Traders, As always, I look forward to going over some of my top intraday and swing ideas for the upcoming week.

Now, with tensions and the conflict in the Middle East unpredictable and seemingly escalating this weekend, any breaking news or significant developments could render all these plans obsolete. So, as always, I’ll only initiate any or all of these plans if price action confirms.

Let’s start with my favorite idea for the week.

Exhaustion / Blow-Off Top in CRCL

Coming into the week, this is my top idea. From its IPO day low, it closed over 300% up on Friday in eleven trading days. However, as far as I am concerned, Wednesday’s breakout was day 1, with Friday being day 2 (Thursday was a public holiday).

So, now, given the volume and range expansion over the previous two days, it’s finally setting up for a potential day 3 blow-off move intraday off the open, in the premarket on a gap and exhaust, and a lower-high and/or consolidation breakdown. AKA, an A+ Mean Reversion Setup.

As I’ve gone over several times recently in my IA meetings, in situations like this, I prefer to be late rather than early. Currently, CRCL is 100% on the front side; it hasn’t broken below its VWAP, it hasn’t breached its uptrend, and it hasn’t exhausted and failed to follow through thereafter.

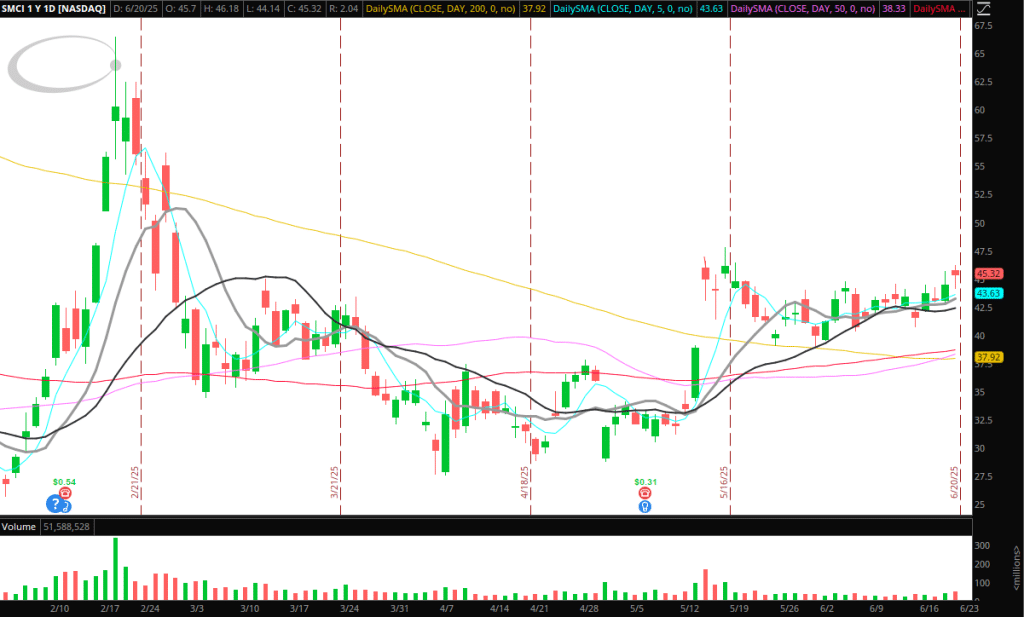

It’s nearing that point, and it’s in the final innings, but it could still go far higher until it provides a short opportunity. So, until then, it’s waiting patiently on the sidelines for confirmation. So, in an ideal world, we get a significant gap higher on Monday, followed by exhaustion and volume exchange, and then A+ entry on a lower high thereafter and/or consolidation breakdown. For previous examples of such entries, just refer back to MSTR, SMCI, and even CRWV’s FRD setup on June 5.

However, if the overall market gaps significantly lower, perhaps due to geopolitical reasons, I might also consider stalking CRCL for a first red day setup.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Bull-Flag in NBIS

One of the better-looking charts from a momentum perspective right now is NBIS, in my opinion. After racing higher, playing catch-up to CRWV, and getting discovered by Main Street, NBIS has now quietly pulled back and consolidated. Given how extended it is already from its mid to long-term moving averages, like 50 and 100-day, this wouldn’t be a multi-week swing trade. Instead, after some further pull-back and consolidation, if NBIS reclaims and breaks above its 10-day SMA, I’ll get long for a multi-day swing trade, with a LOD stop. It has demonstrated excellent momentum on breakouts in its latest cycle, so I’ll be looking for a 3-day hold on a breakout, exiting using an ATR strategy while trailing against the previous day’s low.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Additional Names on Watch and General Thoughts:

HIMS: A lovely cup-and-handle pattern is forming here. If I were short after 6/3’s action, I’d be getting nervous right about now. Not a main priority for me, given the real entry was closer to $60, not $65. But if this bases above $65 intraday, I’d be open to buying breakouts for momentum and a potential squeeze through $66 and $67 for intraday action.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

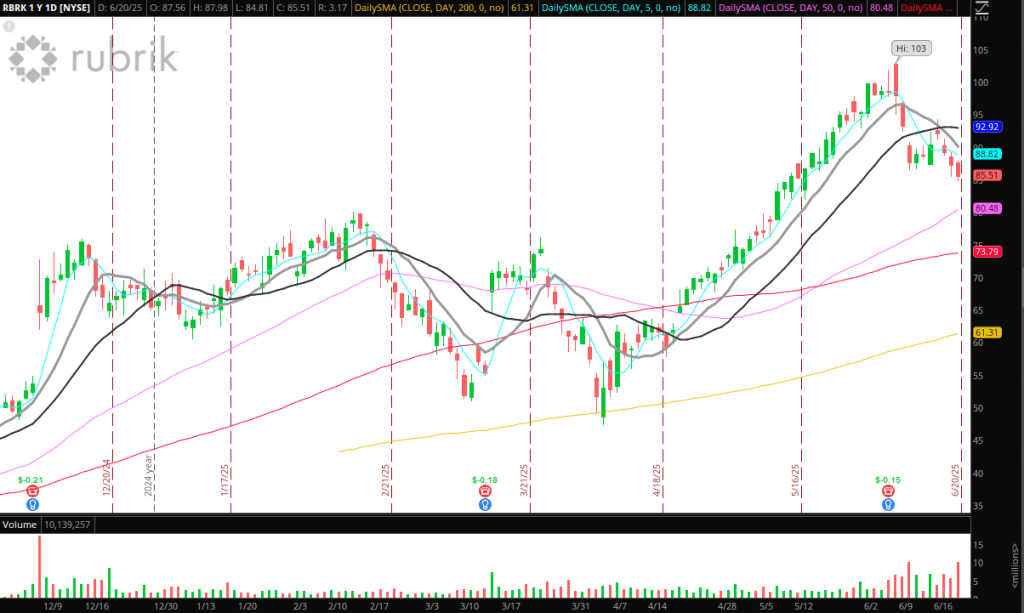

RBRK: technology software leader pulling back sharply now. On watch in the coming days and weeks to see if this can reclaim and base at/near its short-term moving averages, confirming a higher low and providing a long entry within its higher timeframe uptrend.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

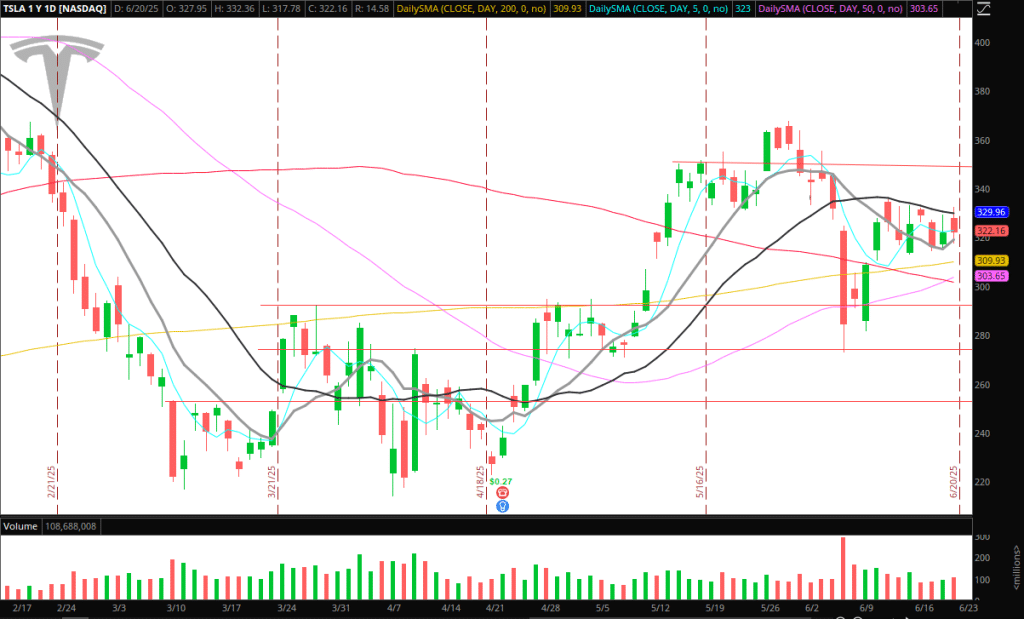

TSLA: Tesla remains on close watch for a swing long entry if we clear the 20-day SMA and hold above $ 335ish.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

SMCI: Struggling to clear its resistance. I’ll potentially get long if we base above $45 and see resistance become support, along with relative strength against its peers and sector.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Overall, I’m seeing leaders within leading sectors, for the most part, remain extended or begin to pull back. In any case, neither provides an entry yet for a swing. Recent breakouts have failed to follow through, as seen with ALAB last week. Right now, I think it’s all about monitoring the flow, being extremely patient, and allowing the market to dictate your positions rather than forcing positions that aren’t working in the current market.