Let’s talk about a way to get bigger in a set up from today. PSS offered an example of a time to get bigger. 16 was our level on our long term charts. PSS started to work and traded down into the 70 cents area. And then it popped back up near 16. You must get bigger into this pop. … Read More

Spencer’s Setups

I have an idea for a new blog series. I will try at least once a week to post a setup based on SMB Fundamentals: Fresh news, Technicals, and the Tape. But in the interest of it being a learning experience and also a recognition that the readers of our blog are way above average intelligence, I will ask for … Read More

How I would have started my prop firm differently

Mike, Firstly, I just wanted to thank you from the outset for your ongoing work and contribution to the trading community. I have read your book, I read your posts daily and I admire greatly the philosophy of your firm SMB Capital. Your firm really is the pioneer of trading education and skill development for prop traders. I hope you realize … Read More

All Caps Webinar Video

Sorry about the technical problems guys. Video w/o commentary below. Will look to post/replace the video with comments later this week. Just wanted to get it out there quickly after the webinar.

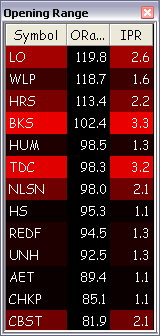

If Check 1, If Check 2, If Check 3 then pounce

One of the ways I use the SMB Radar to identify the best stocks and setups to see if a ticker is appearing at the top of multiple categories simultaneously. At 10:37AM today LO was atop In Play, Weak Today, and Opening Range. It was consolidating at the low of the day after a strong Opening Drive. I love this … Read More

SMB Morning Rundown – May 24, 2011

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open.

Context Matters: Why BIDU was a short and CF was not

Last week I wrote a blog that discussed an excellent short setup in BIDU from May 16th. BIDU was trending down on the daily time frame and offered a very low risk intraday trade on the short side after running up on the Open and then forming a rounded top. I tasked one of our trainees to continue to look … Read More

Expiration Week Pinning Trades

Here’s an e-mail I received from a good friend of mine and former mentoring student Options Tribe Member Craig. Craig is a fine option s trader and specializes in “expiration week trades”. These are highly specialized trades that Craig makes almost every month during options expiration week. Each expiration week , I ask Craig what he’s up to this month. … Read More