Traders,

A friendly reminder that the market is CLOSED on Monday.

It’s a weekend full of travelling for me, so I’ll keep this week’s watchlist fairly concise.

Mirroring my thoughts from my recent IA meeting, it’s certainly not an easy tape right now. For me, the focus continues to be on tighter risk management, locking in gains and reducing risk when positions work in my favor, and playing a bit of defense.

Once I notice greater follow-through in key areas of my setups and strategies, I will look to get a bit more aggressive and play offense.

Thoughts on Silver: Silver, along with small-caps, appears to be the real pain point of traders right now. With regards to Silver, I did well to be positioned for the selloff on both Thursday and Friday. But I maintained a core position that, of course, did not follow through. That’s been the theme – V-shaped recoveries. Not easy.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Alright, going forward, I have a very small position left on the short side. I’m looking for failed follow-through in the current consolidation, and would look to add my size back should we break below major support, which is now at $87 give or take in futes. If /SI breaks out and holds over this resistance, I’ll be flat the position.

Pops to Short in VERO: Friday’s small-cap runner. Remember, with an IWM leading the market and following through on its breakout, small-caps are unsurprisingly catching many shorts off guard right now. With VERO, however, there is now a ton of overhead resistance – something that did not exist on day 1. Therefore, if the stock pushes back into $8+ and fails, I will look to short against the HOD. I’ll add, on that note, while I may have scaled on the short side for such plays in the past, nowadays I wait until there is a clear level to trade against before initiating a short. In a tape like this, things can push further than you think, especially if everyone is trying the same thing.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

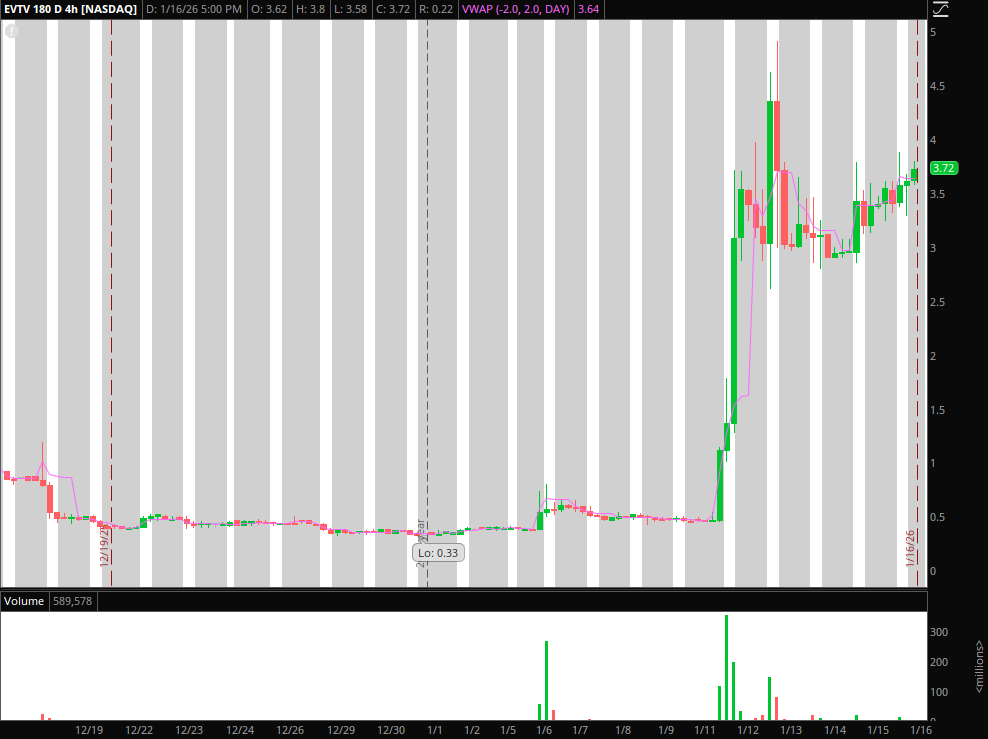

Liquidity Trap in EVTV / Failed Follow Through: Fantastic consolidation above day 1 high, over last week. Going forward, I will be monitoring this for unusual volume over $4, for a long entry against the LOD or consolidation support intraday. Thereafter, I’d look to quickly sell the long on any extensions and focus on flipping my bias to the short side once the crowd passes.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Additional Watches:

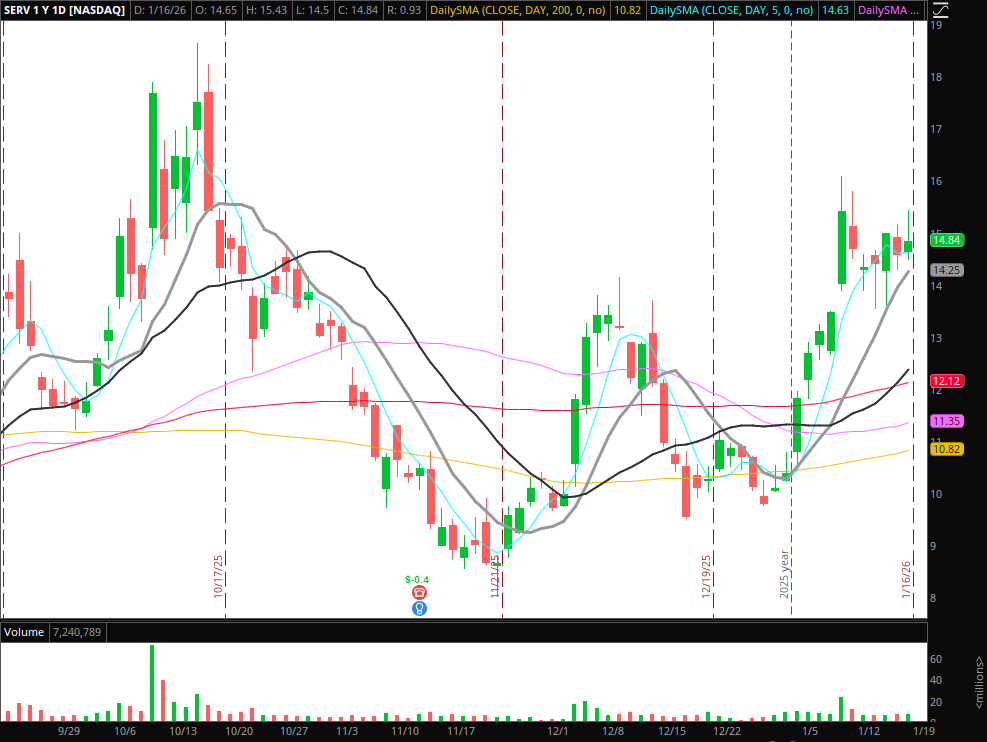

SERV: Consolidating above its 10-day SMA. Looking for further build, strength, and a breakout above last week’s high to stick.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

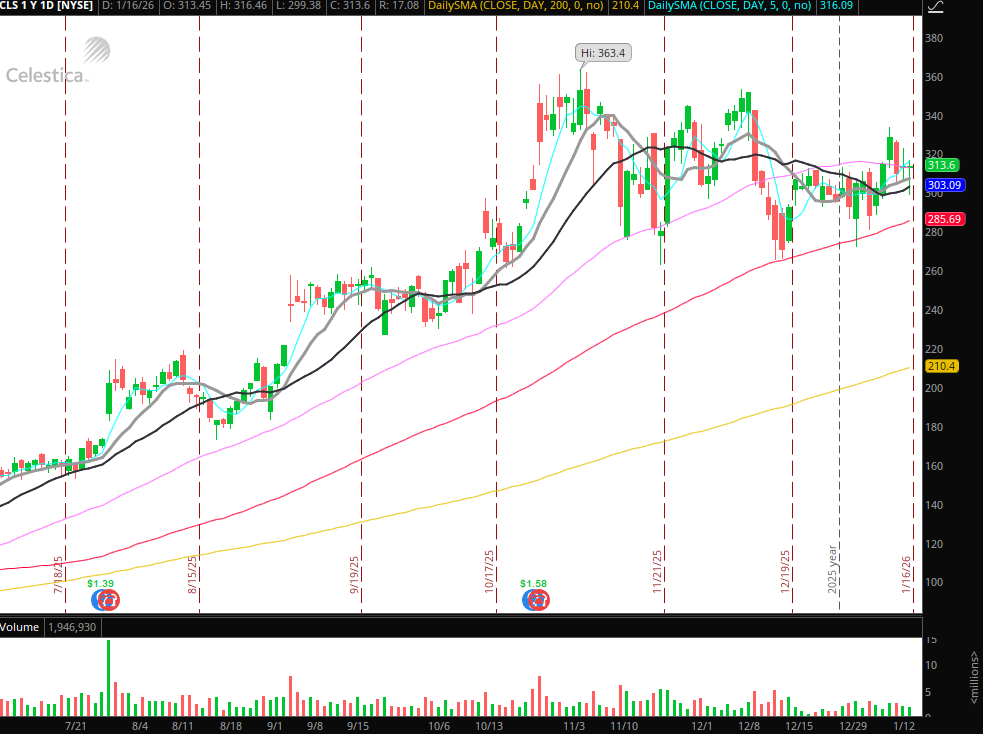

CLS: Consolidating well, looking for a breakout entry, potentially starting near $320.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

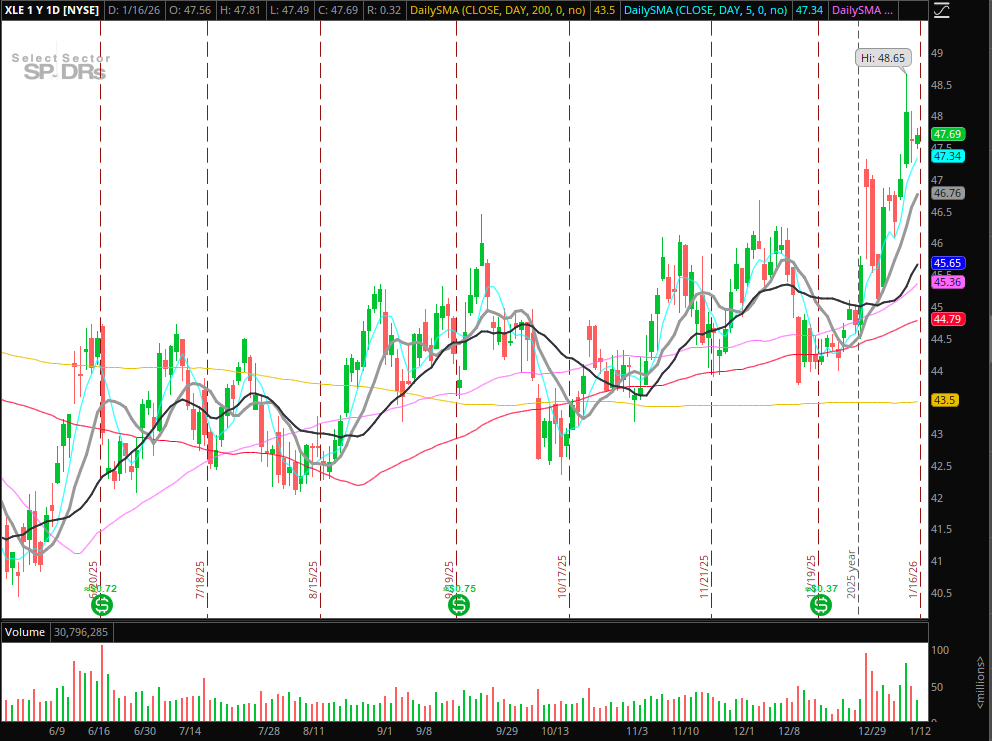

XLE: Same thoughts as I went over in my recent IA meeting; I am continuing to monitor the sector and leading names for a multi-month swing long entry should levels confirm.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

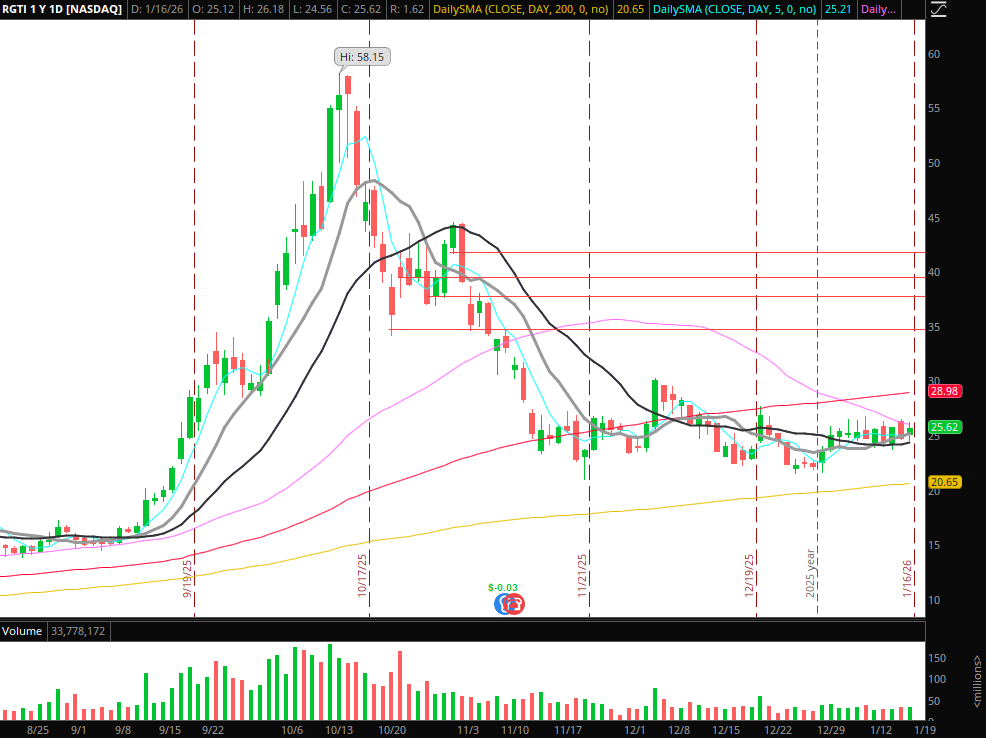

Monitoring Quantum Names: I am keeping a close eye on the quantum sector amid tight price action. In names like RGTI, QUBT, IONQ, QBTS, a tight coil has developed. Watching for reactive trades on a break of the key level.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

NBIS: Beautiful build above key SMAs, which is why I added to my position, as discussed in my IA meeting. Looking for further build and a push toward $115-$120. Other notable movers in the space include IREN and CIFR.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.