Traders,

I’m excited to share some of my top swing trading ideas for the week ahead. Like the successful ones I’ve shared before, such as the recent SMCI overextension long idea, these suggestions and ideas hold the weight to make substantial directional moves.

So, let’s get straight into it as I share my plans for my top swing trading ideas for the week ahead.

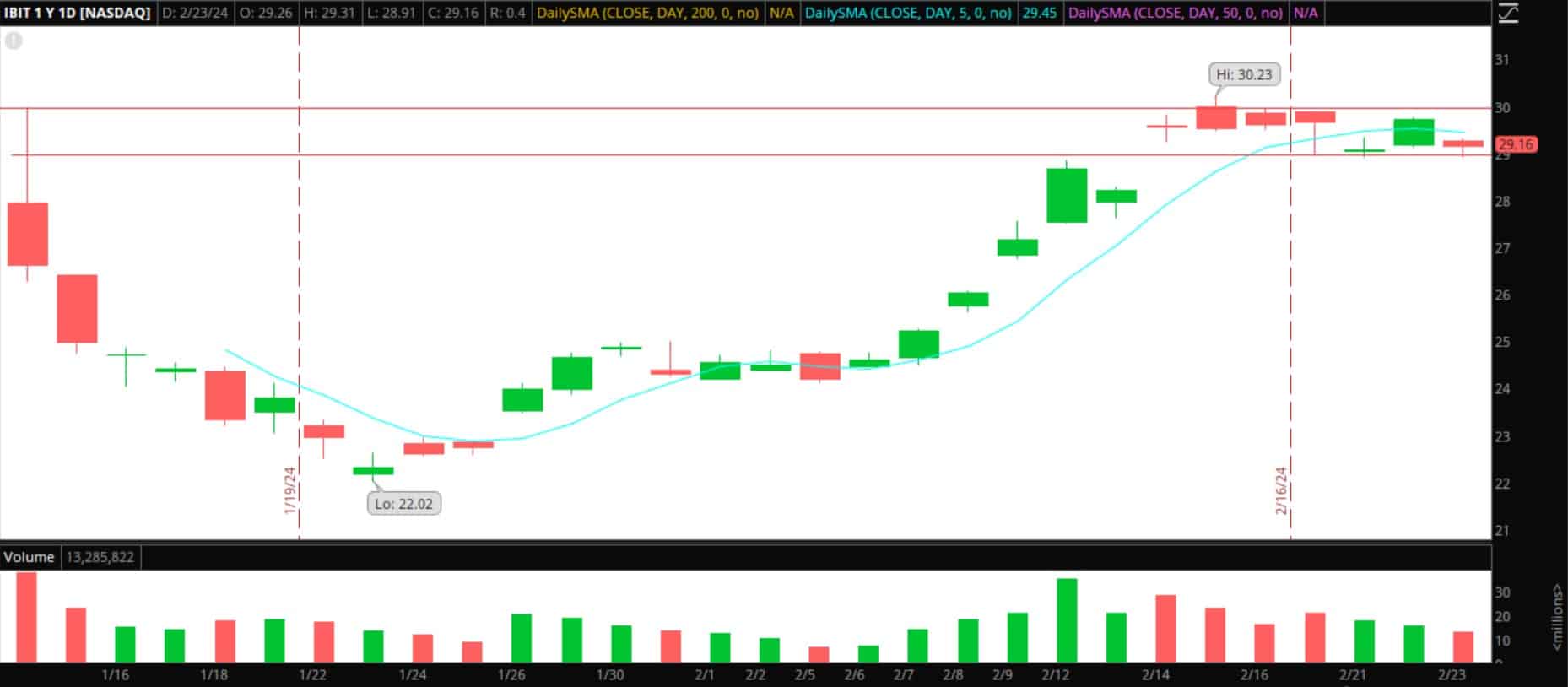

IBIT Consolidation Breakout

There are several different ways of expressing this idea, and various stocks could experience momentum if Bitcoin breaks out of its consolidation. However, I will focus on IBIT due to the risk: reward, and liquidity.

On multiple timeframes, Bitcoin and IBIT are consolidating in a tight range, with $52 – $52.5k acting as key resistance and the breakout level for Bitcoin.

So, anticipating and preparing for a potential breakout in Bitcoin, here is my reactive plan for IBIT.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

My trade plan for IBIT

If Bitcoin catches a bid and breaks out, and IBIT begins to hold near $30 with authority, I plan to get long with a stop either under the precise breakout level or below the day’s low if the breakout occurs intraday.

I will use IBIT’s ATR to set targets, aiming to catch over 2x ATRs if the breakout is successful. I plan to hold this for multiple days if the breakout holds, targeting a move toward $31 and $32 to remove a third of the position into each target manually. As the trade works, I will also manage it by trailing my stop using higher lows on the hourly timeframe and selling pieces of the position as new higher highs are made on the same timeframe. Of course, as it is reactive to Bitcoin, I will also use discretion to exit or adjust my plan manually should the price action in Bitcoin change.

Pops to short LUNR

After a nice multi-week run higher in LUNR, the stock with a 15m float had negative breaking news on Friday in the after-hours. The breakdown confirmed the backside in the short term and now sets up a lower high to get short for a 1 – 2 day continuation backside short.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Here’s my plan for LUNR

While unlikely, I would need the stock to push back into previous key levels, which should act as resistance going forward, to get the skewed risk: reward I desire.

From Friday, two areas of interest are $9 to $10. Low $9s acted as support on Friday; therefore, I foresee a pushback toward this area coming into heavy supply. If the stock attempts to push back toward this zone, I will look for an intraday failure and lower high confirmation. I will short as close to that failure as possible, with a stop above it. I would then target a move back to the $6s over 1 – 2 days.

Range / Channel opportunities in SMCI

Given the volatility and immense range in SMCI in recent weeks, I wouldn’t be surprised to see the stock trade within a large range for several days now while it attempts to digest the move and churn some stubborn longs and shorts.

So, I have no directional bias here. Instead, I will take note of key levels and look to react if the stock finds support near key levels for a range trade long or resistance near potential failure zones for a reactive short.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

The potential areas of support I will be watching for a reactive one-day swing long are $800 – $750.

The areas of resistance I will be watching will be the midpoint $850 – $900 and an outer band of resistance $950. Those areas, just like the support zones, would also act as targets.