I can count on one hand the number of times I have written a blog post that discusses a future move in a stock. The main reason is I reserve my bigger picture trading ideas for the traders on our desk. Also, even if I am confident a stock is setting up for a big swing move, its intraday behavior will have a HUGE impact on how I will trade it and it is difficult to run through all the possible variations in a post.

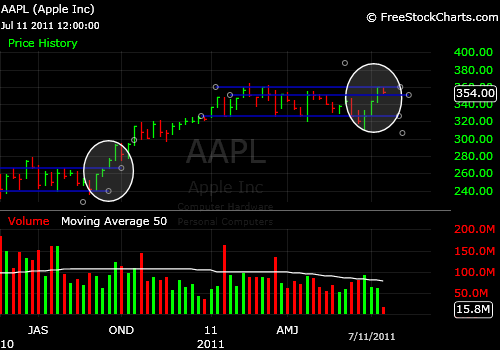

Take a look at this weekly chart on AAPL. The last time it broke out from a weekly consolidation it moved about 50 points from the bottom of its consolidation to the top of its move in four weeks. About 20% in percentage terms. If it were to make a similar move this week breaking out after a six month consolidation we are looking at a move to 375-380. If you subscribe to the belief that a longer consolidation leads to a bigger move then you may want to think about a move to 400.

The likelihood of this breakout increases if AAPL can spend the next day or two above the 350 support line I have drawn on the chart. This would be less than a 20% retracement after a 50 point move in the stock over the past three weeks. This analysis would be no different for me if I was looking at a stock intraday. Big move then small pullback usually leads to big move again if the trend resumes in the direction of the big move.

Now to the tricky part. How do you capture the bulk of the break from consolidation while minimizing risk? Probably not something I can teach or the reader can learn from a blog post. I will use the AMZN breakout from a couple of weeks ago as an example of how I played a recent break in a momentum stock.

AMZN had broken its downtrend that began in mid may and over a 4 day period moved sideways and had failed to break above 195. So because trading is not rocket science and there are no rewards for coming up with the most brilliant idea we decided we should simply get long AMZN if it managed to finally hold above 195. AMZN is not the most liquid momentum stock and has a fairly wide spread. Therefore, itt is important to be cautious when you initiate a position.

One of the oldest tricks in the book is for momentum stocks to pop above a resistance level right on the Open and then drop out for 1-2 points. And while all the momo day traders are smashing their keyboards and cursing HFTs the stock will get above resistance a second time and then trend for the rest of the day. Guess what AMZN did on June 27th? Exactly. On the Open it got above 195 dropped out to 194 and then the second time trended up for 7 points.

To give myself a little extra protection I waited for AMZN to clear 196. This did a couple of things for me. One it proved to me that buyers were really interested in AMZN above 195 if they were will to push it more than a point above prior resistance and two, I was able to use the magic whole number to place a bid to get hit on a pullback at 196.01. For those of you who have tick charts punch up the chart for June 27th and you will see one print on a pullback to 196.01 after it got above there. That was my bid being hit on ARCA. My stop was below 195.70 and the target we had discussed in the AM Meeting was 200-202. A nice R:R of 1:20. AMZN ended topping out that day around 202.50 and my stop was never triggered.

If AAPL plays out in a similar fashion then I would probably be looking to bid once it were to trade above 262 and then expect a move to 268-270.

4 Comments on “I Can’t Sleep So Blog Readers Benefit”

Very nice on $AMZN. The $AAPL move only possible after 19th july results?

Could you share your rationale for placing the stop at 195.70 for amzn? Thanks

HI,

Its very useful article guys, I really liked it.

thanks for it.

“I Can’t Sleep So Blog Readers Benefit” It is a title of this post . And it post offers superb information about Can’t sleep for us. And for read this nice post thank to all.