Traders,

I hope you all had a wonderful weekend!

Without further ado, let’s get right into some of my main focuses for the upcoming week:

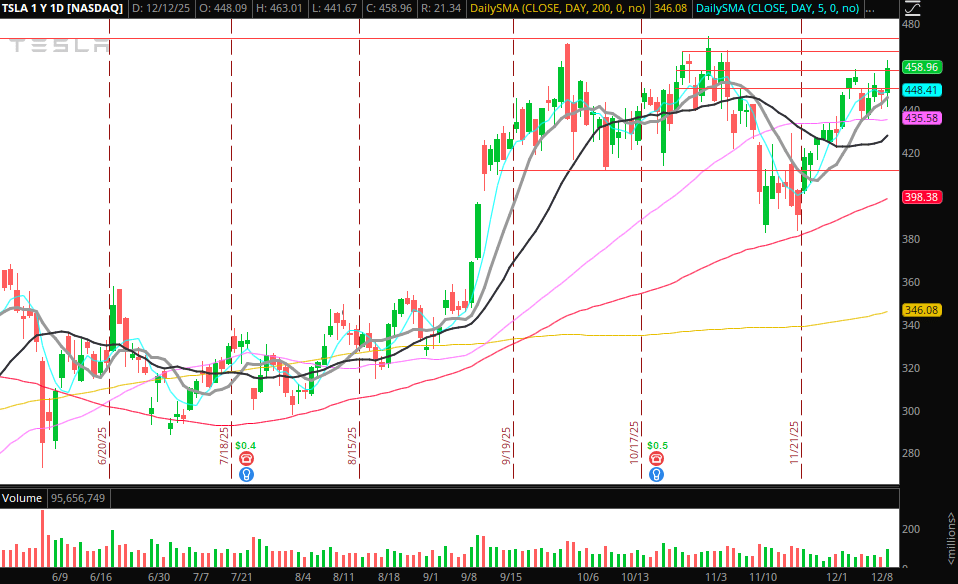

Breakout Consolidation in TSLA: Similar thoughts to prior weeks; Tesla remains on watch for a breakout above the $ 475-ish resistance zone. There’s, of course, no guarantee, but the setup is so textbook that I keep an eye on it each week.

From the weekly down to the daily, it’s aligning exceptionally well across multiple timeframes, and in the short-term, it’s beginning to display some relative strength and get ‘that look’. Until it pushes above resistance and confirms the breakout, there is nothing to do other than monitor price action and look for relative strength to continue to shine. As I’ve said many times, it’s too good a setup to lose sight of, therefore I will continue to have this on watch as long as it continues to build. If it breaks out in the coming days/weeks, I’ll be positioned for a multi-week swing trade long, with A+ size.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

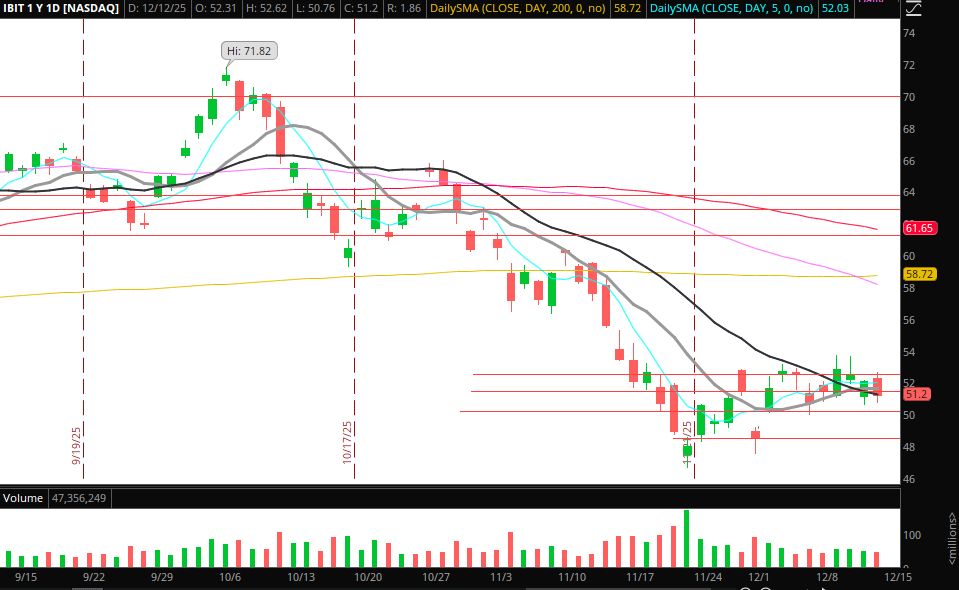

Weakness in Bitcoin this Weekend: Bitcoin, at the time of writing, is sub 90k, which may present an opportunity on Monday for momentum scalps. If Bitcoin remains weak sub $90k, I’ll be focused on IBIT. Below 90k and last week’s low, there could be significant momentum scalps to the short side if it attempts to follow through out of this bear flag. I’ll be looking for weak holds below last week’s low and intraday VWAP for a short momentum trade. I won’t be looking to swing this short—strictly move2move trading.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

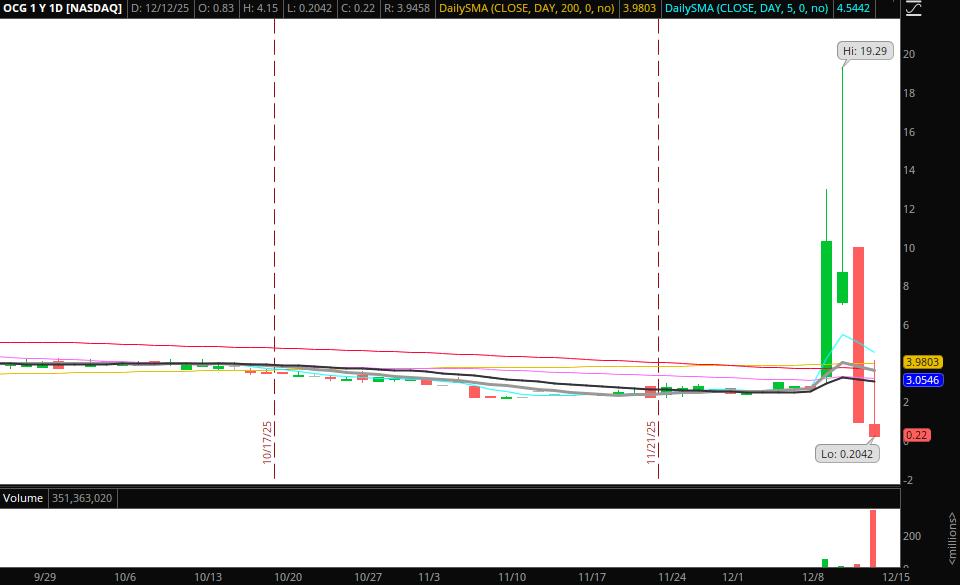

Pops in Last Week’s Liquidation Plays: The small-cap opportunity last week was dominated by pump-and-dump type action. Similar to the price action on Friday in OCG, I see the opportunity there in the future. So, if OCG, MIGI, or JZXN pops back and can extend a bit intraday from VWAP – squeezing out some early eager shorts – I’ll be looking for failed follow-through thereafter and short scalps intraday for reversals.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

NVDA Short if Market Displays Weakness: If the overall market follows through to the downside after Friday’s brief weakness, one of the names I will be focused on is NVDA. I see $165 – $170 as a key support zone, which would be a primary target for short-covering intraday. Thereafter, if NVDA breaks below that zone and holds weak, it opens the door to a larger move toward its 200-day SMA near $156.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

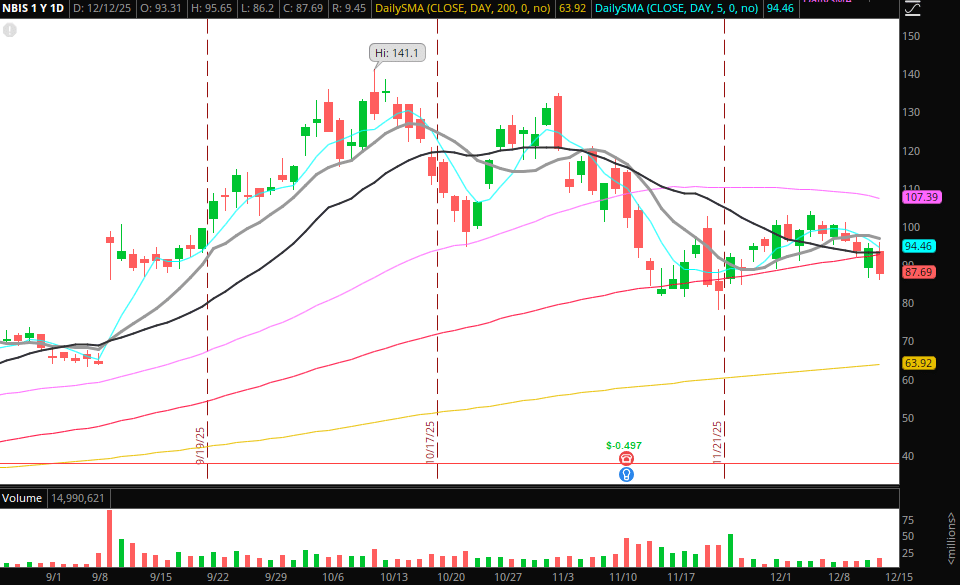

Similarly, Sub Friday’s low, I’ll also be watching NBIS for an intraday short opportunity if the theme of Friday continues further. Lovely bear-flag and hold sub the 100-day SMA, with possible further downside if Friday’s fears continue for another day or 2.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

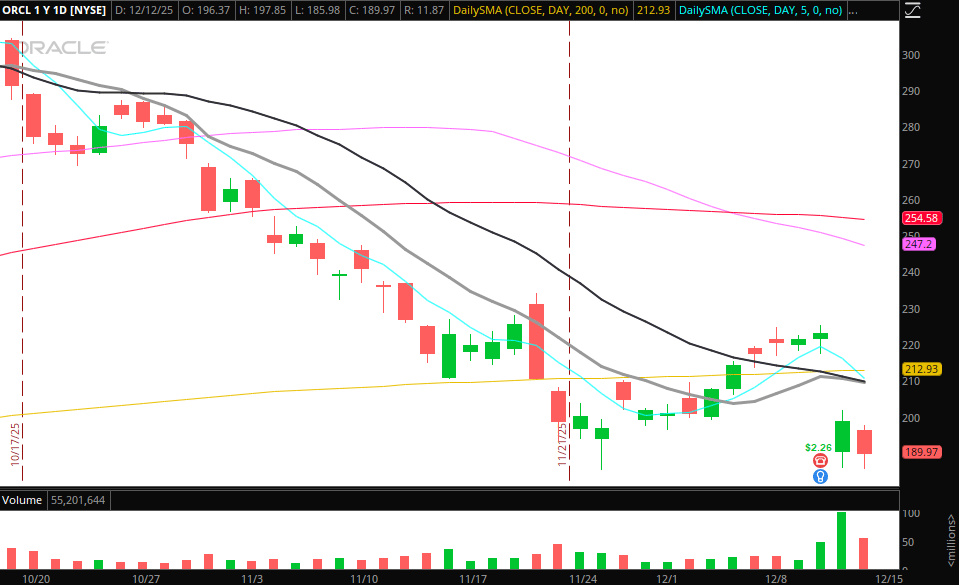

Momentum Scalps in ORCL: Similar to NVDA above, if capital rotates out of names related to AI capex fears, ORCL might present a unique short-scalping intraday opportunity. On a higher timeframe, Friday’s low lines up as key support, with $185 acting as higher-timeframe support. Below that level and holding weak, I’d focus on an intraday short-momentum opportunity.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage, and commissions.

Additional Watches that Need Further Time to Develop / Consolidate:

XLF – Sector-wide strength, looking for a hold above resistance and fresh entry on continued strength.

RKLB – Looking for re-entry on the long swing now. Ideally, a pullback and a higher low/consolidation.

BEAT – Either failed to follow through near $2.8 false liquidity trap to short, or push and squeeze for liquidity trap longs before a short on failed follow-through.