This post is another in a series that we will be publishing over the next month , tracking the hypothetical performance of broken wing butterfly trades selected by Greg Loehr of Optionsbuzz.com.

Last week I asked if Apple can really keep going up forever, and at least for another week it did. And the hypothetical put broken wing butterfly I was tracking, which was the 585-580-570 puts that expired Thursday April 5th, expired worthless since the stock rallied up to $633. AAPL didn’t pull back. So what? The tracking price for this trade was a 5-cent credit, and with the fly expiring worthless, the hypothetical profit is 5 cents on $4.95 of risk. That’s 1% in one week being WRONG on the stock’s direction.

In response to a reader comment from last week, please keep in mind that this 5-cent credit represents the hypothetical maximum reward if the stock goes in the wrong direction. If the stock moves in the intended direction for this particular set up, then the hypothetical maximum reward is $5.05, which is 102% of the risk. So, please keep this in mind: broken wing butterflies can make nice money when you’re right, but you don’t necessarily have to lose money when you’re wrong. That’s huge!

An another thing to keep in mind is that the trade does not need the stock to move to the middle strike of the fly in order to make money. Generally speaking, and depending on time, the stock only needs to move towards the body of the fly.

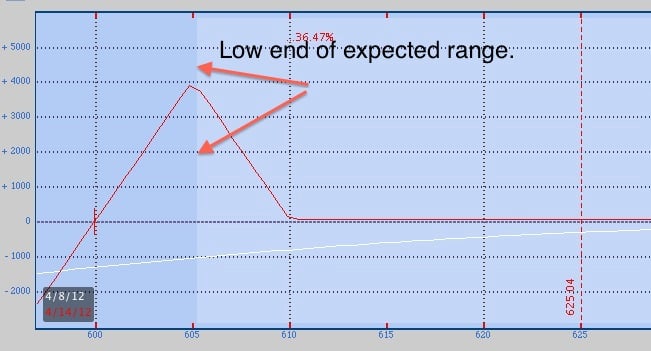

Last Thursday I started tracking another hypothetical AAPL butterfly using the weekly options, and I’m going to continue to focus on AAPL for the next several weeks. The trade that I’m tracking this time is, again, a bearish butterfly using the 610-605-595 strikes that expire Friday April 13th. The tracking price is a 5-cent credit, the same as last week. At the time of the trade the lower end of the expected range (see highlighted area on graph) came right down to the middle strike of the fly. So, based on the current implied volatility of that time, if AAPL stays in this one standard deviation range through expiration, then this hypothetical trade should make money. Of course, implied vols and stock prices will change, but that’s not a bad place to start with a trade.

And with the stock needing to move about three standard deviations in one day before this trade starts to get into trouble, one can start to see how this type of strategy can potentially form the basis of a weekly or monthly approach to the market.

But now, what about that skew I mentioned? I looked at a bullish broken wing butterfly using the same weekly options and I didn’t see anything that I liked. Over the past several weeks hypothetical bullish butterflies were setting up for credits, but now that’s becoming harder to find.

Why? Because of the intra-month skew. I cover this idea of AAPL skew in the 4-part Broken Wing Butterfly series, but let me touch on it here. Normally the OTM puts trade at higher implied volatilities than do their OTM call counterparts. This is called “skew”, and it’s quite normal. But changes in skew are not necessarily normal and can be powerful information to have and understand. For instance, during AAPL’s meteoric run over the past two months, the skew moved to the calls. Could this have indicated incredible demand to buy calls and sell puts? Quite possibly.

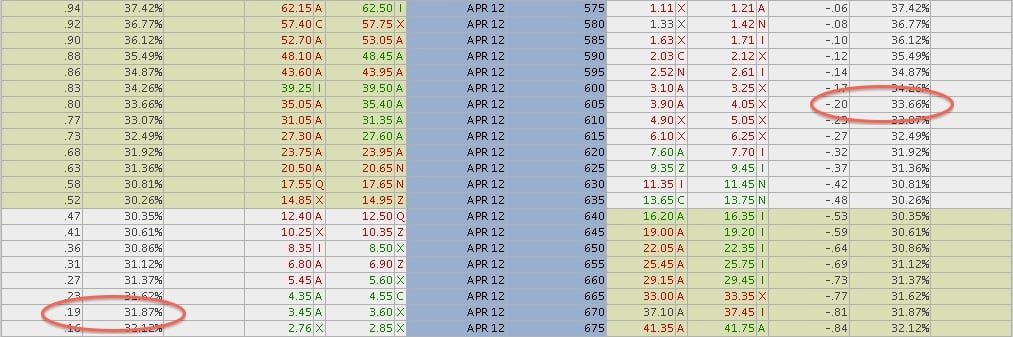

And this higher volatility for OTM calls helped the call broken wing butterflies trade for credits. If you joined us in the SMB Options Tribe Meeting April 3rd, then you saw how a one-week call broken wing I was tracking achieved a 20% hypothetical profit just by having Apple stock move toward the fly body. But, alas, the skew has, at least for now, moved back to the puts. I look at 20-delta options just as a reference point for tracking skew, and this is something that I can cover in the free one-hour mentoring session that subscribers to the Broken Wing Butterfly video series receive. In this picture you can see that the April 20-delta puts are trading about two volatility points higher than the 20-delta calls. During the run-up, the calls were trading higher by as many as four points.

Now, just because the call butterflies are no longer trading for credits doesn’t mean that a hypothetical call broken wing butterfly doesn’t make sense for a potential trading idea. It’s just that, if the stock doesn’t move higher, then a loss will occur in the amount of the entry debit if all of the options expire worthless. That might be OK with you based on your own particular risk parameters, but there’s always other ways of combating that problem. Again, something I discuss more in the video series. But for now, I will continue to track this particular hypothetical trade, and as the market changes I’ll be looking to track other ideas as well.

Trade safe!

Greg Loehr

Optionsbuzz.com

Please note: Hypothetical computer simulated performance results are believed to be accurately presented. However, they are not guaranteed as to accuracy or completeness and are subject to change without any notice. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Since, also, the trades have not actually been executed; the results may have been under or over compensated for the impact, if any, of certain market factors such as liquidity, slippage and commisions. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any portfolio will, or is likely to achieve profits or losses similar to those shown. All investments and trades carry risks.

No relevant positions.