Disclosure: Long: $NTAP

Discover Your Trading Style: Answering the Five Essential Questions

Too many traders falsely assume that there is one “correct” style of trading and that in order to become successful, they must simply copy the trading style of another successful trader. The reality, however, is that no two successful traders share identical trading styles. Far from being a cookie-cutter approach to understanding and exploiting opportunities in the markets, a trading … Read More

How Quickly AAPL Can Turn

This post is another in a series that we will be publishing over the next month , tracking the hypothetical performance of broken wing butterfly trades selected by Greg Loehr of Optionsbuzz.com. Just yesterday I talked about a hypothetical AAPL put broken wing butterfly expiring Friday, and with AAPL trading up this morning to over $640 I kind of figured … Read More

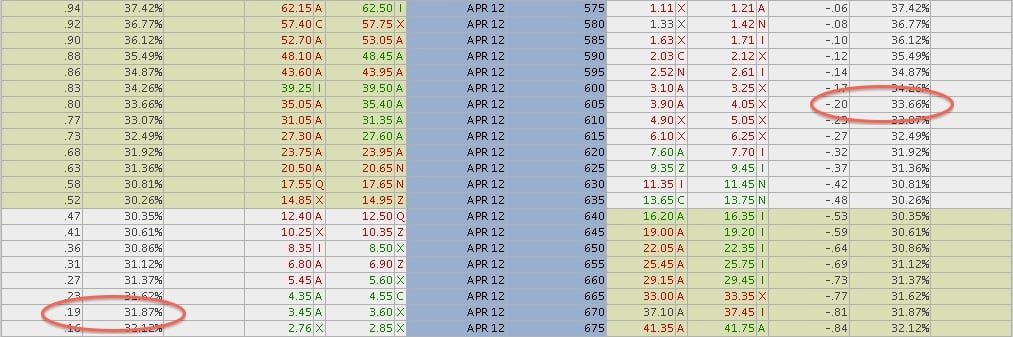

AAPL Skew is Reverting

This post is another in a series that we will be publishing over the next month , tracking the hypothetical performance of broken wing butterfly trades selected by Greg Loehr of Optionsbuzz.com. Last week I asked if Apple can really keep going up forever, and at least for another week it did. And the hypothetical put broken wing butterfly I … Read More

This is a trader’s fault

I received this trading recap from an SMB Trader: I love these types of days where I can keep my tickets really low and keep 95% of what i gross. For some reason when I trade from home, i don’t over trade and am able to keep my tickets really low. maybe because i have other responsibilities when i stay home like … Read More

Five Suggestions for Traders

I was in my office today working on my next book The PlayBook when I got pinged with this from the trading community: Mike, what do you do when you’re a practicing trader, working, saving, and studying to begin trading live, and you feel your motivation begin to peter out. You have this goal but the road there seems like … Read More

The First Lesson of Trading: You Stink

A trader on our desk shared this email sent to him by another trader on our desk. It offers a great lesson to the new and developing trader based on the work of Dr. Steenbarger and a trader’s individual experience. I was reading the first chapter of Enhancing Trader Performance by Dr Steenbarger today and I realized that I was … Read More

The Bear Trap Followup: NFLX 110

Yesterday’s SMB U Trading Lesson was on how not to get ripped to shreads in a Bear Trap. Today, Gman tweeted in Pre-market that NFLX was setting up as a Bear Trap and that he would look to trade it long against 110 to take advantage of those who might be trapped trying to short. Let’s take a look at … Read More