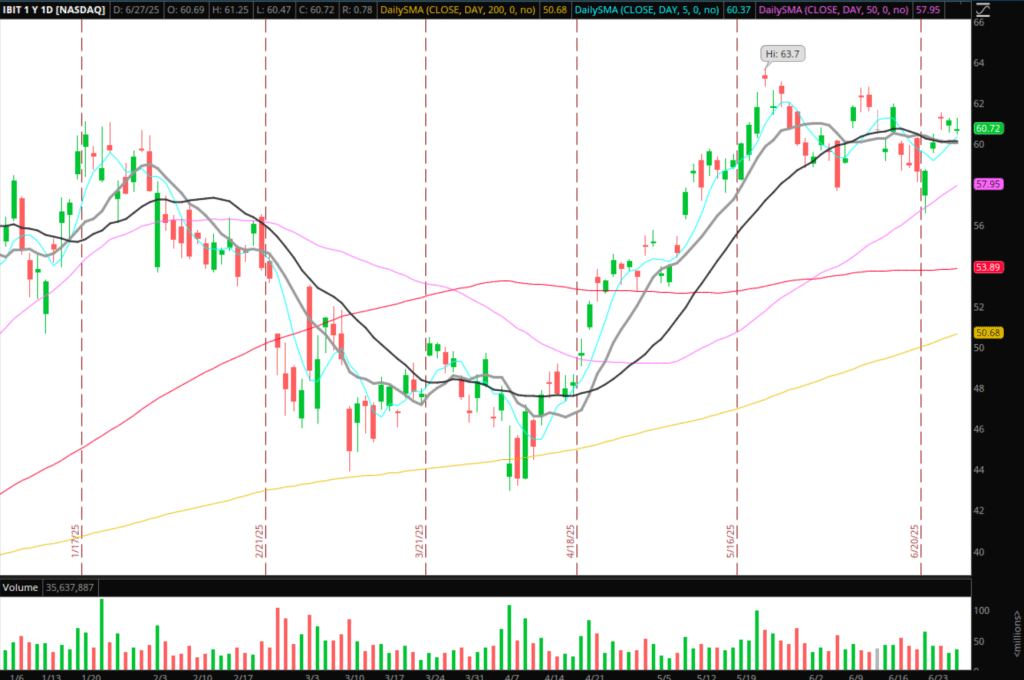

Breakout in Bitcoin / IBIT

Straightforward technical setup forming in IBIT / Bitcoin, with a lovely bull flag near highs. 10 and 20-day acted as support for most of last week. I’ll be keeping a close eye on IBIT to see if it can push above last week’s high and hold over $62 for a potential momo entry targeting a move toward the highs, with a LOD stop. Should the range open up and it experiences some follow-through, I’d be open to a higher timeframe swing.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Consolidation Breakout in NBIS

Very similar plans to last week in NBIS. It continues to base extremely well within reach of highs. The stuff on Wednesday, followed by a sharp reclaim, only gets me more bullish for follow-through if this were to push over $54. So, similar to last week, I’d be looking for a momentum long above $54 for a breakout to new highs.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

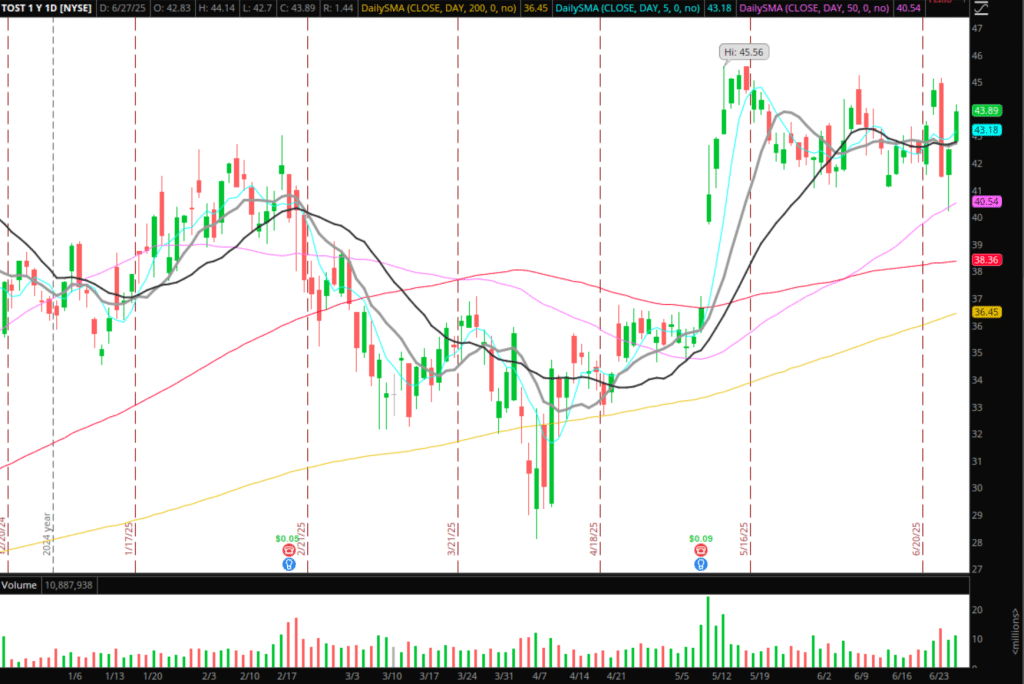

Consolidation Breakout in TOST

Similar to NBIS, after the failed move lower last week, this is on watch for a move higher above last week’s high near $45. If this clears the KL and bases above, indicating strong buying interest and newfound support, I’d look for a long entry versus the day’s low, and open to a long swing.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

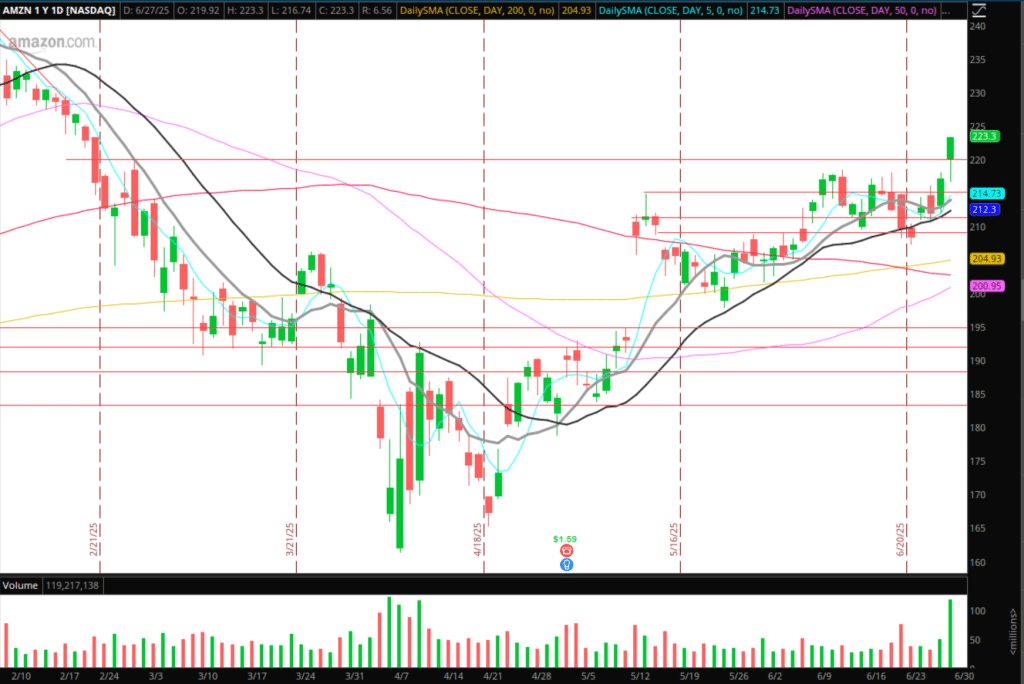

Continuation in AMZN

The ideal entry in AMZN was on Friday over $220 versus the day’s low for a long swing. However, if the stock pulls into the low $220s, confirms a higher low, and resistance turns into support, that could provide another ideal entry point for a long swing. XLY had a lovely breakout with AMZN being the top holding of the discretionary ETF—another potential vehicle for the idea.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

And lastly, additional backburner ideas:

LCFY – Small float and decent staying power on Friday. I’ll have alerts set in case this pushes back toward supply near $10 and fails to follow through for a reactive short. Alternatively, for midweek, it might qualify for a potential liquidity trap if it reclaims $11 – $12, where I’d be open to a long intraday.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

CYN – On watch for a potential day 3 if it pushes back into the low $20s and stuffs for a reactive intraday short.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.