Risk. This is the first and most important metric for a systems trader to track and improve. When learning about a system or strategy, most people first ask about the returns. Imagine you had one program that generated 21% per year on average and second was doing 35%. For some, the analysis is over because they just want higher returns. … Read More

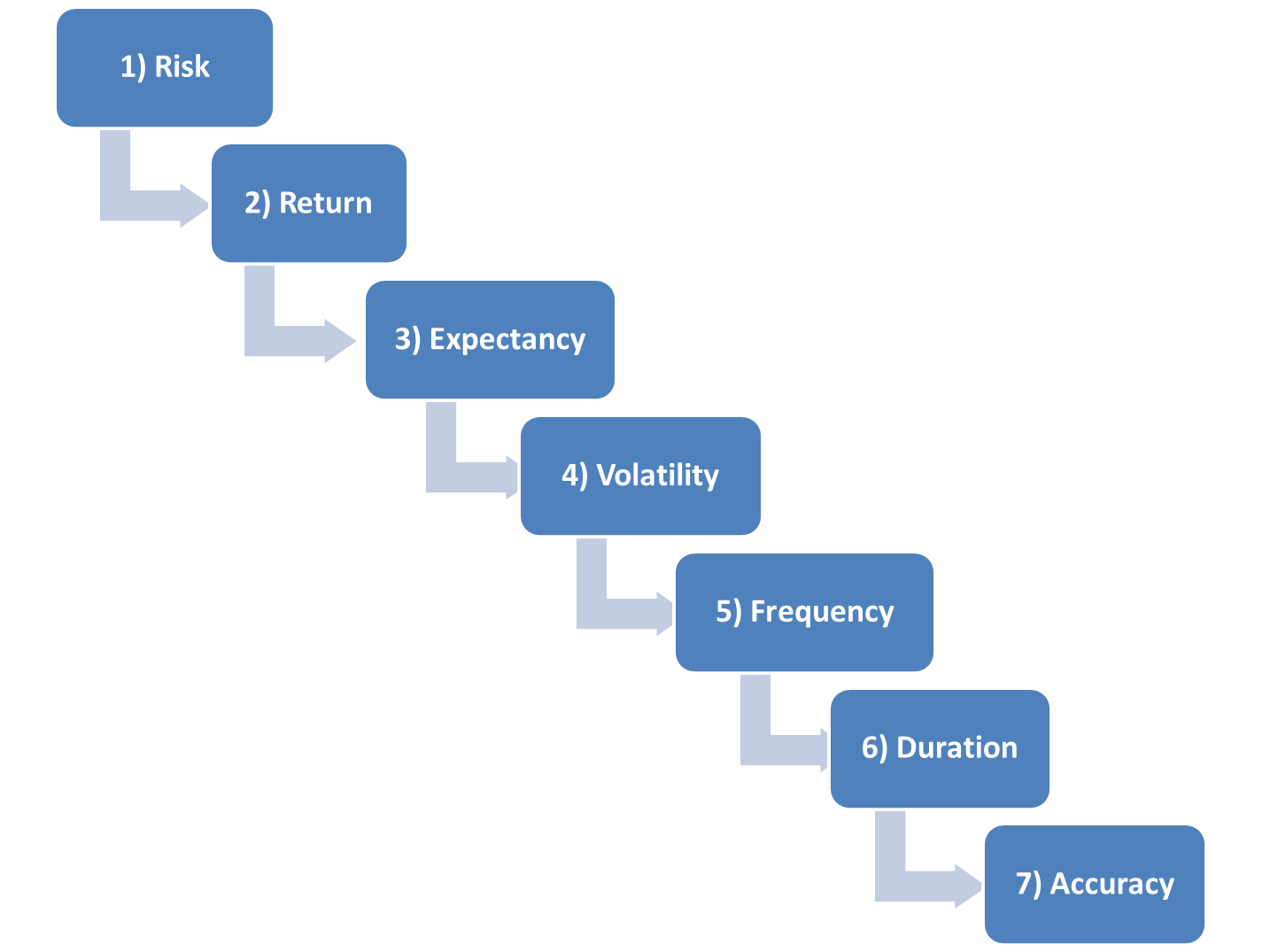

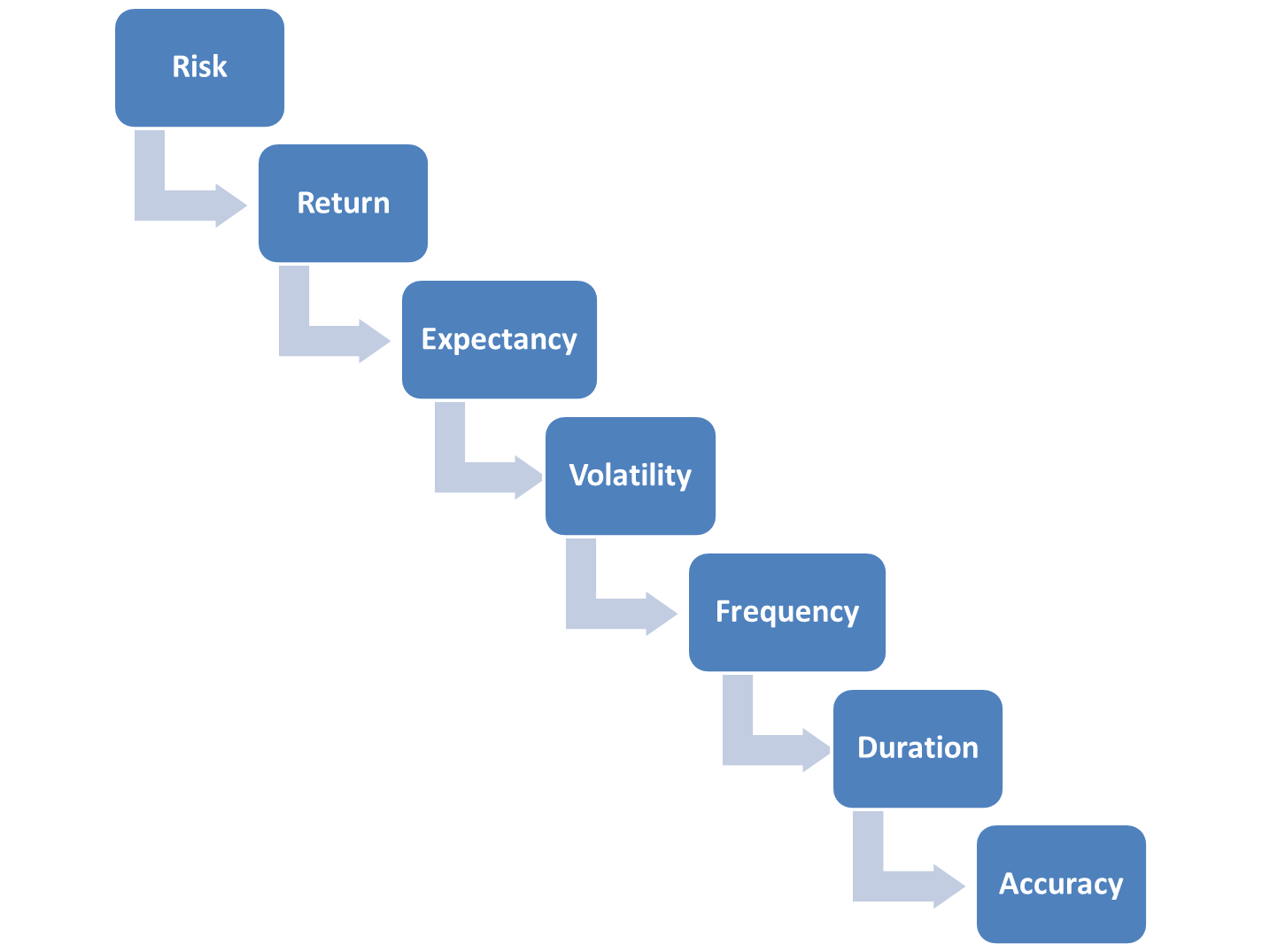

Seven Steps to Systems Success

Most platforms that run automated back testing and trading systems have extensive reporting capabilities to analyze performance. In these reports the software developers have included seemingly every possible statistical metric they could find. Reading these line by line quickly becomes information overload and can often leave the systems developer with more questions than answers. So we have narrowed down the … Read More

Confessions from a Discretionary Trader

Okay, I have a confession. I am spending more and more time each trading day learning more about quantitative trading. And by that I do not mean learning to code. What do I mean? 1) Learning to use data to improve my discretionary decision-making 2) Working with our quants to build and tweak filters for my favorite setups, which perpetually … Read More

[Recording] The Playbook: The Future of Prop Trading

If you missed this Webinar with Mike Bellafiore, author of the “trading classic” One Good Trade, on “The Future of Prop Trading: Introducing the Multi-Product, Multi-Market Discretionary Quant Trader”, you can watch the recording now. *No Relevant Positions