Traders,

Big catalyst around the corner, with NVDA reporting earnings on Wednesday after the close. So, let’s start with NVDA for this week’s W/L.

NVIDIA Upcoming E/R: The NVIDIA upcoming earnings are especially interesting this time around, not only for the broader market/AI narrative and its sector, but also because of its technical setup. Like the broader market, which has chopped in a range for several months, so too has NVIDIA.

Critical resistance stands near $195 for NVDA, with a move above that zone and hold confirming a short-term breakout…and potential momentum shift not only for the stock but perhaps its sector/tech? In the event the stars align following the report and guidance, and NVDA gaps above and holds above $195, I’d be thinking long. Of course, if the gap is well above $200, the R: R diminishes, and I’d likely look for a first move lower before reassessing. Along with NVDA, I will be paying close attention to several other related vehicles, all tightly coiled: SOXL, SMH, TSM, ASML… to name a few.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

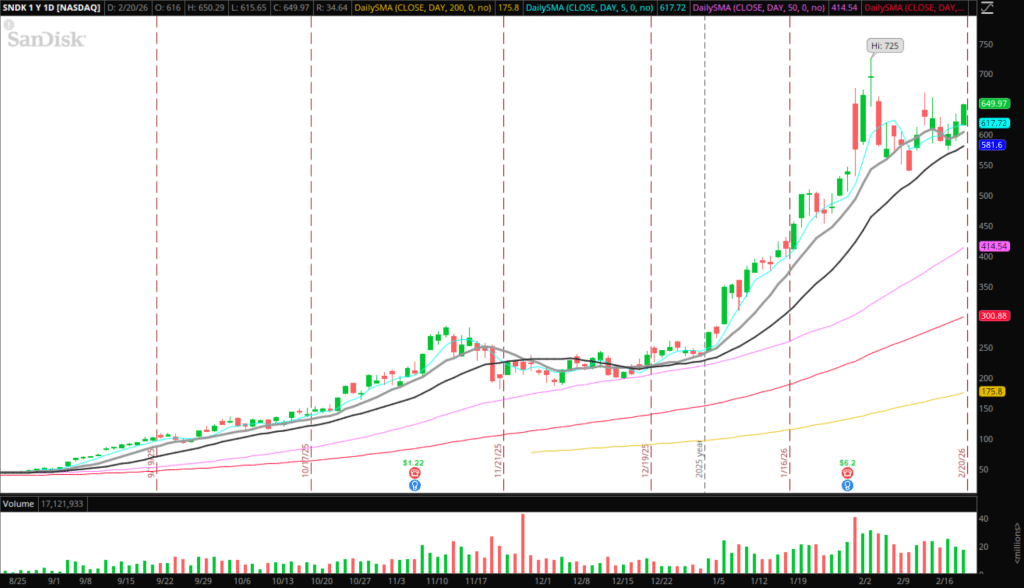

Memory Breakout / Continuation: The memory theme remains very much alive, and SNDK and MU look great. Following the prior run and extreme momentum, both names have pulled back toward their rising 10- and 20-day SMAs, found support, and built a base. Following on from my recent discussion surrounding SNDK in Thursday’s IA Meeting, I’d be looking to size into this if we breakout out of the coil that has formed, with a stop then moving up from the 20-day SMA to the day’s low, and trailing it against the prior day’s low for a momentum breakout.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

IGV: I’m not in the business of fishing for a bottom / trying to catch a falling knife. So while software does appear oversold, price action on Friday told a different story. IGV failed to hold above its 10-day SMA and closed near its LOD. Going forward, I’m not looking for a swing on the short side, given where we’ve come from, but if we break below Friday’s low and daily support and hold weak, I’d be inclined to short intraday for momentum lower.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Addition Ideas on My Radar:

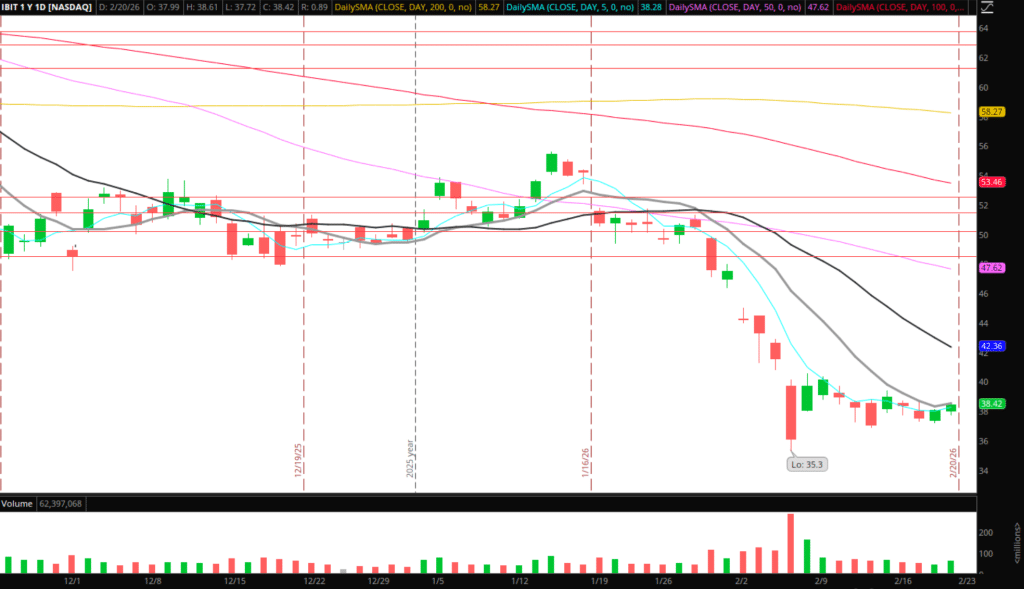

IBIT: If this reclaims its 10-day SMA and shows slight relative strength, I might look for a long entry with a tight LOD stop to see if it can build out. Alternatively, as with IGV, if it fails to reclaim and breaks last week’s low, I would be aggressively short. The same plan goes for ETHA.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

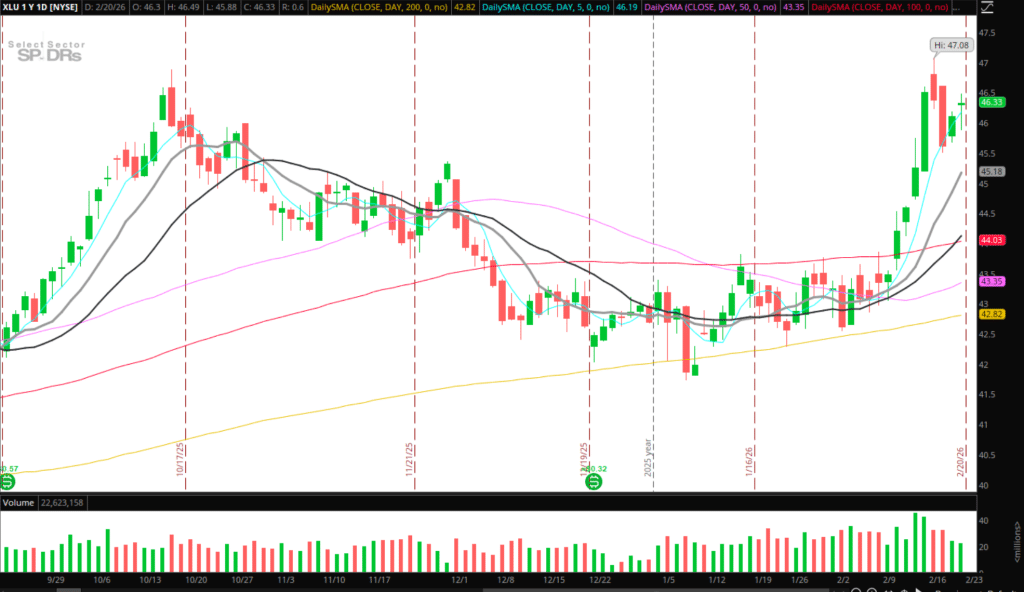

XLU: Nice relative strength last week to the overall market. A bullish look for the sector overall now, with AI acting as a tailwind (electricity), and a bullish technical formation. I’ll be spending some time in the near future stalking the sector and best-in-class names for swing trades if it builds out a lengthier base.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

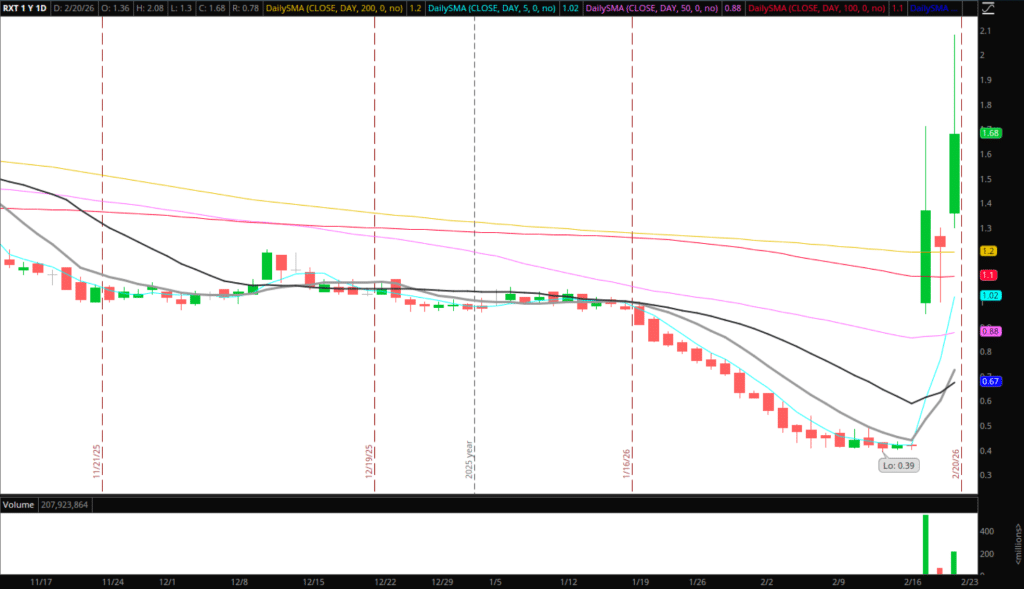

RXT: Great liquidity trap long opp on Friday. The higher the better now for a potential short. 1 such scenario would be a push on Monday into Friday’s highs and stuff / failed follow-through, for a short toward 2-day VWAP / trail rest against intraday VWAP reclaim—ideally, $2.2 – $2.5 before such an opportunity, though.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

BATL: This held up well on Friday, relative to Thursday’s range. This is on watch for a potential liquidity trap long trade.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.