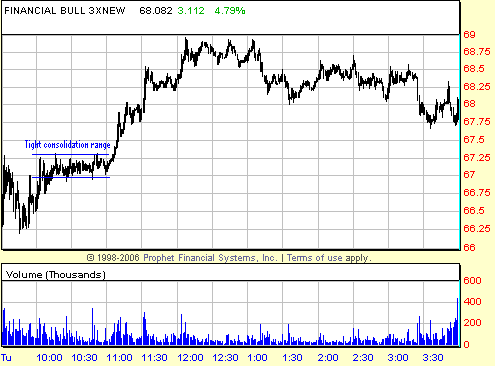

After yesterday’s selloff we had a small overnight gap to the upside and we were watching the Open to see whether to trade the market from the long or short side. As usual FAS was on the radar of several of our traders. There was some initial selling pressure in the financial sector but fairly quickly it began to show relative strength.

The FAS spent about one hour consolidating right below its intraday high in a range between 67 and 67.30. One time the 67 bid dropped and a bunch of people got short myself included. There was no down move and FAS quickly reestablished its trading range. Generally, I don’t like to short stocks that are consolidating close to their highs but FAS is a great momentum stock and I was willing to give the short side one attempt if it appeared to be breaking to the downside.

I immediately covered the short position when FAS was rebid at 67. One of my favorite young traders, Joe P, got long at 67.06. He saw the failed breakdown attempt at 67 and wanted to catch a potential move through the high of the day. Little did I know that JP had some additional caveats to his trading plan.

JP had put a stop order to hit his long below 67 and also decided he wanted to get short if the 67 bid dropped. The first part was fine although after the previous failed breakdown one might consider lowering their stop to 66.89. The second part of his plan made no sense. FAS had already shown once that no one was committed to selling below 67. Without the commitment of a seller below this level it was not a short. The only thing that should have gotten him short besides an identifiable seller below the support would have been a hard downtick in the IYF.

JP got stopped out of his long and then stopped out of his short. Ripper! His loss was greater than the PnL he gave up on the two losing trades. Soon after JP got stopped out of his short position FAS began its best up move of the day. JP got back in but he was in such a defensive posture he was unable to capitalize on a move from 67.35 to 68.50. This was not very difficult money.

Our job as intraday traders is to take in all of the relevant data and then to make correct trading decisions. We had enough information in FAS to know the focus should have been on the long side at 67. Those who maintained their long bias at this level were rewarded with a substantial amount of of PnL.

8 Comments on “Fool Me Once Shame on Me Fool Me Twice…”

Hey Steve!

I see these breakout plays that you mention in many stocks. I just can’t seem to get the play right.

When FAS breaks above 67.35 and you get long, what price is your exit if it becomes a failed breakout? Thanks!!

Hey Steve!

I see these breakout plays that you mention in many stocks. I just can’t seem to get the play right.

When FAS breaks above 67.35 and you get long, what price is your exit if it becomes a failed breakout? Thanks!!

Hey Steve!

I see these breakout plays that you mention in many stocks. I just can’t seem to get the play right.

When FAS breaks above 67.35 and you get long, what price is your exit if it becomes a failed breakout? Thanks!!

Hey Steve,

Great article! I was wondering if you could maybe comment on how much size you’re trying to use on this type of trade and how early you start taking profits or cutting losses. In other words, how do you manage your position size in this kind of trade?

Thanks a lot!

Jeff

Hey Steve,

Great article! I was wondering if you could maybe comment on how much size you’re trying to use on this type of trade and how early you start taking profits or cutting losses. In other words, how do you manage your position size in this kind of trade?

Thanks a lot!

Jeff

Hey Steve,

Great article! I was wondering if you could maybe comment on how much size you’re trying to use on this type of trade and how early you start taking profits or cutting losses. In other words, how do you manage your position size in this kind of trade?

Thanks a lot!

Jeff

It’s very good

It’s very good