After fifteen years trading equities the insight hit me like a sledgehammer… A casual conversation with John Locke turned into one of those movie scenes where the actor wakes up from a deep sleep with a new mission. In my case it was a new thought process of how traders actually earn money. Now keep in mind here I am … Read More

Yes You Can Become a Better Trader!

How You Can Be Better Tomorrow Than You Are Today I am often asked: What is the most important attribute to become a successful trader. My answer may surprise you. It has nothing to do with “conviction” market predictions. In fact, for those that have read my latest book The PlayBook, I scorch the myth propagated by the Financial Media … Read More

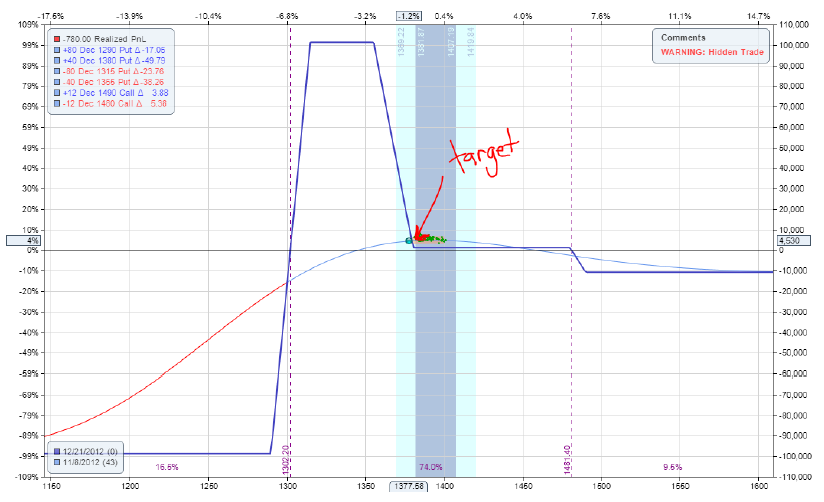

SPX Ratio Spread: 3 Year Back Test

I recently completed a third year of back testing the SPX Ratio Spread on the SPY Detector signals. Without any changes to the rules or the signals, 2012 had remarkably similar results to the previous two years which were much more volatile. Here is some documentation for this back test: PDF Overview: SPX Ratio Spread Back Testing Results – Part 2 … Read More

Risk Management of Iron Condors

This week, Seth Freudberg, SMBU’s Director of Options Training, discusses a monthly iron condor trade using $NDX index options. Enjoy the video! Seth Freudberg Director, SMB Options Training Program The SMB Options Training Program is an eight-month program designed for novice and intermediate level options traders who are seeking an intensive training process to learn how to trade options spreads … Read More

PetSmart Not So Smart?

This morning I created a “trade idea” video featuring a short setup in PETM. Here is how the trade actually played out for me. The idea behind the trade was there was a fresh catalyst causing bearish price action during pre-market trading, and a similar setup has yield excellent results recently in stocks such as DKS and INCY. A very … Read More

How to End Stock Picking Frustration

Even the best traders have their bad days (or weeks or months). Sometimes the frustration can be maddening. It’s not a question of talent – as previous trading success bears this out. It’s just that sometimes, things just stop working and you need some fresh ideas – and when you go to the well, it comes up dry. Successful traders … Read More

Give Me a Break SMB (Part II)

In a past post an SMBU Reader ripped SMB for its exclusive hiring process, in Give Me a Break SMB. This trader recently went on an interview for a prop trading job and was rejected. He vents in this playback of his interview experience. Hi Mike! Remember my previous letter with the same subject? Well, let me tell you how … Read More

SMB AM Meeting Recap: $PETM

In this short video, Steve discusses a stock from this morning’s AM Meeting. Every morning he reviews the market and analyzes the stocks that are in play and likely to have second-day moves. Steve discusses the potential trading setups in $PETM. Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, options, forex and … Read More