Last night, I was reading the review of one of our traders, Trader A, who wrote, “I just need to stick to my plays that make me money (ETRM, TWTO, GLYC) and just faze out those ehhh ehh trades, I will become very consistent and very profitable.” To Trader A, I responded, ” When u say get rid of ehh … Read More

A trading journal that works for you

I trade intraday futures by reading the tape and looking at historically significant price action levels. I start to really get a feel for the process, but I still trade only one future until the process is internalized. To be able to assess myself I keep a detailed journal where I fill in trade information (entry, exit etc.) and trading … Read More

Mike Challenges a Common Trader’s Statement

In our SMBU Daily Video, Mike Bellafiore challenges the common trader statement “If I see the setup, then jump right in.” He thinks you may say this as well. See if you agree with Mike’s teaching lesson. Have a great weekend. SMBU Team * no relevant positions

30 trading habits in 30 days – Journal

When I interview an experienced trader for our firm a central question is: what is your review process? I was at lunch yesterday with a firm trader, who wanted to chat about his recent underperformance. Over an apple salad covered with blackened chicken, the trader discussed his waning confidence. I asked, “What is something you used to do in the … Read More

Traders Ask: Should I Develop Price Targets?

Hi Mike, I just started the DNA Program. I’m very excited! I hope it can help me with my trading. I’ve been working hard. I’ve kept a trading and emotional journal, I’ve been doing my playbook, with so far nine plays. And I’ve been disciplined and focused with the selection of the stocks in play and the research on them, and … Read More

Reviewing the SMB Archives

In August and early September, the market seemed to rotate around two distinct type of trading days: 1. The momentum panic day, driven by major news, with lots of volume in the SPY 2. An uptrending grind or ‘melt-up’, characterized by a wide ranges, low volume and steep pullbacks that would shake a lot of traders out but seldom break … Read More

Traders Ask: The Benefit of Being an Idiot

I received this email from Reader Bob titled “Someone has to tell me to stop being an idiot like I was today”: Might as well be you :-). So overtraded, didn’t focus on my edges, missed my #1 set-up on LEN (top of my trade plan). The easiest $1 anyone will see when it walked through the top of the … Read More

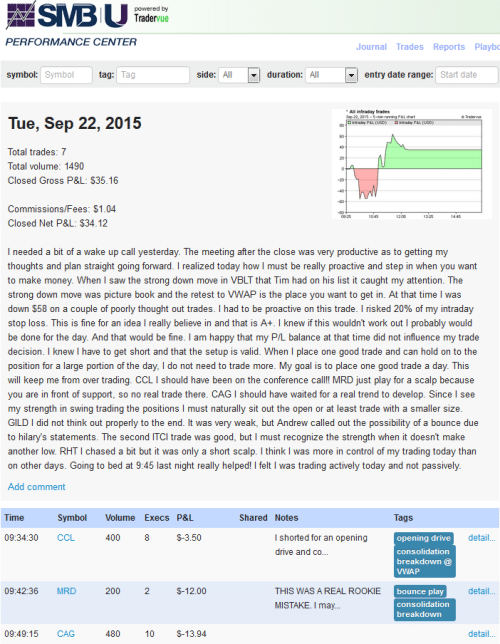

What Do You Learn From Your Trading Journal?

GMan and I revamped our trading journals and the SMB trading journal on a 9 1/2 hour car ride home from the Outerbanks. And this has helped. For me my trading journal helps me to focus on my monthly and daily trading goals. I start each morning writing down my goal for the day. So my day is just a … Read More