Tuesday August 23, 2011 at 5:00 pm Eastern Daylight Time SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by outstanding veteran options traders and experts in the world of options … Read More

Find an ATM and Use It!!

Do you have a stock that due to both technical and fundamental reasons has traded in pretty much one direction for weeks or months? I do…for the last few months it’s RIMM. I have RIMM on my screen everyday and I know exactly how it feels, moves and reacts. I play it virtually every day and use it like my … Read More

New SPY Inflection Point

I must be crazy writing a blog post as I begin my vacation in Nantucket Ma. But I have something I want to highlight that relates to a webinar I gave earlier this month. The topic of the webinar was multi-day inflection points. Identifying these levels and using them as the focal point for various trading plays. On Thursday August … Read More

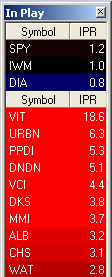

SMB Radar Update for August 16, 2011

These are today’s top stocks on the In Play column on the SMB Radar. This is the most important function of the scanner. The Radar uses a number of proprietary algorithms on a prescreened universe of stocks and processes every tick in search of finding stocks that are In Play. These stocks have unusually high order flow that indicates heavy … Read More

Happy Buddha Says

An email from a new trader: Hi Bella, My Weekly Goal: 1. Being patient to wait for great setups to get aggressive 2. Trade 200 shares responsibly on excellent R/R setups 3. Go over entire Reading The Tape lectures again 4. Recognize bigger picture and trade stocks that move away from prices 5. Get more well-rounded in this new market … Read More

Discipline, Focus and Patience

The above three words have been written about many times by Bella and Steve and you have read about them in countless other places. Becoming consistently profitable in day trading requires the knowledge and use of all three! I would like to give a simple thought from my trading yesterday intertwining the three principles… At one point yesterday if you … Read More

Trading this volatile market

After the close some traders who I personally mentor send me a review of their day. One trader emailed: Overall- Today was a productive day both in terms of learning and in terms of P&L. I have had better days in terms of P&L, but I came out of a hole on the open and I am more proud of … Read More

Here is a trade I do not make anymore

A new trader, TO, sat in my office just under my print of Derek Jeter diving head first into the stands, without regard for his body, to catch a foul ball. He is a recent graduate who spent many hours neglecting traditional studies for his first passion trading. TO has followed us for a few years and now trains with … Read More