@mikebellafiore One thing I do before the open is develop a game plan. What stocks do I want to trade first? What prices do I want to enter positions? This helps a trader to not get overwhelmed when the market opens. There is all this data flashing buy on multiple screens in nanoseconds. Sorting out your best stocks and best … Read More

Why this trader got sent home

Yesterday we sent home a trader. Why? To cement a small win from him which he can build. The trader is just passing over his Year1 mark into Year2. This is the year where there are PnL expectations. At our firm our data suggests most traders experience significant improvement in Year2. Yesterday he was having one of his best days. … Read More

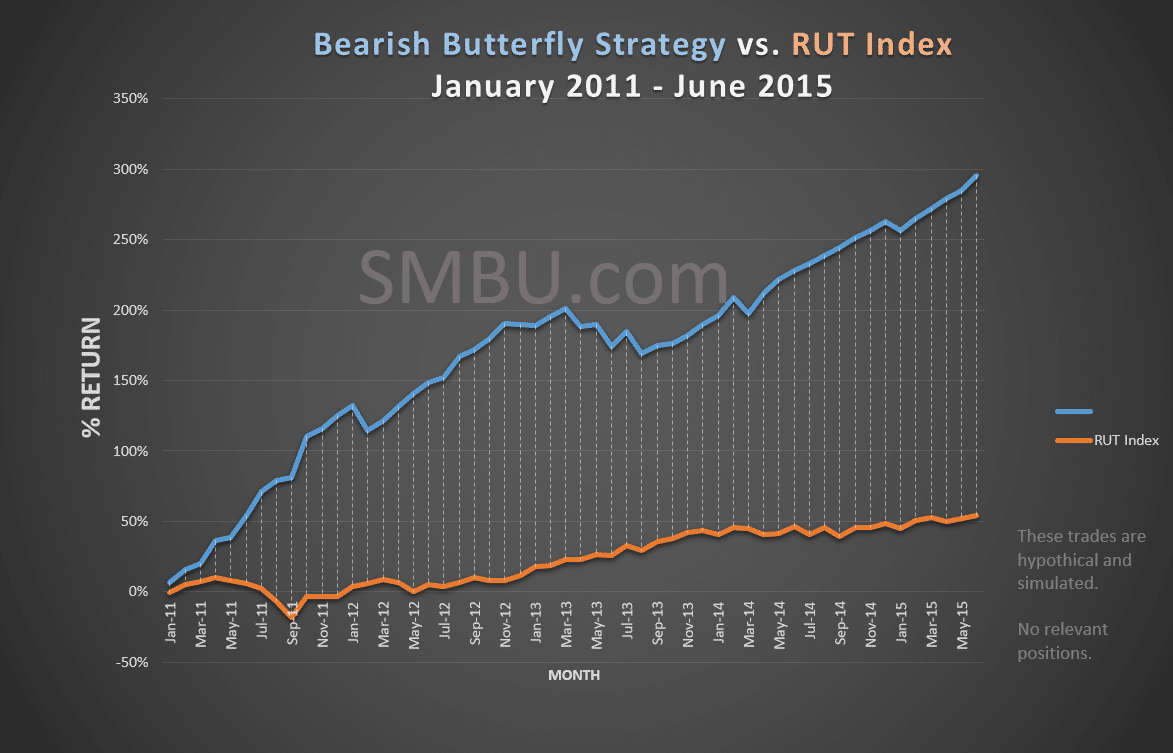

How this Bearish Strategy Beat the Index by 288%… Even in a Bull Market

Please note: Trades discussed below are hypothetical and simulated for educational purposes only. Review the options risk disclosure. The graph below compares the Bearish Butterfly vs. the S&P 500 index. If you had traded the rule-based Bearish Butterfly Strategy for the past 5 years, you could have outperformed the index by 288% — even though the market was bullish during … Read More

Thoughts On Trading A Bear Market–SPY FB NFLX

In this video I offer some thoughts for how the market is setting up for the second week of February. If you are interested in our process for finding the best trading setups each day join me for a free webinar Monday February 8th at 4:30PM. Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading … Read More

Future of Trading: Insights from My Columbia U Guest Lecture

I was invited to lecture at Columbia University this week to talk with their students most interested in the markets. I have been guest lecturing at colleges since the start of our proprietary trading firm, ten years ago. While walking home to my apartment a few blocks south after this lecture, it struck me that so much has changed with … Read More

Sprinkle 4 Ingredients onto Your Smart Trade Ideas: Boost Your Trading Intelligence

Here’s what I see from my seat as the managing partner of a proprietary trading desk in NYC with underperforming experienced traders. Add four ingredients to your trades. They do a wonderful job of developing trading ideas. They have many of them and many of them work. But too many of them do not work. And they mostly just trade … Read More

Tweaking Our Strategy During Market Volatility

In our SMBU Daily Video, Seth Freudberg explains how SMB’s Options Trading Desk tweaked its portfolio of monthly trades to adjust to this market environment. Traders need to realize that the market has changed–2016 is much more volatile In these environments, tweaking your portfolio of trades is recommended for retail traders * no relevant positions

SMBU’s Options Tribe Webinar: Doc Severson of Tradingconceptsinc.com: The Top Ten Lessons for Trading a Small Options Account

This week Doc Severson of Tradingconeptsinc.com returns to the Options Tribe to discuss his tips for traders who are managing smaller options trading accounts.