Today I live tweeted @stocktwits and traded TRV. Below are my tweets and an expansion on my thinking. I have attached the intraday chart for your review as well.

–What I saw here was auto buying at 78.60. Anytime someone offered 60c that offer was cleared immediately. We say there was a “hunt order to buy” at 60c. Once an offer could hold 78.60, was not cleared immediately, me and a few around me hit the bids and got short(er). TRV fell steeply to 78.13. Noticing this one change on the tape was the catalyst for the downmove.

–Because TRV had such a steep downmove below 60c, my focus was to add to my core short into a retracement. I did cover some into the steep downmove but now I wanted to short some more into a pop higher. When TRV found 40c I added to my core short. I was willing to add to my short until it held about 60c, the signal I was wrong.

–Stock selection is key for the intraday trader. When you see a move like this there is nowhere to go. Stocks do not fail very often from support like TRV did at 60c. Stay. Trade this stock more. It is paying you. Take more from this stock until you are proven wrong.

—

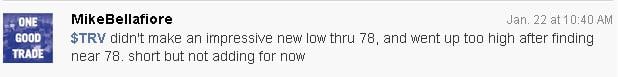

–I was expecting TRV to break below 78 and make new lows. This did not happen. As a result I wanted to lighten up on my shorts and not short into an upmove. The risk/reward was not as great that TRV would continue lower. Thus I wanted to now risk less with the trade.

TRV spiked too much for my taste after touching a new low. For me this was a reason to be less excited about the play. I wanted to lighten up from my core position even more. I was still short. I just did not want to be as short.

I covered what remained of my core at 77.96 about 15 minutes before the close.

I hope this gives you some insight into my thought process trading TRV today. HT to @sspencer_smb for this blog idea. I would be happy to answer any of your questions at [email protected] or in the comments section.

Trade well.

Mike Bellafiore

Mike Bellafioreno relevant positions

2 Comments on “My thought process for TRV”

Thanks for your time and effort. Appreciated very much. Though EP news was out, Daily ATR is about $1.10 and way extended in the daily chart. With the bull run the market is having, short did not cross my mind. What was your reason to go for shorting this stock? Did you give more weight to extended daily chart (profit takers from this time frame) or just intra-day tape reading regardless of daily chart.

Thanks again.

GM

Congratulations. How much did u make in this trade. We all interpret the market in our own way and what’s important is to maximize what we see as opportunity and avoid all the pitfalls the market throws at us every single day. It was amazing that you held this all the way to the close after it threatened to go back to your entry point. Did you play other stocks through the day. That is a lot of patience and must have been a monster position for you to warrant doing that. I was watching Steven Spencer trade and he had some excellent really excellent calls on SODA after it popped out of a little range and he was getting long before the actual move. It really wants me to adjust my trading style to target some of these breakout trades. (really like a one off kind of play for me from time to time, but I am slowly seeing the light). Thanks for the insight nonetheless. -Sam