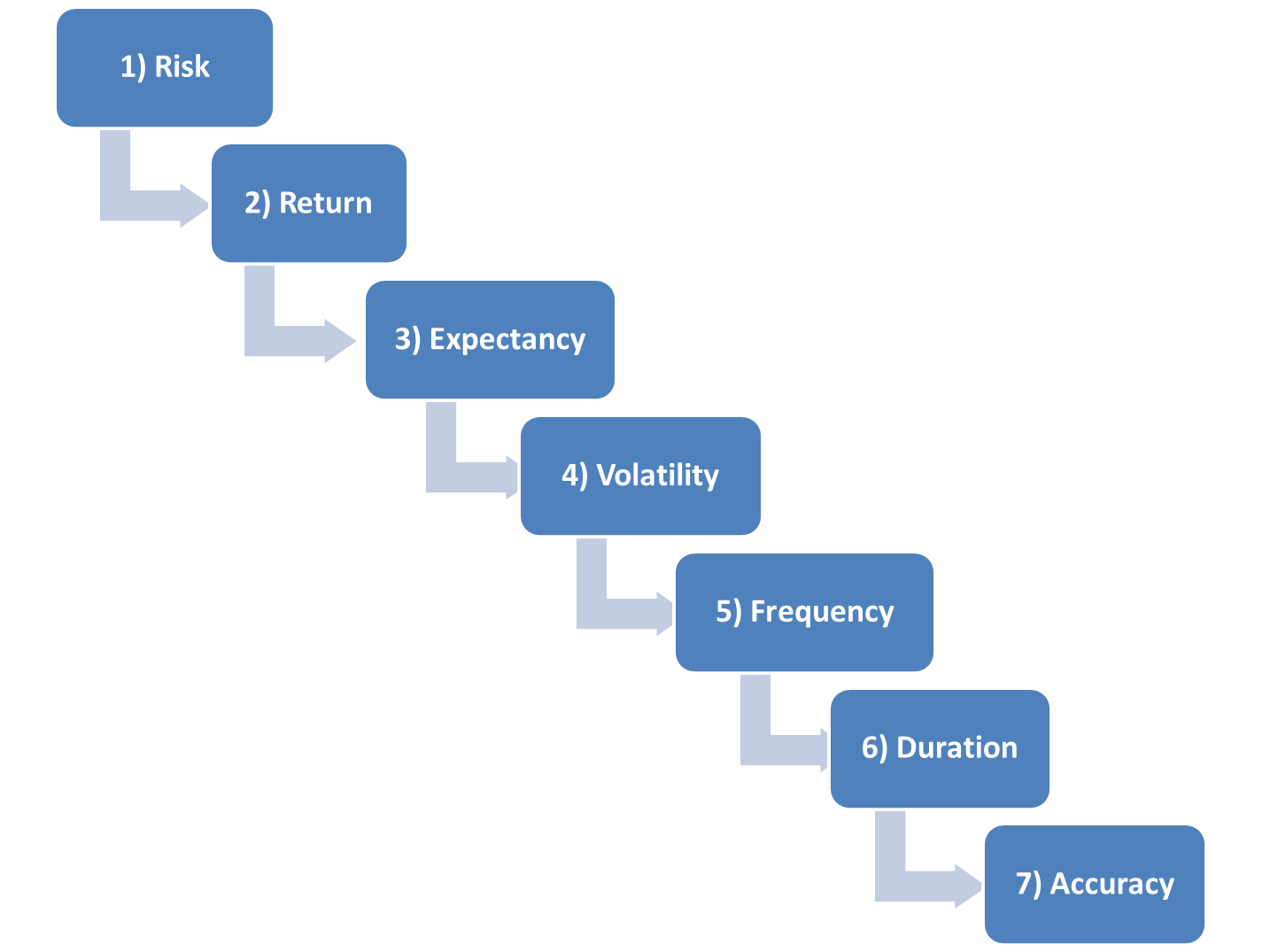

Previously, we covered Risk and Return as the first two things we look at when building a system. The third thing we want to review is called Expectancy. The idea behind expectancy is to focus on the big picture and long-term results of your system — and not just the next trade. Insurance companies and casinos base their entire enterprise around this … Read More

Trend Follower or Counter-Trend? Unraveling the Complexity

What makes prices in a financial market system fluctuate the way they do is traders entering and exiting the market for an infinite number of reasons. Some may be getting stopped out while others may be adding to a position. We can never know for sure the reasons why they may be acting a particular way at a specific period … Read More

SMB’s Mike Bellafiore Speaks with Students at Pace University

Mike Bellafiore, co-founder of SMB Capital, spoke to students at Pace University about trading and the need to start early while they’re in college if they want to get an edge in trading. Enjoy the video! You can be better tomorrow than you are today! Mike Bellafiore One Good Trade The PlayBook No relevant positions

Members Options Webinar: Livevol and Casey Platt: A Unique Perspective on Playing Earnings with Options (Sell the News, Buy the Rumor)

SMBU’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each Tuesday, SMBU hosts an options webinar—the Options Tribe—during which veteran options traders and experts in the world of options trading share live presentations. Next week, Kevin Nichols and Shannon Brandt of Livevol, along with Casey Platt, … Read More

Enhancing Trader Performance by Taking Some Nasty-Tasting Medicine

*****David Blair, The Crosshairs Trader, is a blogger/trader/educator who does a wonderful job of sharing research on elite performance and how it relates to trading. Below is his latest post for the SMB trading community.***** — Editor’s Note Enhancing our trading performance means we must swallow some nasty-tasting medicine from time to time. But I have found the nastier the … Read More

PlayBook Checkup: $CHTR

Below is our newest installment of the 2014 edition of The PlayBook Checkup with Bella, author of One Good Trade and The PlayBook. During these sessions a trade archived by a Junior Trader from our desk will be reviewed by Bella. Attendance is free for SMBU Tools subscribers, who can also ask questions during the event. In this video a Junior Trader talks about … Read More

Smart Options Trading: Unlocking Success with Strategy and Skill

“It’s better to be lucky than smart.” I’m not sure how that one got started, but I have to count that as one of the most foolish expressions in the English language. First off, what does it even mean? That if you have no intelligence or experience, that the only thing you have left is “luck” and you had better … Read More

SMB Trading Lesson of the Day: Buying Pullbacks on The Open

In this SMBU Trading Lesson of the Day, Bella, author of the “trading classic” One Good Trade and The PlayBook, talks about a trading pattern that’s been working in this Bull Market. Highlights from this trade: 1) This pattern works extremely well in a Bull Market. 2) Incorporate this strategy into multiple timeframes. 3) LOW gapped up significantly on earnings; see Mike’s thoughts … Read More