Traders, I hope you’ve all had a wonderful weekend.

I look forward to sharing several of my top ideas with you for the upcoming week, including swing and intraday potential trades, as well as exit and entry scenarios.

So, let’s jump right into it.

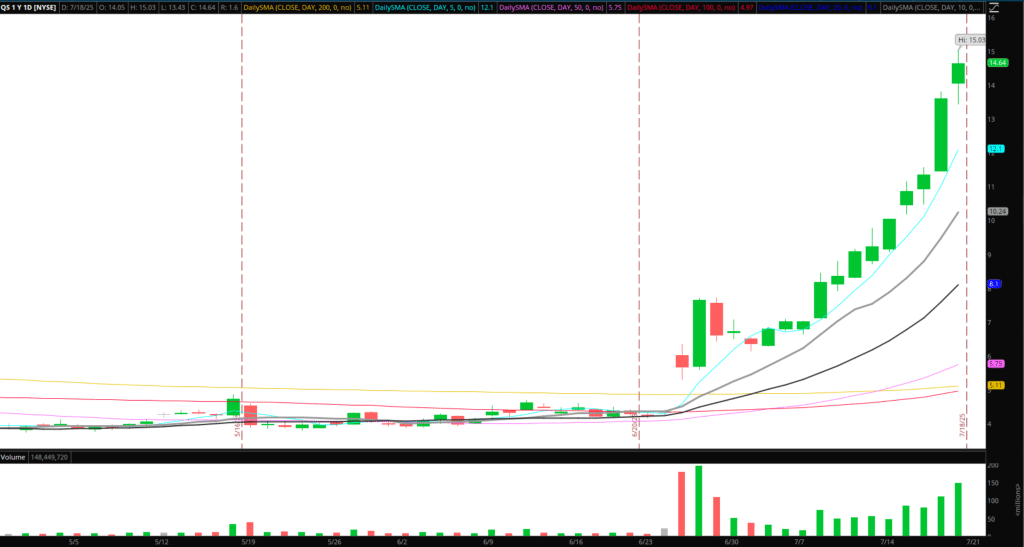

Pullback in QS: Incredible run and momentum over the previous weeks in QS. But, with the RSI closing in the 90s on Friday, significant range and volume expansion over the previous two days, and a major expansion from moving averages, I’m now leaning firmly on the short side.

It’s also important to remember earnings mid-week for the stock. Now, given the earnings, regardless of my personal bias, I won’t be looking to hold this for a swing. Rather, I’m just looking for a profit-taking, one-day selloff event. Now, I think we’re in the final innings, considering the price action over the previous two days, but I’ll only short once I see a major change of character.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Specifically, to get short I need to see one of the following: the stock experience failed follow through near a key level (HOD for example) and holds below vwap (change of character from previous days). Or, I’d need to see a First Red Day setup materialize. Lastly, and best of all, would be a gap up and blow off in the morning.

Regarding a mean reversion/pullback trade, I am monitoring JOBY for a similar opportunity, although I rate it lower than the setup in QS.

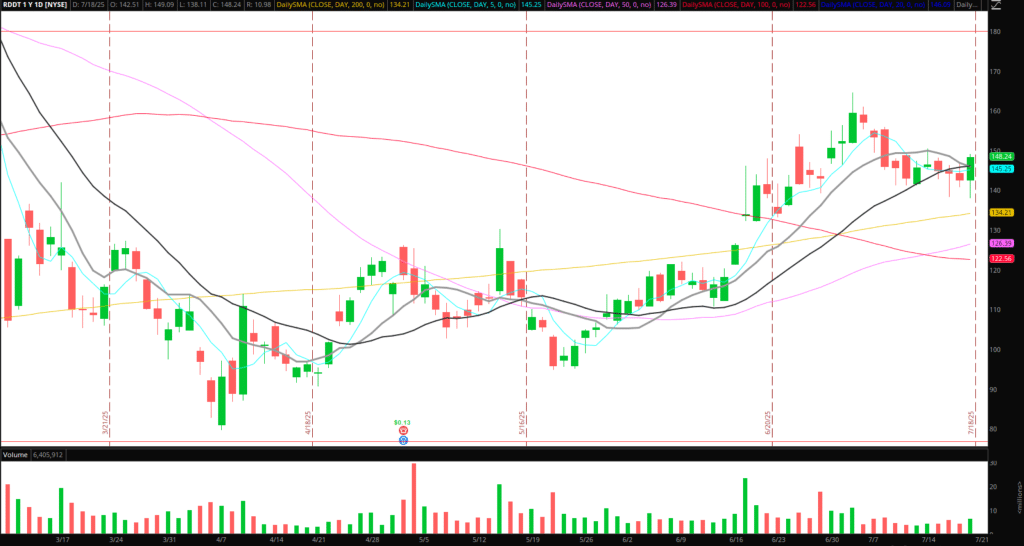

Continuation in RDDT: Lovely chart forming across higher timeframes. I specifically like the 200-day SMA reclaim, followed by a tight consolidation at converging 10-20-day SMAs. If the stock can push and hold above Friday’s high and intraday VWAP, I’d consider going long against the LOD for a multi-day swing.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

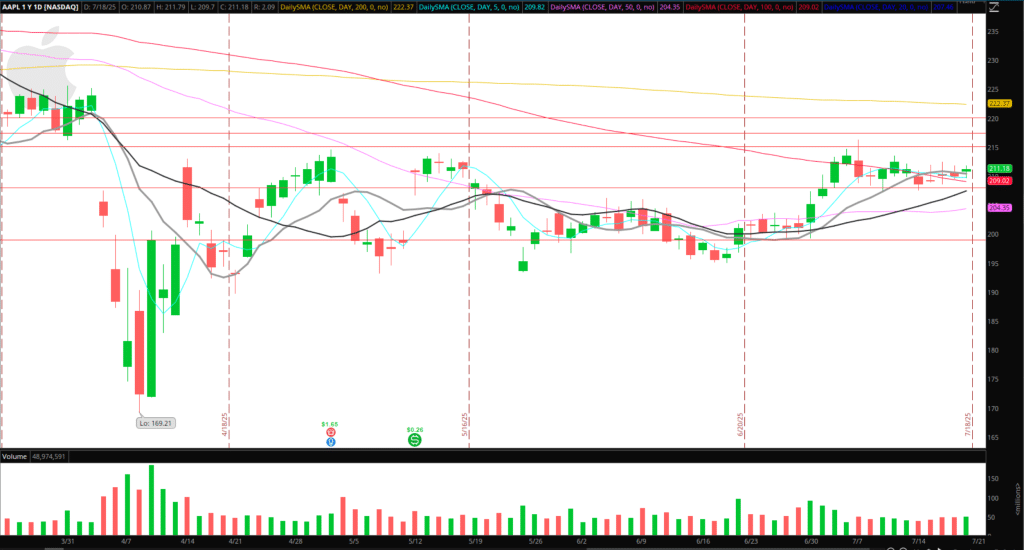

Breakout in AAPL: Lovely setup forming in AAPL as well. The only difference between this and RDDT is that AAPL remains below its 200-day SMA. Given that, I wouldn’t be aggressive, considering the overall trend and overhead. But, if AAPL can take out last week’s high and display notable relative strength on the day – a significant change in character – I would go long against the LOD for a multi-day swing long.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

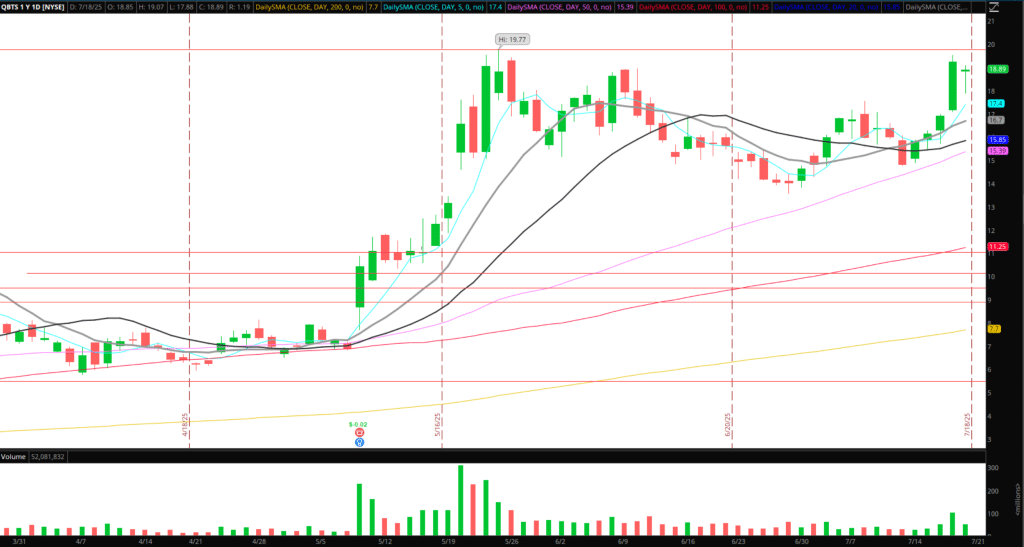

Intraday Momentum Breakouts in Quantum (IONQ, QBTS): The two best-looking charts in the industry for me are IONQ and QBTS. Now, fundamental bias aside, from a technical perspective, with serious momentum and clean levels, I’d certainly be open to momentum intraday longs on a clean breakout through significant resistance. So, for QBTS, that is around $19.70. For IONQ, Friday’s high is the KL to watch for volume and firm support above.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Additional Ideas:

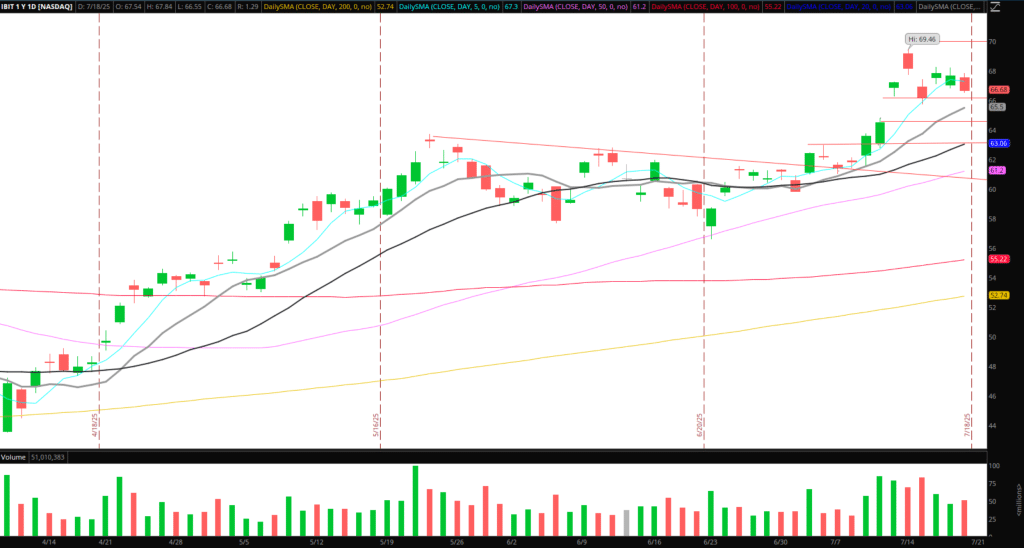

Bitcoin / Ethereum: Regarding Bitcoin, crypto, and crypto-related names – Nothing has changed week over week for me. Same thoughts as last week.

*Please note that the prices and other statistics on this page are hypothetical, and do notreflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

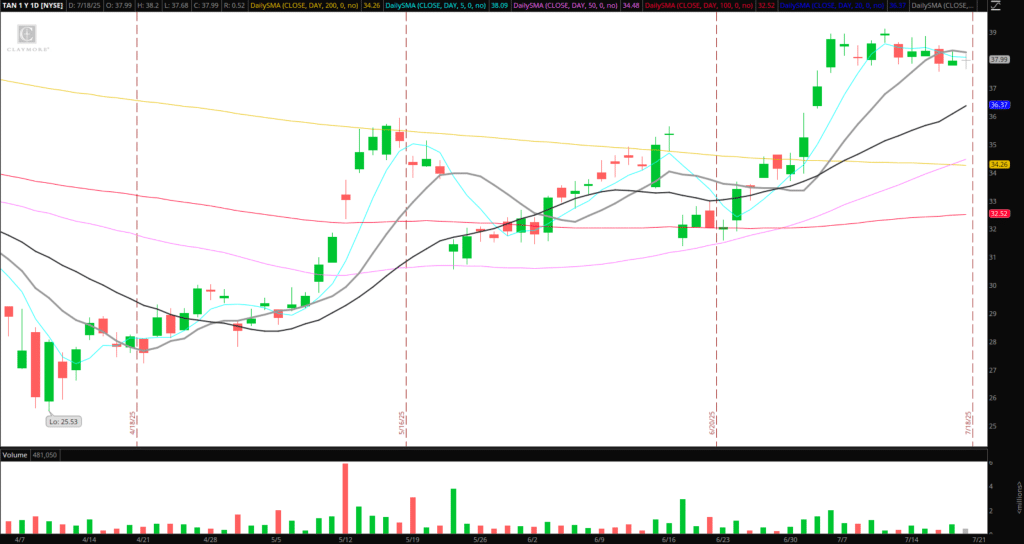

Solar Names Acting Well: TAN, SEDG, FSLR are holding up exceptionally well and forming bullish bases. On watch in the coming days/weeks for a breakout entry.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Pops to Short in TELO: I’m doubtful, based on its history, but if TELO pops up early next week $2.5 – $3, I would look to re-short post failed follow-through.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.