AM Meeting Synopsis: FDX is gapping lower on reduced guidance. Looks like it is going to open around 82.50, which is longer term support. Look to trade short below that level but if supports there look to trade long above 103. The Open: FDX opens just below 102.50 so initiate a short. Maintain the position until the downtrend is broken. … Read More

Recording: John Locke: A Piece of the Rock

SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by veteran options traders and experts in the world of options trading. In this presentation, John Locke provided a detailed example … Read More

Do You Pick Bottoms and Tops?

Good afternoon Mike, I read One Good Trade, and I pre-ordered The Playbook so I could get some additional insight into professional trading. I saw quite a few references to buying the support plays or selling the resistance plays, and I was wondering about the strategy, so my question is overall do you try to buy the low or sell … Read More

How to Prevent Back Pain as a Trader

Hello Mike, What is your advice regarding your back health during work? Doing so many screen time requires a lot of sitting, what is your experience and your partners in preventing back issues to have longterm career? I read your book, watched all webinars I can find ,read blog ( but only general topics ) and I dont remember you mentioned that,so assume your back is … Read More

AM Meeting March 14th – $SRPT, $VMW, $LNKD, $BBRY, $NFLX, $GMCR, $MLNX

*No Relevant Positions

How Do You Determine How Far a Stock Can Move?

Hi Bella, I have a question. I noticed in one of your blog posts a comment from one of your traders during trade review. Specifically it was a statement anticipating somewhat of a certain length move based on daily avg volume/relative volume compared to ATR. Now, I realize there are many things that move a stock- but my question … Read More

Two Good Trades

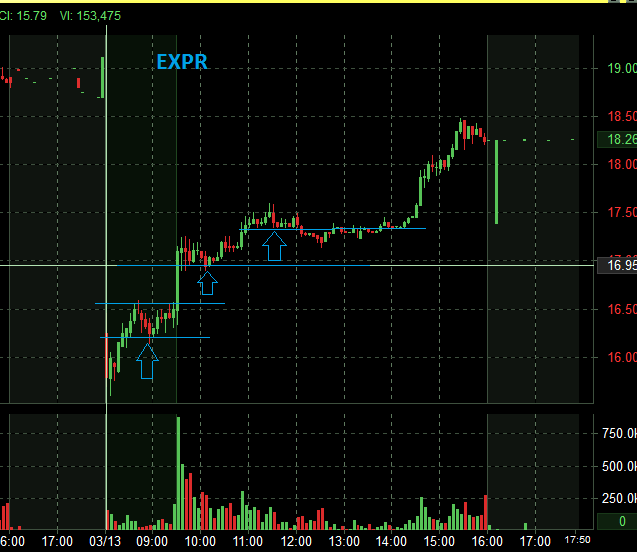

There wasn’t much In Play this morning. EXPR was gapping lower in reaction to an earnings release. When a stock has a large gap from an earnings release the first thing we do is look for clues during the pre-market session for whether it will be a gap fill candidate or a continuation play. EXPR was trading actively in the … Read More

The Wicks Win ($WAG)

One thing I always try and remember when running a firm is this: trading is not very easy. The margin of error can be slight between great trade and stopped out. The trade below is a spot on example. I love how this trader keeps a PlayBook and then has taken the time to ferret out A+ trades from his … Read More