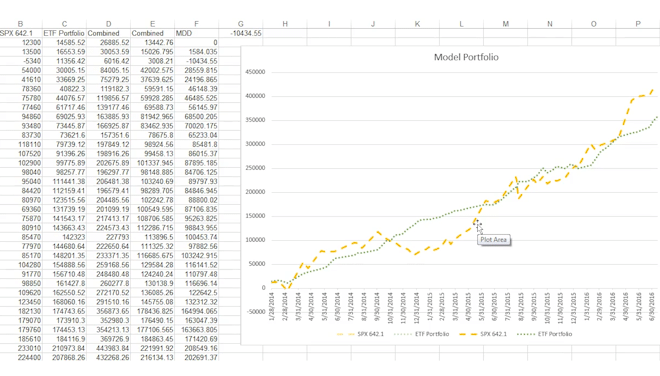

In this video Andrew Falde shows you how to use two trades simultaneously to help reduce drawdowns. * no relevant positions

A West Coast Story on Journaling

Hi Mike–I listened to your video regarding the trader that was having issues journaling. I solved that same issue by typing onto the chart itself – – the reasons why I bought and sold at the exact point of entry and exit. As you know, Tradestation can pinpoint the exact point of entry and exit if you turn on that … Read More

The way you express yourself successfully in markets

I want to share with you an awesome video from Sherri Coale, Head Coach Women’s Basketball, that will make you a better trader. But exactly how needs some context, so first a few comments. It is really hard to start as a discretionary trader these days. HFTs cut and stop you out of positions. The media has been warning of … Read More

Taking that next step forward in your trading with sizing

I sit in a unique seat in the trading community. For the past decade, I have trained traders from new to consistently profitable or failed trader. As the author of two trading books, gratefully many reach out to me sharing their trading challenges and triumphs with the why and how. What I do in my writing is share my observations … Read More

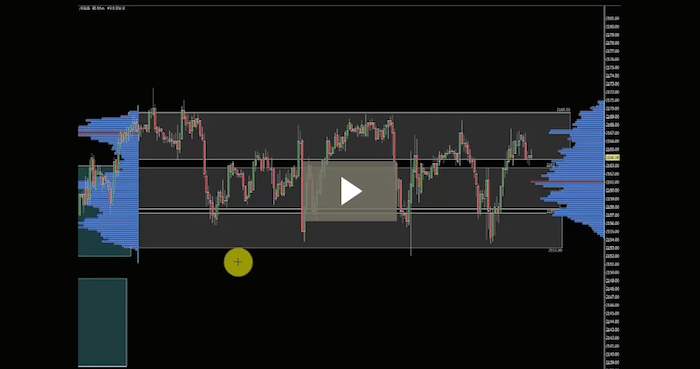

Current Emini S&P 500 Market Structure

Here’s part 2 of this free insight into using Volume Profile to find great trade locations. If you have further questions about adding this tool into your trading, reach out to Merritt at [email protected]

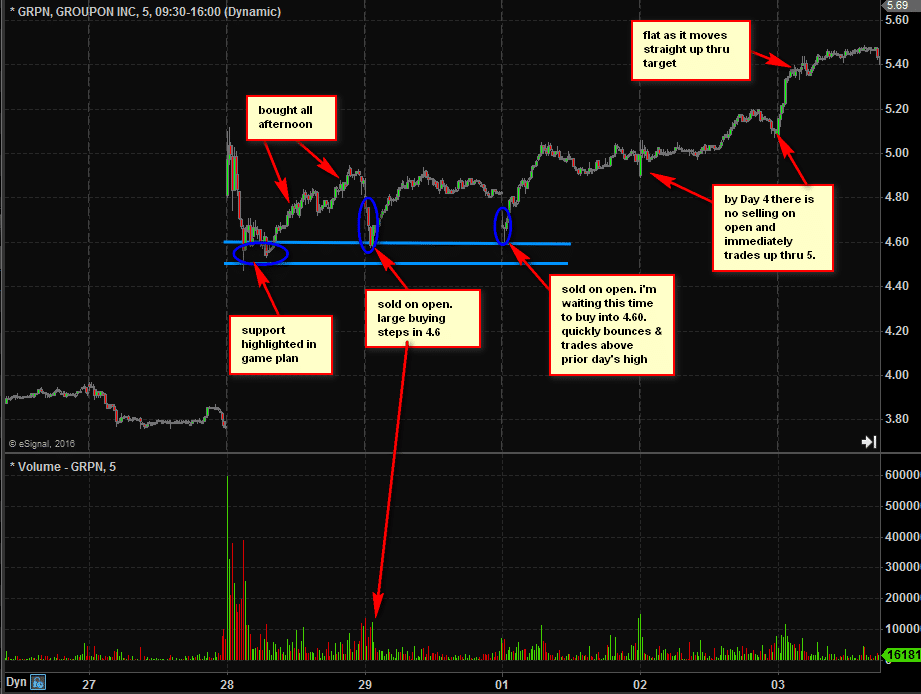

Old School Market Manipulation

So my friend JC Parets tweeted recently that he is miffed by traders and investors complaining about market manipulation and not formulating a plan to profit from said manipulation. His point is, I think, as market participants our job is to find ways to extract profit from the market and if we recognize patterns/manipulations then we should have a plan … Read More

Don’t Push Your Luck

In this video Seth Freudberg discusses why it is a good idea to stick to your plan and avoid getting overly excited about recent success.

How this trader improved

I was chatting in the hallway at our firm in NYC, with a developing trader who was verbally proud of his improvement on that day. He was really proud. I asked him what progress he had made and how. In detail, he offered his improvement. When he was done, I asked him to memorialize the improvement in an email to … Read More