Good morning traders. As I wrote in my morning note for Waverly Advisors: “Though yesterday’s price action in the US Equities markets does not appear to be constructive for the bulls, it is important to consider the context of this move. The S&P 500 (chart above) shows what appears to be a classic failure above resistance, but smaller market cap … Read More

You Gotta Have A “Plan B”

Each morning we hold an AM Meeting at SMB to discuss the Stocks In Play as well as the bigger picture including global markets, unusual activity in commodities, and the US markets via the SPY. If a particular type of “day structure” is likely to occur that will be discussed as well. This morning with global markets humming and the … Read More

Morning thoughts for December 7, 2010

Morning Ideas from Adam

You have to figure out where the treasure is buried today…

Find the best stocks in the best sectors for the easiest money each day.

Applying Dow Theory Divergences to Modern Markets

I just had an article published in the December issue of SFO Magazine. Read the article here. Follow me on Twitter AdamG_SMB.

Who Believes in You as a Trader?

There is lots of talk about Coach Ryan the coach before tonight’s J…E…T…S Patriots battle. Coach Ryan is a believer in making sure his players believe. In a Bloomberg.com column the importance of belief found another sport: Speaking of winning, Duke basketball’s Mike Krzyzewski, one of the most respected and successful coaches in team sports, likes to use the same four … Read More

Morning Thoughts for December 6, 2010

Good morning traders. Market trading down premarket near support levels from Thursday and Friday. As long as the SPY is able to hold over 122 we should expect a serious attempt for a breakout of this trading range within the next few sessions. I will be watching FCX BIDU and AAPL as market tells. These stocks are all setup to … Read More

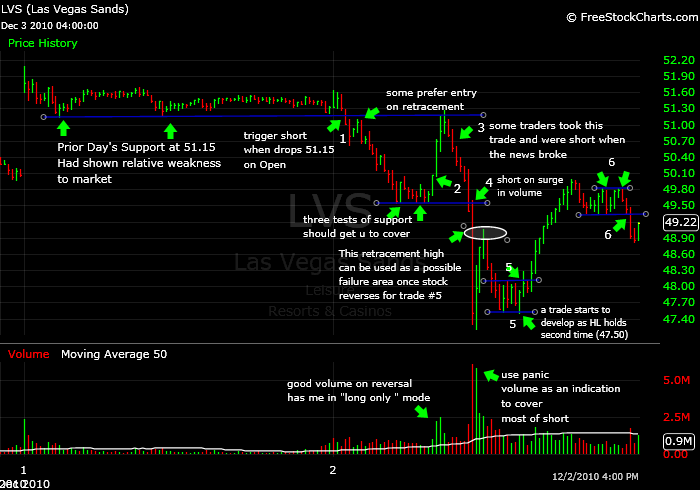

Traders Ask: What Was Your Thought Process In LVS?

Hi Steve, I am interested in learning your thought process behind trading LVS on 12/02. Do you mind writing a post on it? Thanks, AZ Here you go: Before I break down the various trades that I thought offered good risk/reward on December 2nd for LVS I would like to discuss December 1st. LVS gapped higher on 12/1 with the … Read More