If you have to use your imagination to see how you win… it’s time to close your trade. Seth Freudberg discusses when it’s time to close a trade.

SMBU’s Options Tribe Webinar: SMB Capital Options Desk Trader Alex Porcaro: The Longer-Term M3: observations from back-testing and live trading

This week, SMB Capital Options Desk Trader Alex Porcaro returns to the Options Tribe to discuss an M3 trade that is initiated much earlier than usual and his observations about the trade from backtesting and live trading this approach.

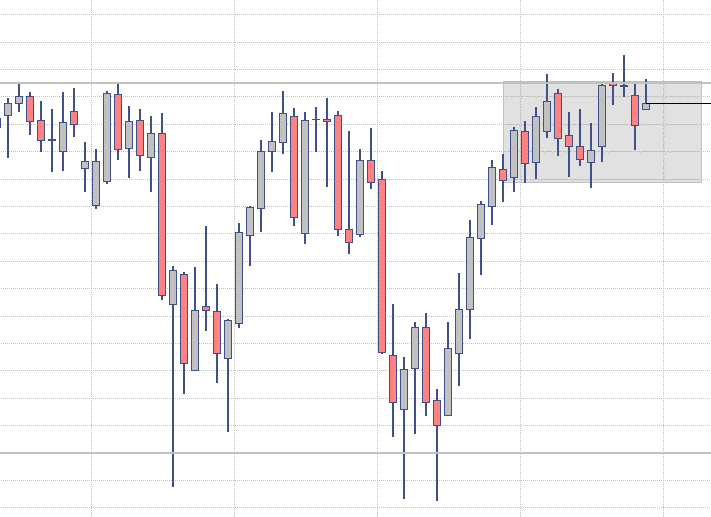

Entry Types For Momentum vs Rangebound Plays

Last Friday we had a great talk, with Brexit fresh off the press, during our weekly Trading Conversations webinar last Friday. As usual, we covered a wide range of things such as using context, how to adjust your trading to handle volatility, and more! Not a bad way to wrap up your trading week with some open trading conversation. One … Read More

SMBU’s Options Tribe Webinar: Robert Chastain of Monarch Capital Group: Practical Options Tactics

This week, Robert Chastain debuts on the Options Tribe to discuss practical options tactics that he has developed over his long career as an options trader.

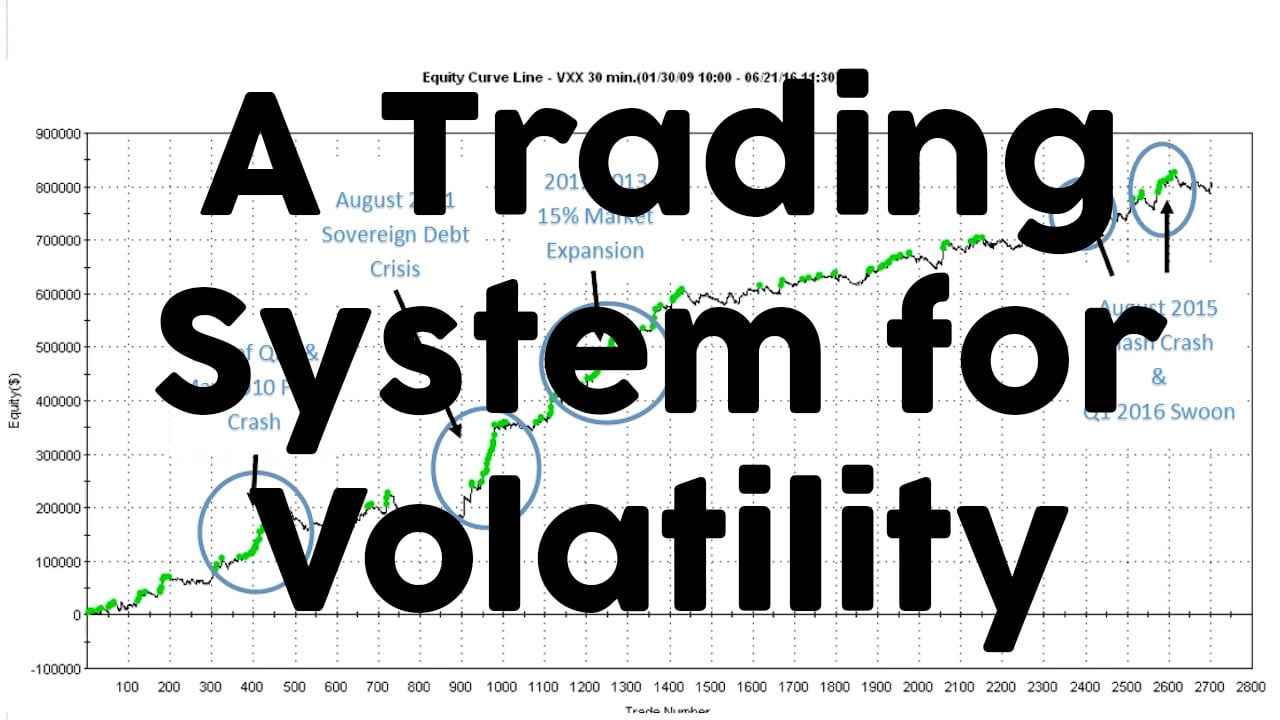

A Trading System for Volatility

Andrew reviews a VXX strategy to see how it would have handled several high volatility events over the past several years.

Why did LVS trade through 44 if that was support?

LVS hit our radar for a Spencer (my trading partner) 2nd Day play. There was not much a news catalyst in LVS, but yesterday it traded a higher RVOL, finished near the bottom of its range, and traded significantly weaker than the market. We walk onto our trading floor today wondering if there will be follow through or a bounce … Read More

Underperformance and Your Beliefs

We covered several interesting topics during our weekly Trading Conversations webinar last Friday. As usual, we covered a wide range of things such as using context, randomness, risk/reward, knowing your market with statistics, and more! Not a bad way to wrap up your trading week with some open trading conversation. One topic we covered in particular stood out to me, … Read More

How Do I Use Previous Support and Resistance Levels?

Hi Bella, I have been learning a ton from One Good Trade, The Playbook, and all the online educational content you have. Thank you! When you are analyzing a stock “in Play” and looking at previous support/resistance levels, how much weight do you give them going forward with that days trading? After all, we would be trading this stock in … Read More