Traders,

Happy Holidays! I sincerely hope you’re all having a wonderful festive season, and I wish you a peaceful, joyful time with your friends and family.

As the year winds down, it’s the perfect time to also reflect and review the year. Until the new year begins, this is when I spend time reviewing my year in detail and setting my goals for the year ahead.

I won’t be actively trading until the new year, but below are some of the setups that have caught my attention for the week ahead. Albeit a briefer watchlist than usual.

Continuation in Tesla: Great follow-through, working out of a lengthy higher timeframe coil and consolidation. Notably, at the beginning of the week, the relative strength stood out to me, along with the close above resistance and its 5-day. Now, for a new position to be initiated in Tesla, I’d want to see a momentum breakout above Friday’s high, which might set up the much-anticipated move through $500, with an initial stop LOD and trail against the prior day’s low from day 2.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

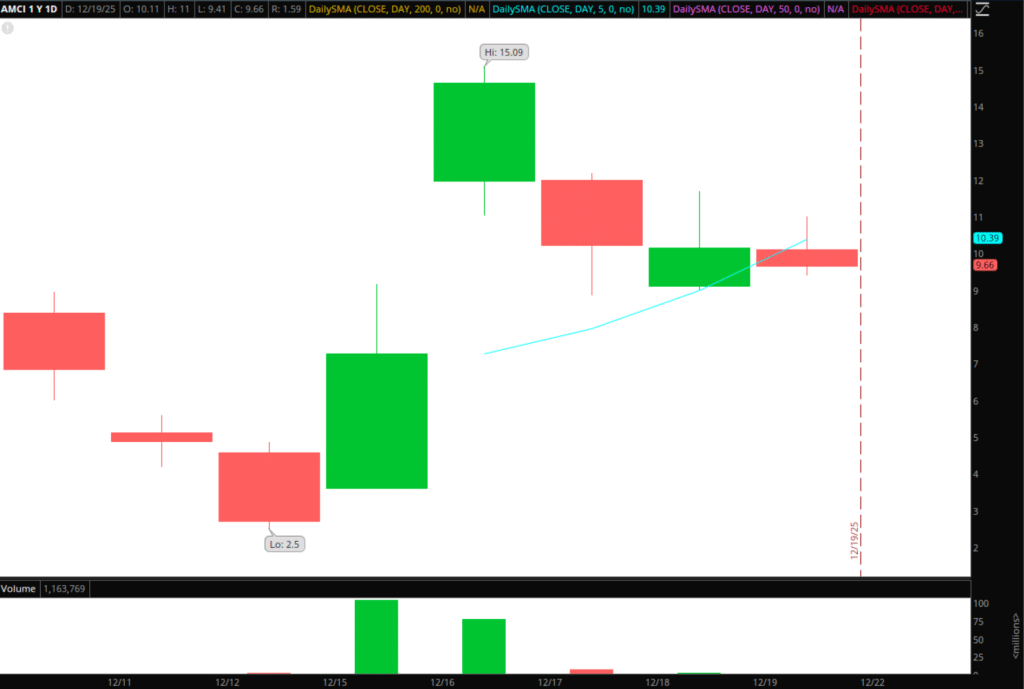

Liquidity Trap / Squeeze in AMCI: Not a fundamental bull here at all. However, given the pullback and impressive hold on drastically declining volume from the initial upmove, I can see it setting up for an impressive intraday squeeze. If this holds above $11 and churns volume, I’d like to go long against VWAP for a potential squeeze and retest of $14- $15 +.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

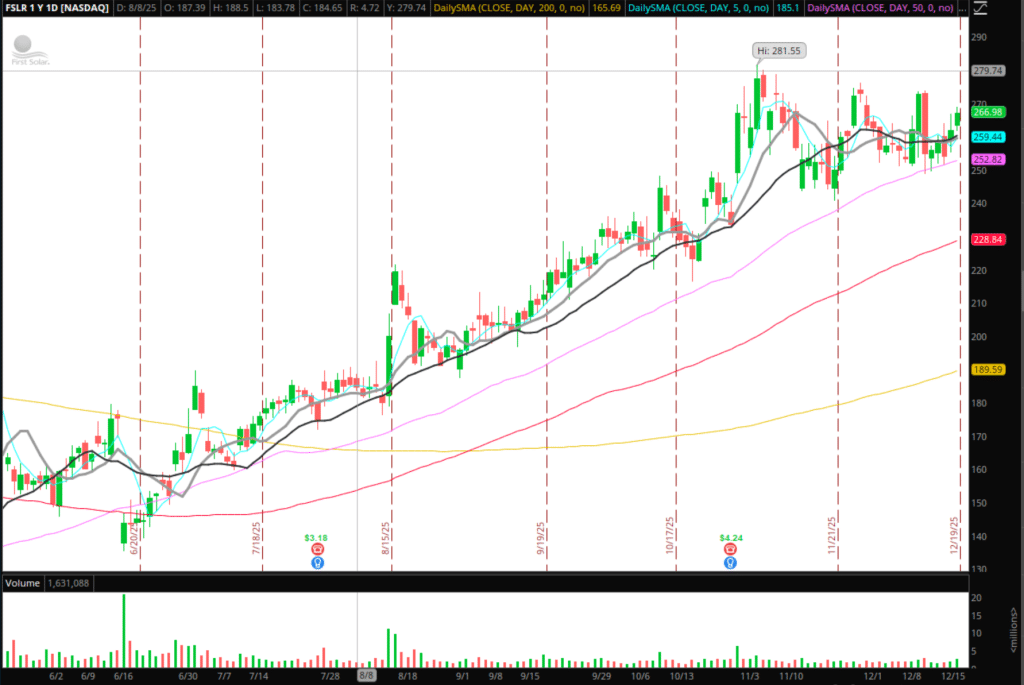

Solar Names on Watch: Several good-looking charts are setting up across the solar sector. FSLR, for example, is consolidating beautifully within a tight range and within a higher-timeframe uptrend. Above $270ish, this could begin its next leg higher within its higher timeframe trend. Another solar name worth keeping tabs on is RUN. It’s pulled back well and is trading near the 10-, 20-, and 50-day SMAs, with the 50-day SMA acting as resistance and the pullback flag’s breakout point. Several other names within the sector are holding up well, too…So I’d say that doing some further research into the sector isn’t a bad idea!

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

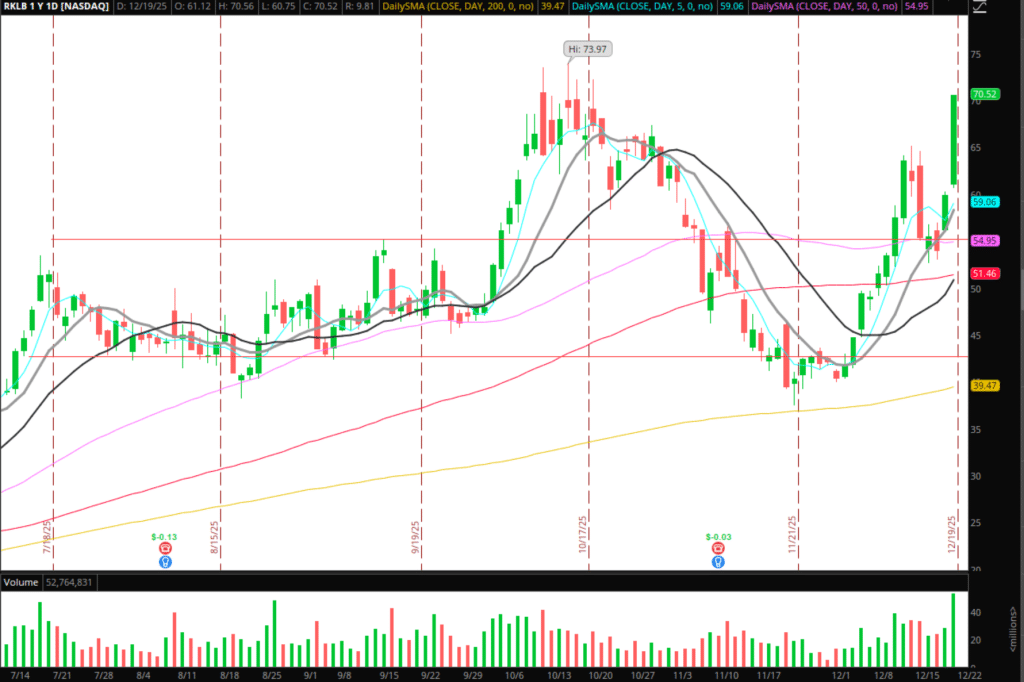

Space Theme: Great thoughts in prior weeks on RKLB, which has played out unbelievably well. With the catalyst building for the name, it is not surprising to see the momentum behind it. For the entire sector, the SpaceX IPO has served as a significant tailwind. Now, given the strength already seen, I certainly wouldn’t be chasing highs across the board. But in the coming weeks, I will be looking for pullbacks and bases with tight, well-defined R: R. Some names that are of interest to me: RKLB, LUNR, PL, RDW, ASTS, SPCE.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Additional Names I am Keeping on the Radar:

SLV: I’d love the RSI to get further overbought by way of consecutive gaps. Starting to think about a mean-reversion play here.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

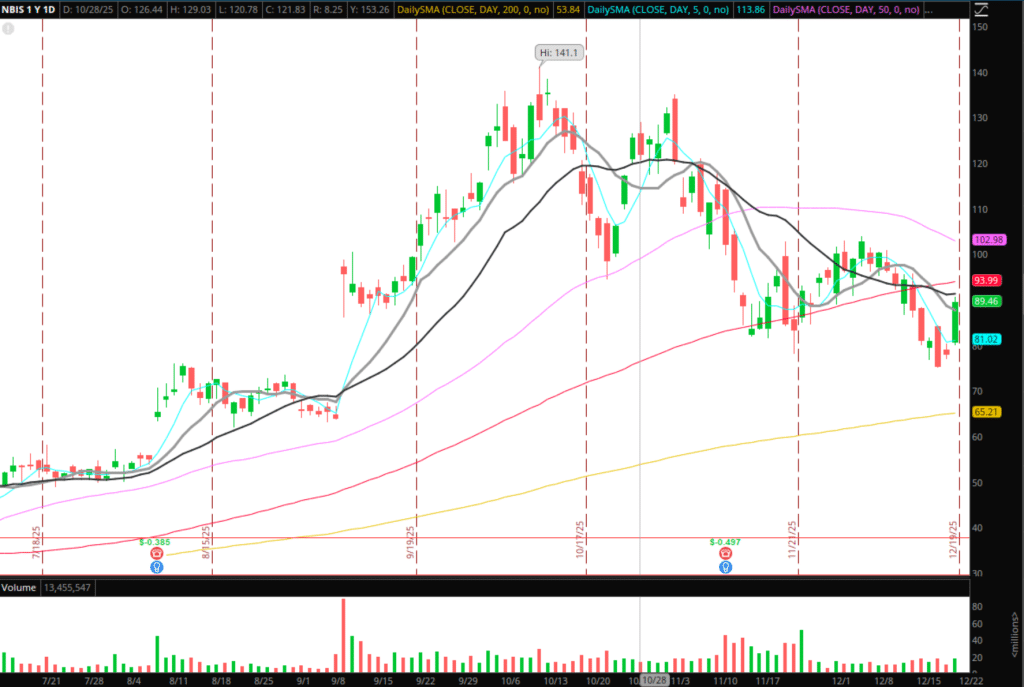

NBIS: Potential bounce candidate. For that to take shape, I’d like to see consecutive higher lows, a push and hold above $95, and a break of this downward channel’s resistance.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

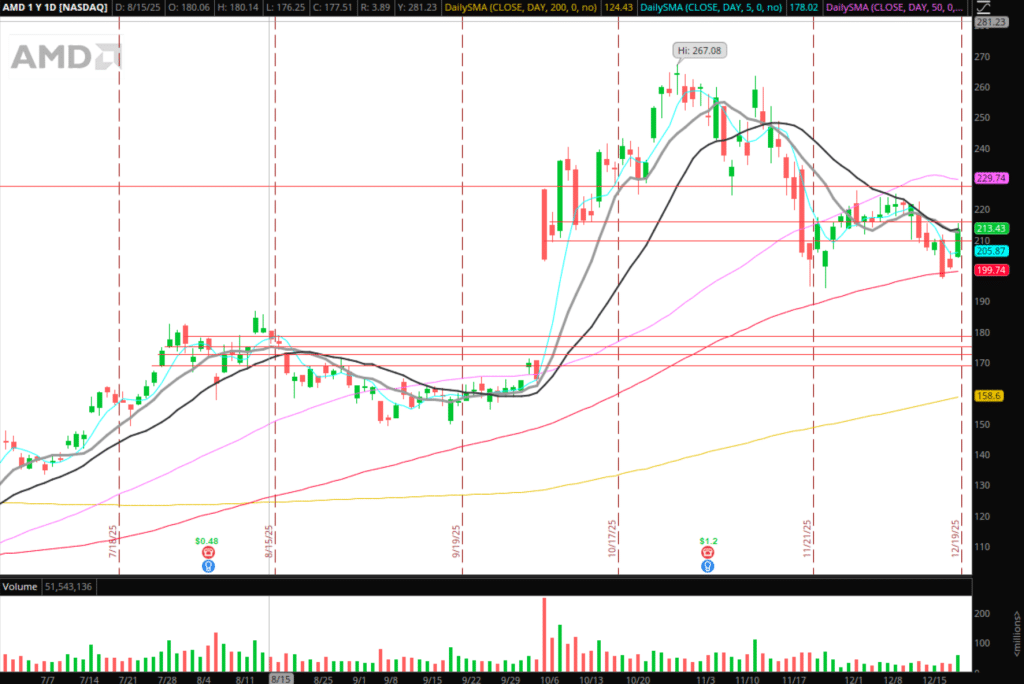

AMD: Similar to NBIS, I’d like to see some build above $220 / higher low confirmation for a multi-day bounce.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.