Traders,

The focus for the upcoming week on adjustments will continue to be much of the same as I outlined in my recent IA meeting. In short, that’s stock selection and hype patience until things open up. We’ve got a full year ahead of us, no need to push whilst the market remains in a tight coil with major catalysts just on the horizon.

On the topic of catalysts, let’s start the watchlist off with that – the Supreme Court decision surrounding the legality of Trump’s Tarriffs:

IF/THEN’s for Legality of Tarriffs: The next date the Supreme Court can make their decision on the tariff will be on the 14th. Now, there is NO guarantee they pass their decision on Wednesday. The 14th is simply a possibility. So, what’s important for us traders to do is to prepare for any potential outcome.

That’s where my focus is and where yours should be, too. What happens if they rule against the tariffs? What will your basket of go-to names be? What happens if they rule a split decision, ruling against some and in favor of other sectors/industries? What if they rule in favor of tariffs (surprise outcome)? What will you trade in each scenario? What risk and positioning would you look to do?

For example, if the market expects the outcome and rules against tariffs, one of my go-to stocks for the initial move would be NKE. Big-box retailers have been hit hard by tariffs. The initial headline and move could offer immense relief. My plan would be a breaking news entry long on NKE, initially trailing the 2-min prior low, with the rest against the 5-min prior low. As this IF/THEN is a part of the likeliest outcome, I’d also be open to flipping short for a potential sell-the-news if things get a bit out of hand on the initial bump higher.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Now, of course, there are a ton of IF/THEN’s and a basket of names for this potential catalyst, so the above is just 1. If I run through it all, this wouldn’t be a brief watchlist, more like a thesis.

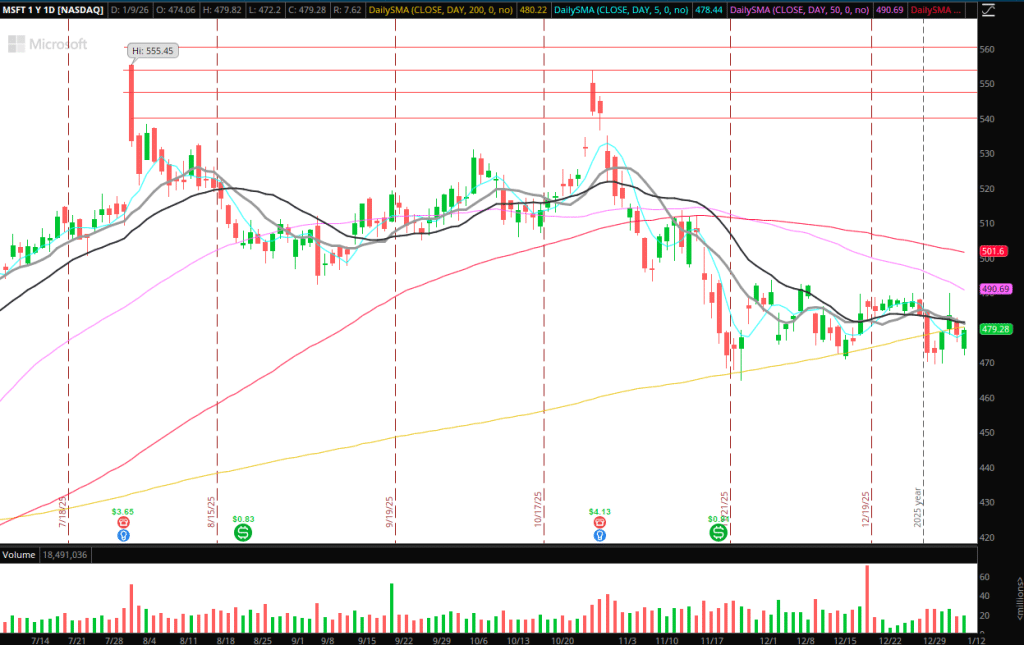

Continued Rel. Weakness in MSFT: I continue to see relative weakness on the higher timeframe in MSFT. As a result, if the market takes a turn lower on the week, MSFT would be a go-to name for momentum beneath its support near last week’s low.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

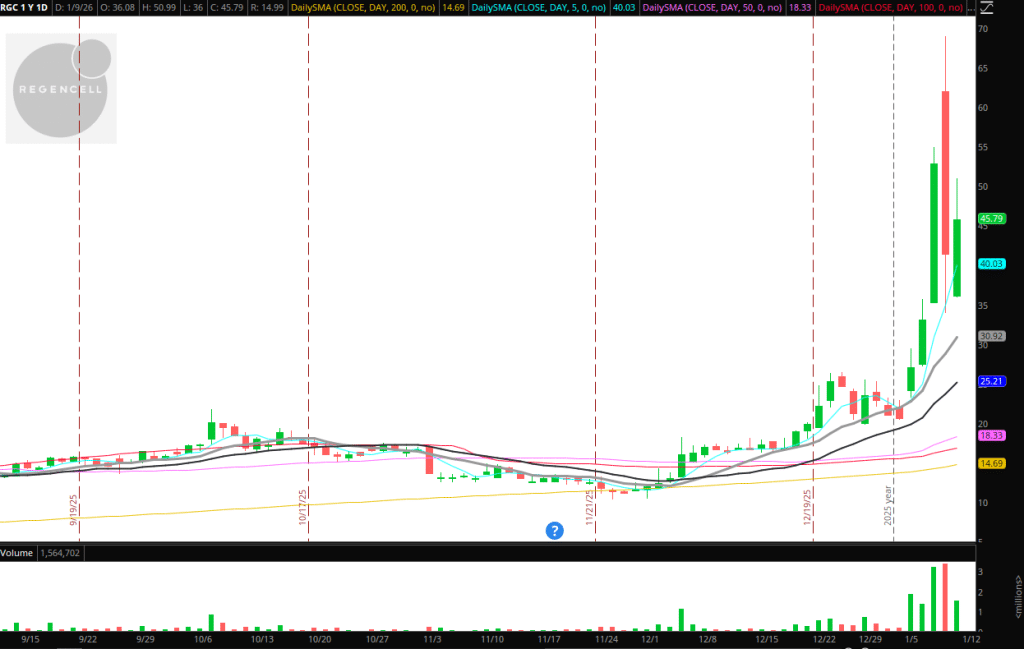

Failed Follow-Through in RGC: After Thursday’s move and Friday’s lower-highs, I’d love a push above Friday’s high to bring in some liquidity. Thereafter, I’d look for a clear and obvious failure, then begin shorting against the HOD for a continuation lower.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

It’s early in the year, and the market lacks meaningful direction and momentum. As a result, I’m stalking a bunch of setups, but I’m waiting for tighter bases and market confirmation before taking action. Some of the stocks I am watching include: RKLB, PL, PATH, ONDS, IREN, CIFR, ZETA, NBIS, DLO, RDW, SERV, KTOS, BW, GOOGL, AMZN.

And lastly, from last week’s watchlist re: BABA and XLE, those focuses remain firmly on the radar for me.

Good luck for the upcoming week, and remember, if the market is slow for your style of trading and playbooks, focus on improving 1% each day rather than trying to force trades when there simply aren’t any.