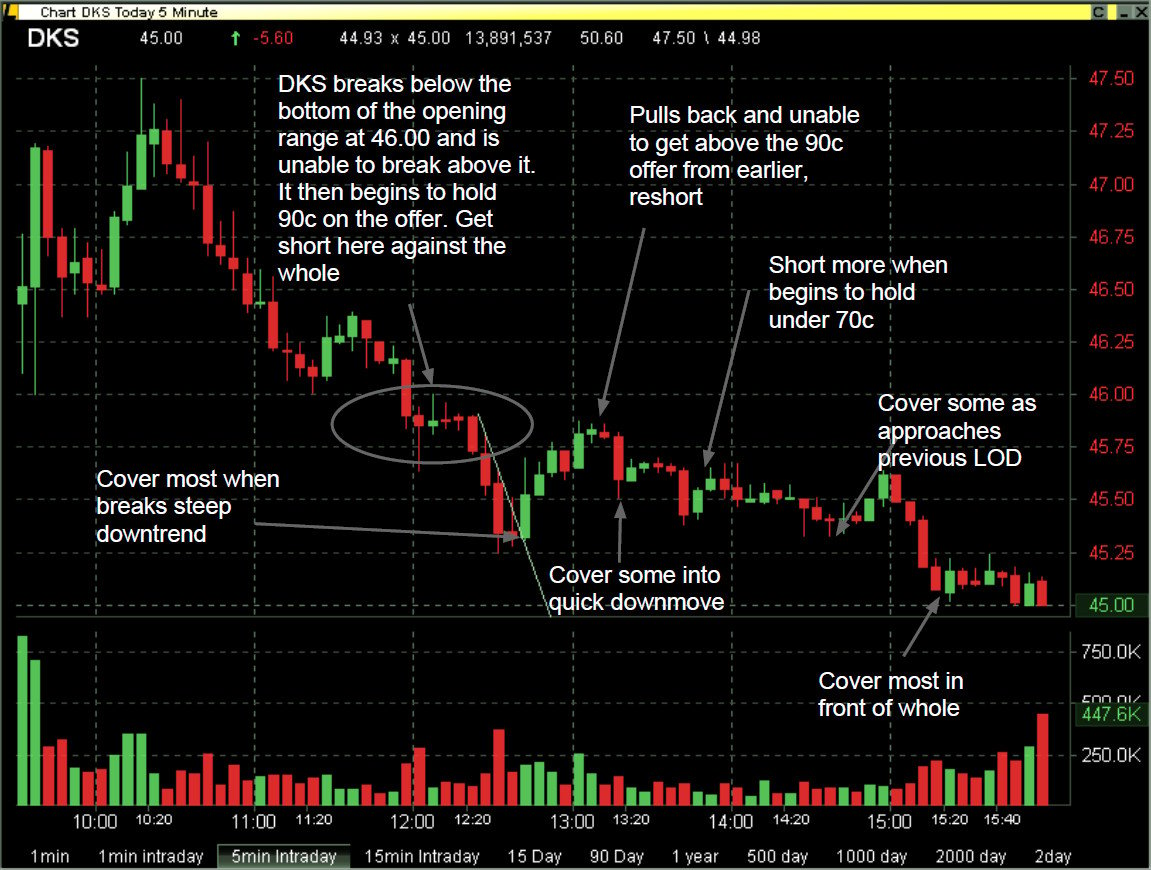

Below is a Trade Management slide from a PlayBook trade of an SMB Trader. As I discuss in The PlayBook, our traders archive a favorite setup from the trading session for their trading PlayBook. Looking at the trader’s markup below, we should review an opportunity to get bigger in this position.

Shorting below an Opening Range of a Stock In Play, like today in DKS, is a wonderful setup.

Intraday Fundamentals

FQ4 EPS of $1.03 misses by $0.03. Revenue of $1.81B (+12% Y/Y) misses by

$0.05B.

Comparable-store sales forecast to slip -2% to -1% . Higher merchandise

margin seen offsetting escalating store costs during the period.

ATR: 1.12

ADV: 1.47M

SF%: 9.8%

The trader finds an excellent place to enter, weakness on the tape, below the Opening Range at 45.90. A few things about the management of this trade:

1) I like the idea of taking some off into a steep downmove as the trader suggests into 45.25. This is not a move where you should be flat. You should get lighter but continue to hold some of your Trade2Hold position from 45.90.

2) A retracement to near 45.90 is an even better short and where you want to get bigger than your original position. Why? You saw the trade start to work with that move from below the Opening Range at 45.90. You saw confirmation from the price action that your idea to short was correct. There’s more evidence that the short below the Opening Range will work. Get bigger!

3) When you get bigger into a retracement your core position should increase and you should hold until there is a Reason2Cover. In this case the closing bell was your Reason2Cover, assuming your were making an intraday swing trade.

Traders are always looking for opportunities to get bigger and hold. This was one such example.

Mike Bellafiore

no relevant positions

2 Comments on “How and Where to Get Bigger ($DKS)”

Hello mike i want ask something related to this post. Why not start the short before then got to 46.

Im looking forward your answer

Thanks a lot

SMB is strictly a trend trading shop and their number one tool in defining trends is a break of support or resistance. They identify key levels. For stocks that range and are about to break out, they determine if the ceiling of that range is broken to the upside and then they get long.

Conversely to the downside they employ a similar tactic. One of the trades they love and I’m sure emphasize a great deal in their trading program is the breakdown of all support in a stock creating new 52 week lows. A good example would be HLF when Ackman first indicated he was short. I’m not sure if they were in that, but they like stocks like that that are down big on news, have no support. They will enter in the second or even third day of a collapsing stock such as this and as long as it breaks the prior days lows, they will short all they can.

Reason why SMB didn’t short DKS before 46 was 46 was the bottom of the opening range. That’s the floor. Once the floor is broken, they trade the momentum in the same direction. They will do the same the other way around (but has to be a breakout of resistance in the last week or two at least).

If you look at DKS chart you can see clear support around 44 level going back to last year. This play actually was not a huge play for SMB but just an example of a sure thing single or double type of play.

For the homerun play, if DKS opened at 45 for example, and in intraday broke below 44, the entire SMB firm would probably bet the ranch getting short and trying to ride it down to low 40’s.

This is just my observation from watching SMB trade. They are good at this technique and you can learn a lot if you observe. Pretty fail proof type of trading and very high probability.

-profader