Traders,

Happy New Year!

I’ll be easing back into things this week, after a brief vacation.

Now, without further ado, let’s get right into this week’s watchlist:

Blow-Off in SIDU: SIDU’s reclaim on Friday was the ideal scenario. Bearish sentiment has been overwhelming for this small-cap, driven by fundamental and dilution biases. But it’s kept trapping shorts and ticking along. I am short-biased, but I have yet to short it. To constitute an A+ short, I need to see this blowout, stubborn shorts, and then fail to follow through thereafter.

Specifically, I’d like to see another day or two of gap and continuation, along with range expansion—alternatively, a significant gap and a blow-off in the morning before failing to follow through, or an FRD. Once the top is in, I’ll focus on shorting lower-highs / failed re-tests of prior resistance, targeting a move back toward $3, with a core position against the prior day’s high or multi-day VWAP reclaim.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

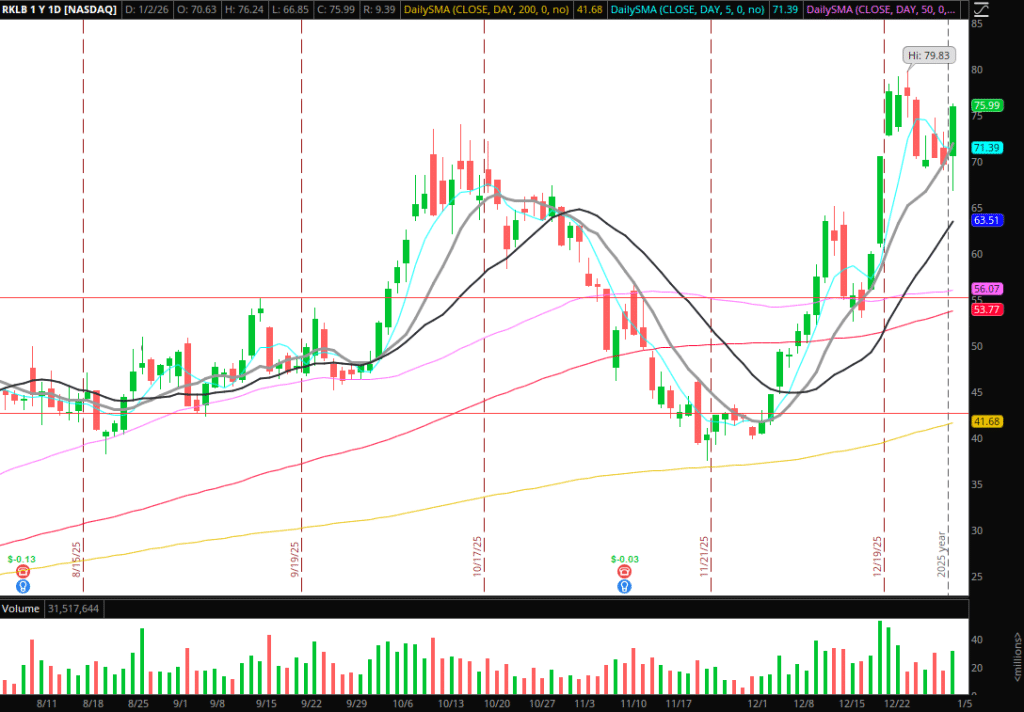

Continuation in Space/Defense Stocks: Several names stood out last week for their relative strength and bullish technical positioning.

Rocket Lab (RKLB) is one of the standout performers. On a higher timeframe, it held key support near $70 in the short-term, which was prior resistance from October. If a dip into the multi-day VWAP firms, or if this bases above Friday’s high, I might look to get long for a momentum long trade through $80.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

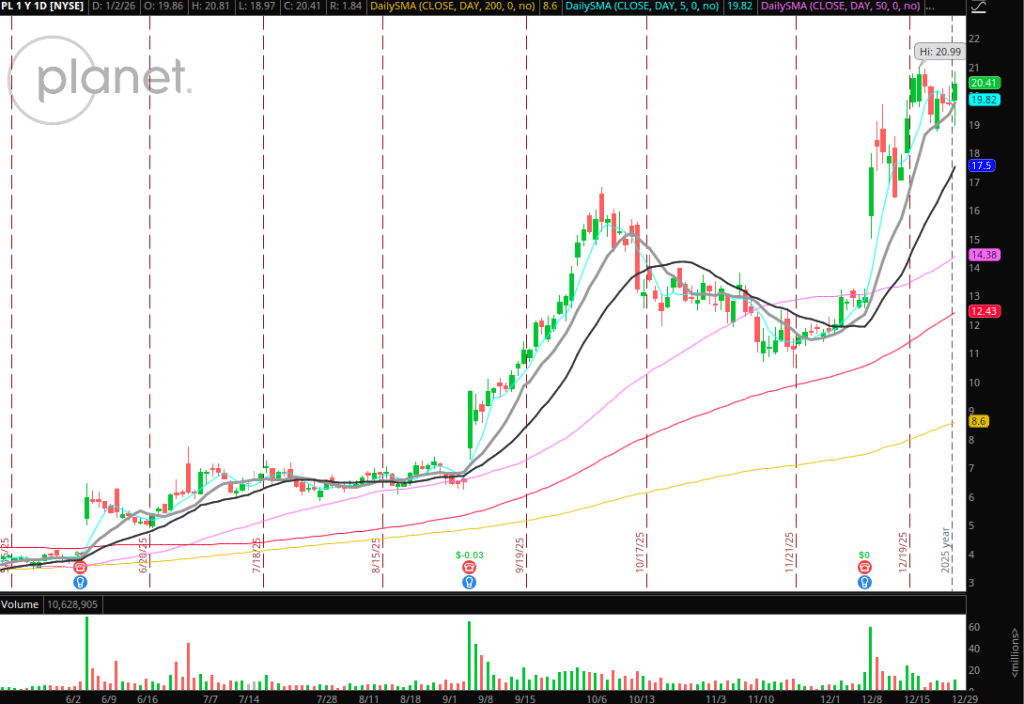

PL is another name within the theme that is holding up exceptionally well. Similarly, it’s finding support and building a base near prior resistance around $20. I’ll be interested to position long if the relative strength continues and the stock can push above Friday’s high. My stop would be LOD for a multi-day continuation long swing.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Other names within the sector that I will continue to monitor: ASTS, RDW, LUNR.

Uptrend Development in BABA: It’s not yet clear how the news re: Venezuela will impact the market this week, or whether it could negatively impact Chinese names. But as it relates to recent strength (BIDU breakout) in emerging markets and Chinese stocks, BABA is looking great. Specifically, I love how the stock recently pulled back toward prior resistance on the higher timeframe near $148 and caught a bid. Next up would be a hold above Friday’s high / consolidation breakout after multiple days of consolidation/breakout above $160 and hold. I’d trail against the prior day’s low if it sets up.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Additional Names on Watch:

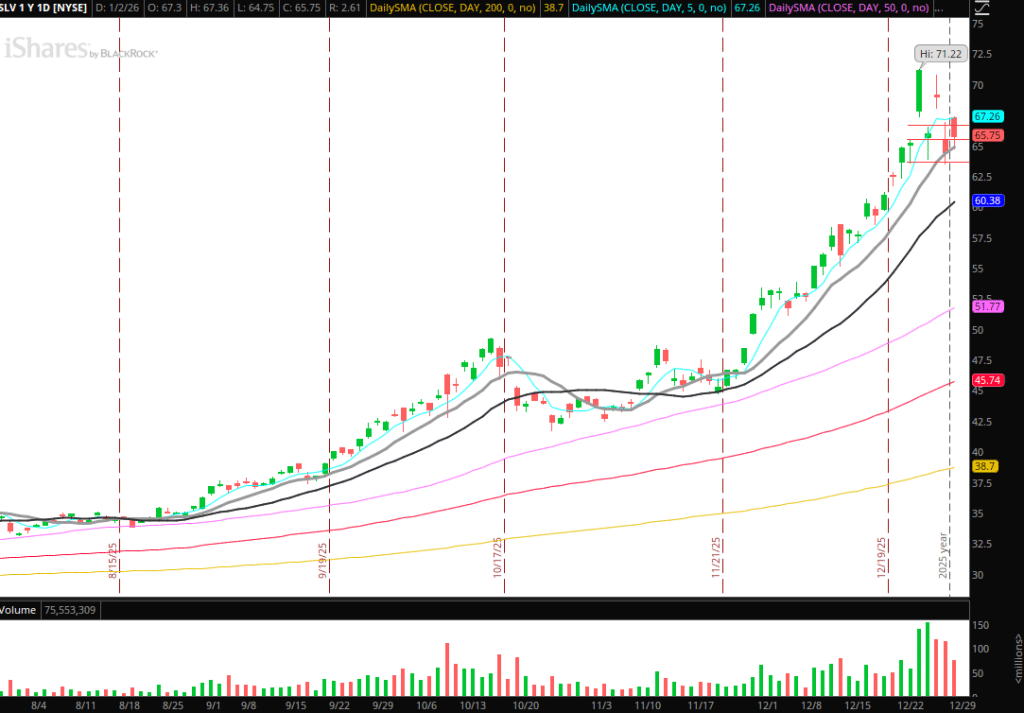

SLV Momentum Shift: Tight consolidation after the A+ parabolic trade in SLV. Significant support has now emerged near the 10-day SMA and $63.50 zone. I’ll be closely watching that area to give way and position short. Alternatively, watching $70 in SLV for a potential failed follow-through short or momentum higher.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

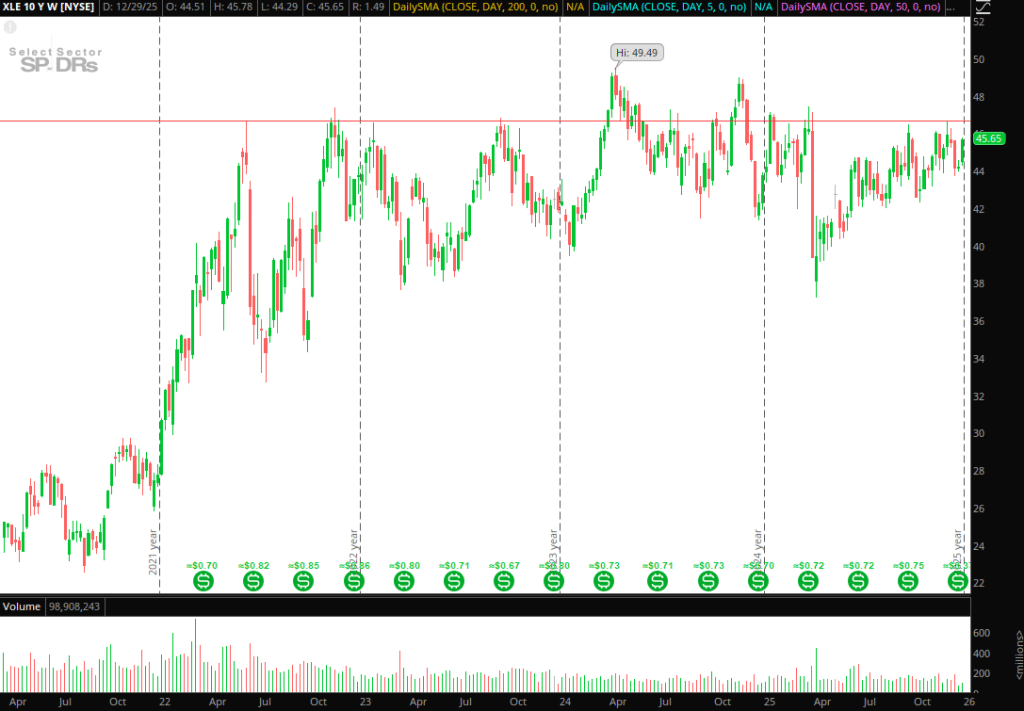

XLE – Energy is Coiled: The energy sector has been range-bound for quite some time now on a higher timeframe. If the news over the weekend catalyzes the industry in the coming days or weeks, I want to be ready. Several names of interest to me: XLE (sector ETF), OXY, COP, XOM.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

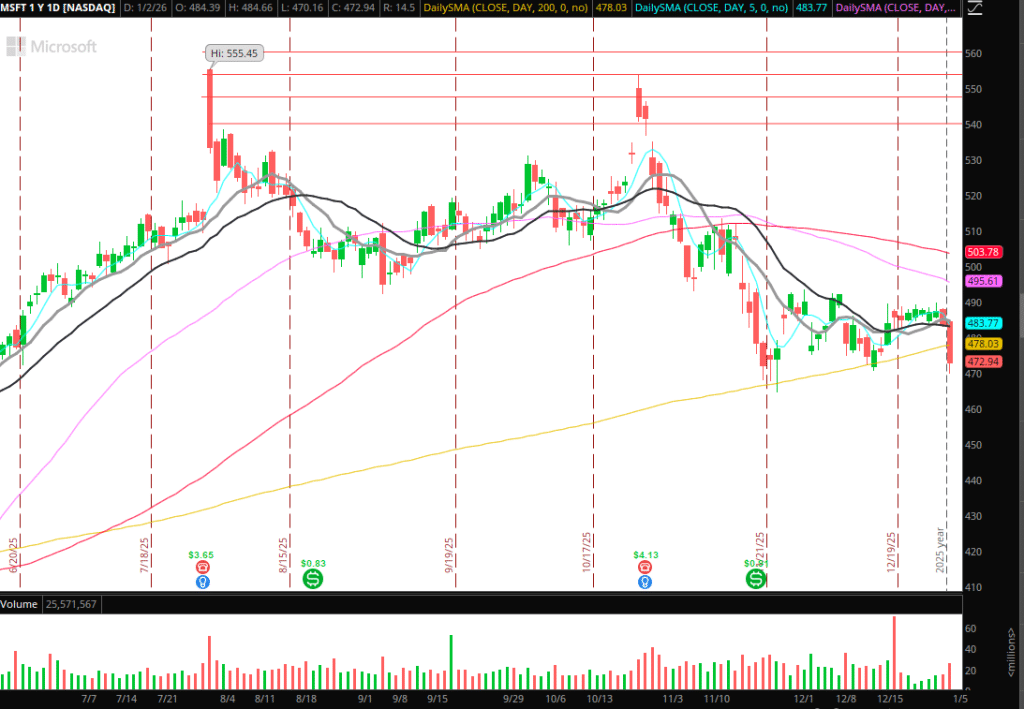

MSFT: Bearish look here after giving way to the 200-day SMA on Friday and closing near lows. On watch for sustained relative weakness and momentum short scalps sub Friday’s low and higher timeframe support.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.