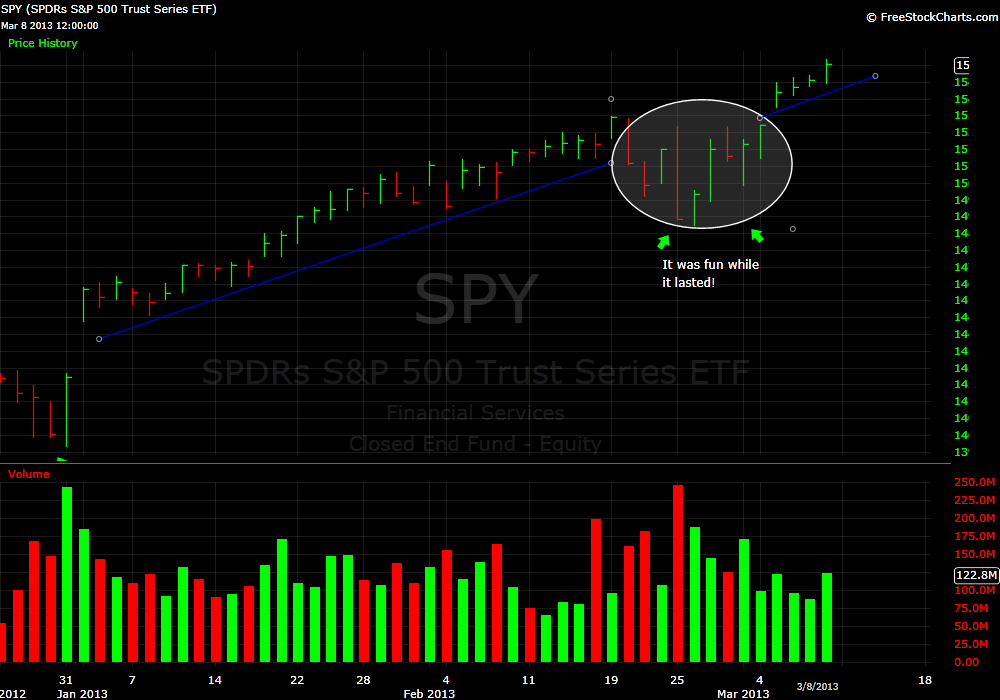

Two weeks ago while on vacation I wrote this market-related post, wondering if the most recent down move would lead to a higher level of market volatility or simply retrace and be back to business as usual. Well, it appears that we have our answer as it is back to the #NewNormal. In the past four trading days the SPY intraday range has been 82 cents and that includes Friday’s price action following an unexpected jobs report that gave us a 99 cent range.

This is the market we are in now. If you are continually looking to make “market plays” you are expending energy on an area that is not providing a good risk/reward. Every day we are seeing a few stocks have unusual moves that warrant our attention as short term traders. The market gave us two weeks where there was money trading market ETFs. Be thankful but its time to move on to trading CREE, NFLX, MPC, MET, GMCR, SBUX, MTG and other names that have shown above average volatility with good order flow.

Steven Spencer is the co-founder of SMB Capital and SMB University and has traded professionally for 17 years. His email is [email protected].