Thursday, June 9, 2011 Adam Grimes will share some specific entry and trade management techniques around bigger picture technical structures. Swing traders will find these ideas immediately applicable to their trading, but daytraders will be able to adapt some of these concepts as well. Success usually depends on trade management more than the actual entry spot, so the focus will … Read More

From the Prop Desk: Adjustments to Your Trading

One our new traders sent me this outline over weekend for his trading. Excellent work by him working on his game over the weekend (even if he is a Heat fan). Below are my comments to his adjustments. One of his suggestions is so cutting edge this is worth your review. Adjustment Plan for current environment Volume Decrease average trading volume … Read More

Traders Ask: Do You Ever Shut It Down for the Day After You Hit a Profit Target?

Hello Mike!I have a question about when to stop trading during day trading session and go home.You’ve traded many years. Can you say what is better in your opinion and what you prefer to do in your own day trading?Setting a goal to make max $500 each day and when achieve it, switch off the monitor and go home immediately It’s limiting … Read More

Why Do You Trade? (Dr. Brett Steenbarger)

In a recent post, Mike Bellafiore raised the important question of “Why Do You Trade?” In that post, Dr. Jonathan Katz pointed out that the motivation to make money is often not sufficient to sustain traders. He explains that, “People need to continually find new challenges in what they do and pursue.” This is a great topic, because it separates those … Read More

Eight Things I Learned From John Lee

Special Guest Post from @travisharbauer John Lee, professional trader and host of “Charts Gone Wild” on StockTwits TV, spoke with SMB traders Friday afternoon, and below are eight things I learned from his discussion: [1] Keep it simple; don’t trade using an overcomplicated strategy. Lee’s 13-year-old cousin profitably uses his strategy and she’s learning more about the markets everyday. [2] … Read More

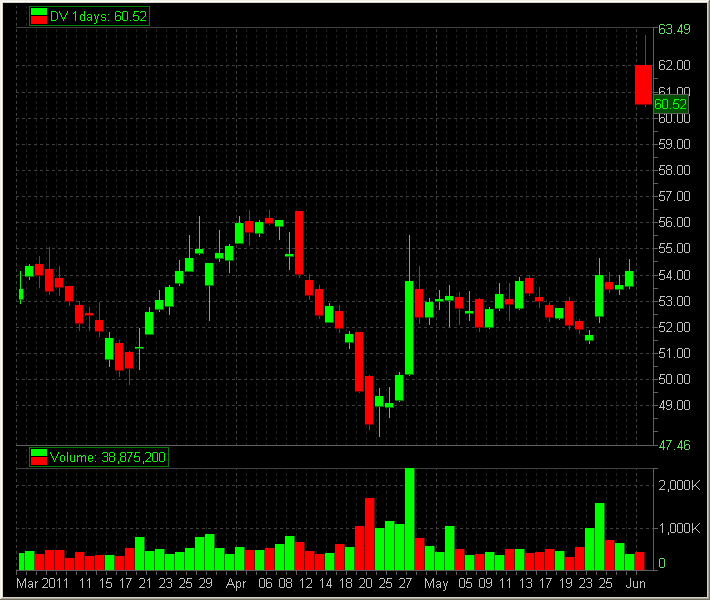

Traders Ask: Was this One Good Trade ($DV)?

Mike, I have a quick question today about a setup I was in… After a great run-up from this AM and yesterday the education stocks were starting to come back to life and making fresh intra-day lows (around 11AM)… I saw APOL, STRA and ESI making these intra-day lows (the spys were making lows as well)… while cycling through the … Read More

Finding Yourself as a Trader

One of our options trainees recently asked me if I thought it was wise for him to model his trading style after my own personal trading approach. It was a legitimate and intelligent question and it deserved a thoughtful reply. I recently tweeted a great article by Charles Kirk, which is exactly on point to this question. In the article … Read More

SMB Morning Rundown – June 3, 2011

Today, the Market appears set to open slightly lower. The levels we are watching in the SPY are 130.50 – 130.60 (Resistance), and 130, 129.60 – 129.50 (Support). Our best AM Idea for today, which we highlighted in our AM Meeting is to get short RIMM holding below 40 and to be more aggressive below 39.80. Don’t forget to follow … Read More