Hi Bella, I just finished reading your book One Good Trade and I wanted to thank you for writing it. I am trying to learn the craft of trading, and I found it to be entertaining and educational. Toward the end of the book you mention how in 2009 and 2010 you started moving toward longer term intraday positions and even … Read More

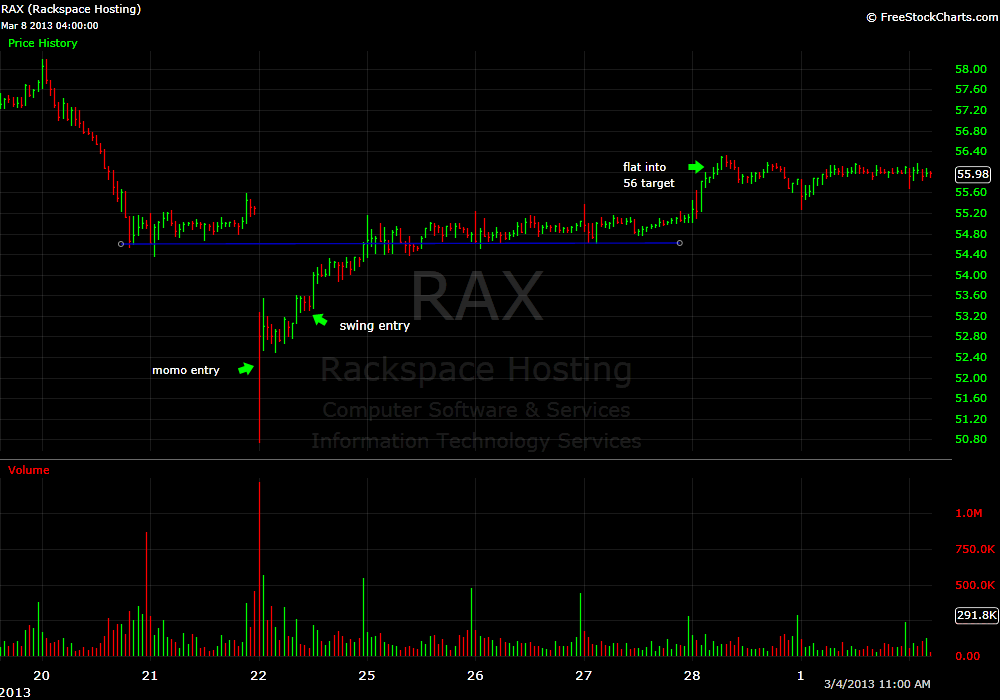

The Intraday Swing Entry

In October 2009 I began talking to our desk about “Intraday Swing Trading”. This discussion was preceded by about six months of mounting frustration from a large group of traders. Our desk at the time consisted largely of traders we trained in 2007-2008 a time of extreme volatility in the market that favored a very aggressive style of momentum trading. … Read More

One Good Pitch: Learning from Mariano Rivera

Mariano Rivera’s career path can teach us about our trading. I remember when Mo was not Mo, the greatest relief pitcher in the history of baseball, and with One Good Pitch: the cutter. If you are not as good of a trader as your ambition Mo’s journey could inspire you. My dad and I were sitting behind home plate, right … Read More

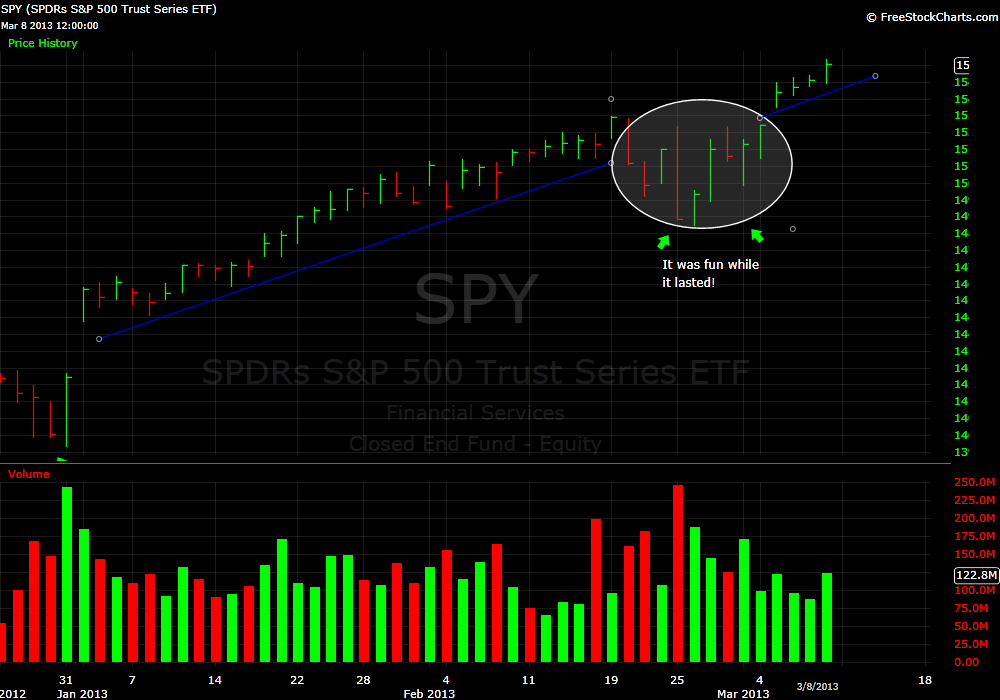

It Was Fun While It Lasted

Two weeks ago while on vacation I wrote this market-related post, wondering if the most recent down move would lead to a higher level of market volatility or simply retrace and be back to business as usual. Well, it appears that we have our answer as it is back to the #NewNormal. In the past four trading days the SPY … Read More

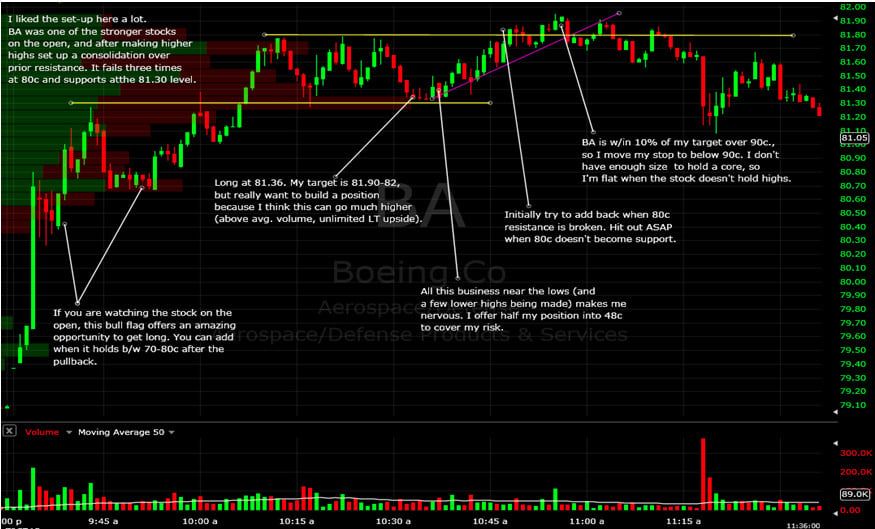

Elevating Your Trading Game: Discover the Power of an Effective Exit Strategy

Traders often struggle with when to sell a winning position. They sell too early and they regret as the stock trades three points higher or they don’t sell and the stock gives back all of the trader’s gains. The poor sale can send them into a distraction of regret, frustration, and even anger. In my next book The PlayBook, I … Read More

The Misunderstanding of the Conviction Trade

“I am going to stay in this until I am proven wrong. This is a Conviction Trade.” Things heard on a prop trading desk, from a retail trader, at a macro hedge fund, on the Financial Media Entertainment Complex. If only most of the above had conviction when they should. I was in my office chatting with a new trader … Read More

Do you have a news edge?

Last night I had dinner with Ravee Mehta, author of The Emotionally Intelligent Investor and former hedge fund trader at Soros Fund Management, hoping to learn more about getting a real news edge while trading. On my desk I hear my guys talking about Conviction Trades before the stock confirms their thesis. I have worked with very experienced discretionary traders who … Read More

Does the 10,000 Hour Rule Apply to Trading?

It takes purposeful practice AND 10,000 hours to become great at anything, says this latest blog from Barking Up the Wrong Tree. I write about one way to practice purposefully in my next book The PlayBook (which you can preorder), by creating your PlayBook. I have written about other ways extensively on this blog (some examples below). Improving Our Performance … Read More