Over the weekend Bella posted a new trading idea “I’m All In”. Here is the response from SMB Foundation alum and professional futures trader Bruss Bowman. I think his comment speaks for itself. Bella, Great thread. My personal trade log for the last month is full of entries around just this thought. One of the things that I’m looking at … Read More

I Was Captain of the Mathletes

In high school I was captain of the Mathletes. Once a month we would travel to other schools and compete against their top math geeks. Many of the problems we were asked to solve appeared to be complex but often contained what were simple solutions. In math and in nature things that appear highly complex often can be reduced to … Read More

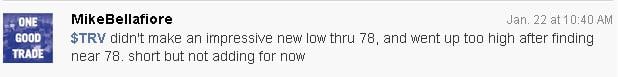

My thought process for TRV

Today I live tweeted @stocktwits and traded TRV. Below are my tweets and an expansion on my thinking. I have attached the intraday chart for your review as well. –What I saw here was auto buying at 78.60. Anytime someone offered 60c that offer was cleared immediately. We say there was a “hunt order to buy” at 60c. Once an … Read More

How Do You Distinguish a Good Trade From a Loser?

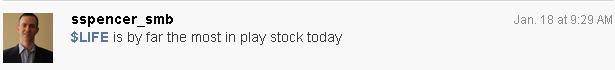

Hi Bella, I just read your recent post talking about the “All-In” trade on the SMB blog. Although my trading experience is limited (less than 3 years), I have on occasion seen these types of SEE IT trades. The most recent example was this past Friday in $LIFE. I know Steve kept the community in the loop that day & … Read More

CNBC Made Me Do It!

Here is an interesting comment from a reader in response to my blog post “My Thought Process: LIFE” Steve, Thank you sir for your thoughts. I constantly look for your tweets during the day. I don’t know why I bought so many books in the past. I have learned a lot from your generosity. I turned LIFE green into red … Read More

You are not a consistently profitable trader YET

I made a mistake the other day. I told someone from SMBU that everything he touches gets better. I demotivated him with my words. I have written in a past blog post, Do Not Say Practice, about the power of language to motivate traders. This idea was discovered from the work of Dan Coyle on his blog The Talent Code. … Read More

I am All-In (a new trade)

I have been thinking about a new trade, I am All-In. I have been thinking about this trade for a few years and how it would work. One of my guys during his review after the close on Friday is working on it. Let’s start by reading his review (edited). I went for it with an A+ trade. I had … Read More

My Thought Process: $LIFE

It isn’t my regular practice to “Live Tweet” when I’m involved in actively managing a position. By nature I am not a good “multi-tasker” (don’t get my girlfriend started on that topic 🙂 ). But LIFE was so In Play today that I wanted to share some of my thoughts and actions right as the market opened for trading. So … Read More