The above is from a slide for my last presentation at an 800 plus event. This exercise has had a profound impact on my trading and trader mindset. Let’s explain the Gratitude Exercise which you might co-opt for your trading. Each day find time to close your eyes and replay three things for which you are grateful. During the … Read More

John Locke – Weekly Market and Position Update for August 11, 2013

John Locke Be sure to visit our trading blog! www.lockeinyoursuccess.com

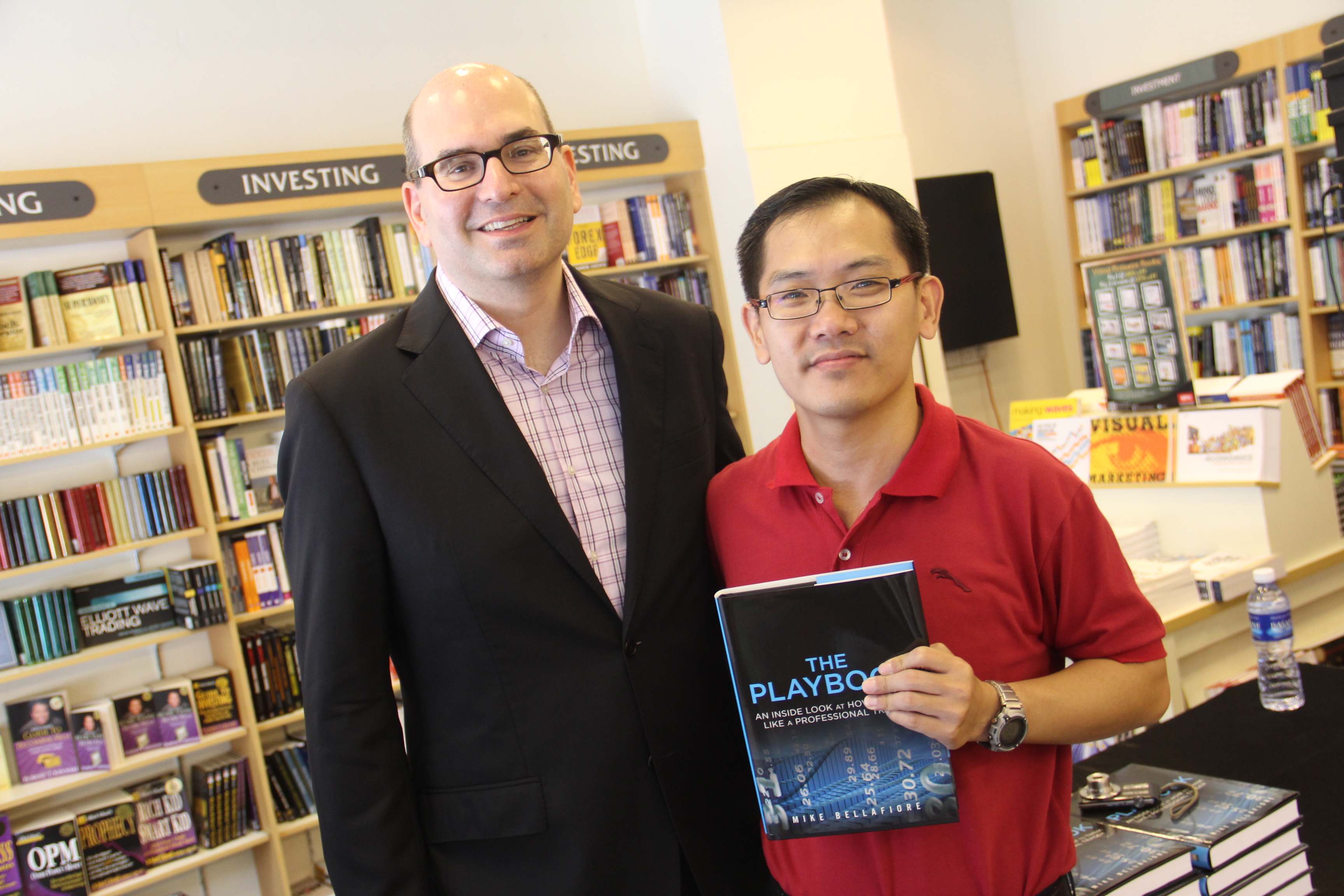

The PlayBook Signing Event in Singapore

Mike Bellafiore, co-founder of SMB Capital and SMBU, recently held a book signing with FT Press and Phillip Capital in Singapore. Mr. Lunch (below), a former student of SMBU, and one of the most enjoyable characters highlighted in The PlayBook was one of those who stopped by for his autographed copy from Mike. If you are interested in seeing more … Read More

Mike Bellafiore at Phillip iFest 2013, Singapore

Mike Bellafiore recently was the keynote speaker at iFest in Asia. You can find slides of his trading presentation here. Below is a picture of this 800 person event at Marina Bay Sands Casino in Singapore. An international lecturer, Mr. Bellafiore has built trader training programs globally for hedge funds, prop trading desks, and retail traders, working with some of … Read More

Mastering Options Trading for Income: Unveiling the Credit Spread and Iron Condors

When people first get interested in options-income selling strategies they usually start by learning how to sell credit spreads or iron condors. Let’s discuss these two strategies and why they might be attractive to options traders. If you have traded stocks or even simply invested in stocks, you know that you make money only if the stock goes up, assuming … Read More

Get a Trading Coach Already

There is little evidence of anyone competing at the highest levels without critical feedback, coaching, and mentoring (coaching is what happens in real-time and mentoring after the close). I received this e-mail yesterday that can teach us about the power of trader coaching and education. Dear Mr. Bellafiore, I wanted to send you a quick email to thank you … Read More

Put Options Basics: How to Protect a Position or Earn a Profit If a Stock Price Declines

What is a put option? A put option gives the purchaser the right but not the obligation to sell 100 shares of the underlying stock for a set price, the strike price of the option. This is true except at expiration, when a “long-in-the-money put option” is automatically exercised by the Options Clearing Corporation unless you instruct your broker not … Read More

What Do You Wish You Knew When You Started, Your Favorite Book and Setup?

Mr Bellafiore, I want to thank you for taking the time to read this email. I know you likely receive innumerable emails each day and reading and responding to them takes a considerable amount of your time. As a busy trader and a managing partner of your own firm, time is likely your most valuable asset, so the time you … Read More