This turned into a four part series when yesterday’s post on evaluating your daily performance ended up being longer than I planned. It is especially important that you understand the information from the second post in this series before reading this post, which will focus on actually quantifying your edge in your trading plays.

As a starting point, you need to have a significant set of data from a fairly large set of trades. I would suggest that these should be categorized according to the type of trading play, and that analysis be done on each category separately (though you may also find value in doing all of your trades as one large set. You may be surprised to find out that some kinds of trades, which you thought were very profitable, might not actually be worth as much time as you’re spending on them. Conversely, there may be a set of trades that you are not really focusing on that are quietly churning out small profits, and this set of trades could represent a real opportunity if you can play them more aggressively.

This issue of how to divide your trades into categories is not trivial. It is tempting to create a category for every variation of trade, but, at the end of the day, you will end up with categories that are too specific and have too few trades in them to be useful. In my playbook I have basically four broad categories of trades: In play scalps (breaking news midday, or on the open), pullbacks, end of trend patterns and breakouts. I have many different ways to get into and manage these trades, but I basically label each trade with one of these four broad categories. If you are an active trader, it is easy to end up with a dozen or more categories, but this level of detail can quickly become unmanageable. Rather than making a firm plan at the beginning, most traders will find it is better to start keeping records and then start adjusting as need be.

I touched on this in the previous post, but it is important enough to repeat here. You must think about how to standardize your trades. Working in raw dollars is not that useful. Percentages (of the stock price) might be a better metric (hint: if you use percentages I would multiply everything by 100 or even 10,000 because our brains deal with numbers like 42 a lot better than .0042.) My preference is to standardize everything for the risk I was taking on the trade, which is a number that absolutely must be recorded at the time you put the trade on. I cannot overemphasize this enough — if you do not standardize your numbers, you won’t get meaningful information. One trade in AAPL or PCLN can swamp a lot of trades in lower priced stocks.

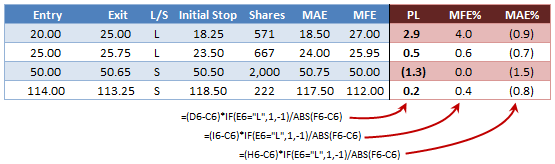

Take a look at the following table of theoretical trades:

I hate to repeat information from an earlier post, but let’s just make sure we are on the same page with this table. Everything on the blue side is collected from your trade blotter and everything in red is calculated. (I thought I was being helpful when I put the formulas on the sheet, until I realized that I did not include column labels! The leftmost column in the table is ‘C’.) A few reminders about the blue columns: Entry and Exit are average prices if your trade included multiple entries. Initial stop should be recorded at the time of entry. In this table, I assumed a constant $1,000 risk per trade, so the number of shares reflects that risk level. Obviously, you would record what you actually traded.

The first calculated field is P&L, which is your profit/loss as a ratio of the amount you risked on the trade. This, to me, is the absolute bottom line and the single most important statistic you need to track. This is also what is commonly called your risk/reward ratio, but there is no guessing or speculation about what you intended–this is your realized risk reward. Looking at the numbers in the table above, I see a huge red flag: a trade with a loss of -1.3 times the intended risk in the trade. For a daytrader, this should happen very rarely. (Swing traders will have some surprises on gap openings… my single biggest loss was -4.5 times the intended risk on the trade on a gap open.)

You should also run basic statistics on this column. Knowing your mean, median and standard deviation of this number for different categories of trades will tell you a lot about your actual edge in the market. (Many traders who think they are trading with 1:2 or 1:3 reward to risk will have some real surprises when they actually run these numbers.) In addition, you should probably run sets of numbers on winning and losing trades separately. I have found interesting information in the differing variances of each set, and also in the the analysis of outliers.

Consider next the MFE (Maximum Favorable Excursion), which is the furthest the trade ever moved in your favor between your entry and exit time. We should think about an important and fairly widespread misconception here. Some people believe that the “reward” part of the risk/reward equation comes from this number, but this is absolutely false. Risk reward is what you execute on a specific trade or over a large set of trades; this number only shows you how well you could have done with perfect foresight. (Imagine selling the exact high tick of every move.) Subtracting your PL from the MFE% column shows your “give up”, or how much open P&L you gave back in any open trade, which is another important stat (not shown in the table above) to track. Obviously, there will be a lot of variability in this number, but if you’re seeing that it is very large relative to your P&L (say, giveup is 1.2 and average P&L is 0.8) might suggest that you could be more proactive about taking profits because, on average, you are leaving a lot of money on the table.

The remaining column, the MAE (Maximum Adverse Excursion), is the furthest the trade went against you from the point you entered. (If you are respecting your stops, this should almost never be less than -1.0, so the trader in this example has some explaining to do!) One good way to look at this number is as a measure of “heat”–how much heat you are taking in each trade. Again, think about how you might use this number. If you are seeing very large numbers here on average, perhaps it would be appropriate to scale into your trades a bit more rather than going all in.

For simplicity’s sake, I calculate one more number not shown in the table, a simple “indicator variable” that is a 0 if the trade was a loser (PL < 0) and a 1 if it was a winner. This might seem like a silly number to calculate, but if you have this column set up like this, you can simply average it to find your win ratio. (In the example above, you would have 1,1,0 and 1, which averages to .75 = 75% win ratio.) I segregate winning and losing trades into separate groups and calculate stats on them, so I can easily calculate the expected value of any trade in my playbook using the simple formula of winning percentage * average win – losing percentage * average loss. Remember, the beauty of this system is that these results are based on actual, hard, executed numbers, with no guesswork or wishful thinking involved.

All of these numbers are only meaningful across a significant sample size (say 20-30 trades in each category), and they are also not valid if your execution is not stable. If you are a new or developing trader and have made significant changes to your trading style across the period you are analyzing, then you are comparing apples to oranges at each end of the time period. (There are tools for dealing with this kind of style drift, but they are a bit beyond the scope of this article. At any rate, you should strive to execute consistently.) In my opinion, the most important use of this kind of analysis is twofold. First, you cannot possibly understand your true edge in the market without doing some kind of analysis like this. Especially for developing traders, this is a critical point. Perhaps even more importantly, it will show you the right kinds of questions to ask of your trading. This kind of analysis can be a critical part of your toolset and an important part of your development as a trader. I hope this series has given you some ideas and can provide a good starting point for you to refine your own analysis of your performance.

| Entry | Exit | L/S | Initial Stop | Shares |

| 20.00 | 25.00 | L | 18.25 | 571 |

| 25.00 | 25.75 | L | 23.50 | 667 |

| 50.00 | 50.65 | S | 50.50 | 2,000 |

| 114.00 | 113.25 | S | 118.50 | 222 |

8 Comments on “Evaluating your trading results (4/4)”

thx for the great post! I have added MAE and MFE to my analysis. Is there a stat that you use to see if you are too trigger happy and left money on the table? Do you think I can modify MFE to record the IDEAL price to get out even after my exit (but within the timeframe I intended to trade). e.g. if I am trading a horizontal level breakout over 30, entry at 30.02, MAE 29.98, scalped and exited at 30.3, MFE 30.33, but it actually went to 30.52 without breaking the uptrend. What are your thoughts in recording 30.52 as another stat to track if I am leaving money on the table?

Thanks!

yeah that’s obviously the weakness of MFE. you could create a stat like you’re describing but i dont do it.

Thanks! I’ve been having the hardest fine tuning my trade log (I use Numbers 09) so much so that I gave up on the finer things. I’m motivated to get the charts hooked up and ad MFE MAE to analysis.

thanks for the thoughts! I have a hard time tracking that (and am using more general qualitative comments of execution), especially on swing trades. Thanks for the series!

Thank you for this. I haven’t been focusing on the small profits. Little did I know that these will profit me more. I took note of everything you mentioned here. It’s a really big help.

Thanks, Adam for the excellent lessons. I have a question about MFE. Is MFE only for the time I am in the trade, or is it MFE for the intended target, if reached, or intended hold time. I guess that could be considered hindsight, but my thought is, I should record what the setup would have given me if I didn’t bail on the trade (for whatever reason) before my stop was hit. It happened today in TWX. When the indexes sold off hard from 10:05ET to 10:20, I bailed ahead of my stop, thinking this was situational awareness. If I use MFE only for the duration of the trade, it makes the sequence look better than I think it actually was.

you (and IEM_Chris) successfully identified the weakness of MFE. the advantage of it is that it is concrete with no wiggle room. you certainly could (and maybe should) create a measure that tracks what happens after you exit the trade, but you will need to create clear rules and be perfectly consistent with this. good catch.

Adam, Been using this method since I read this blog 3 months ago. Only, i’ve been filling this info in by hand after the close every day…its taking me forever! How do you have the “blue” data automatically entered into excel? I use light speed now too. Please Help me here! this is taking too much of my time! (but its so worth it)

Trying to work smarter,

Jason

[email protected]