Previously, we covered Risk and Return as the first two things we look at when building a system. The third thing we want to review is called Expectancy. The idea behind expectancy is to focus on the big picture and long-term results of your system — and not just the next trade. Insurance companies and casinos base their entire enterprise around this … Read More

The Second Step to Systems Success

Last time we talked about Risk, which is the first and most important aspect of a trading system. We discussed how limiting risk can create higher absolute returns because of reinvestment, raising capital, and using leverage. Now we can talk about our second focus: Returns. There are three types of returns that we need to understand. First is the back tested returns. … Read More

The First Step to Systems Success

Risk. This is the first and most important metric for a systems trader to track and improve. When learning about a system or strategy, most people first ask about the returns. Imagine you had one program that generated 21% per year on average and second was doing 35%. For some, the analysis is over because they just want higher returns. … Read More

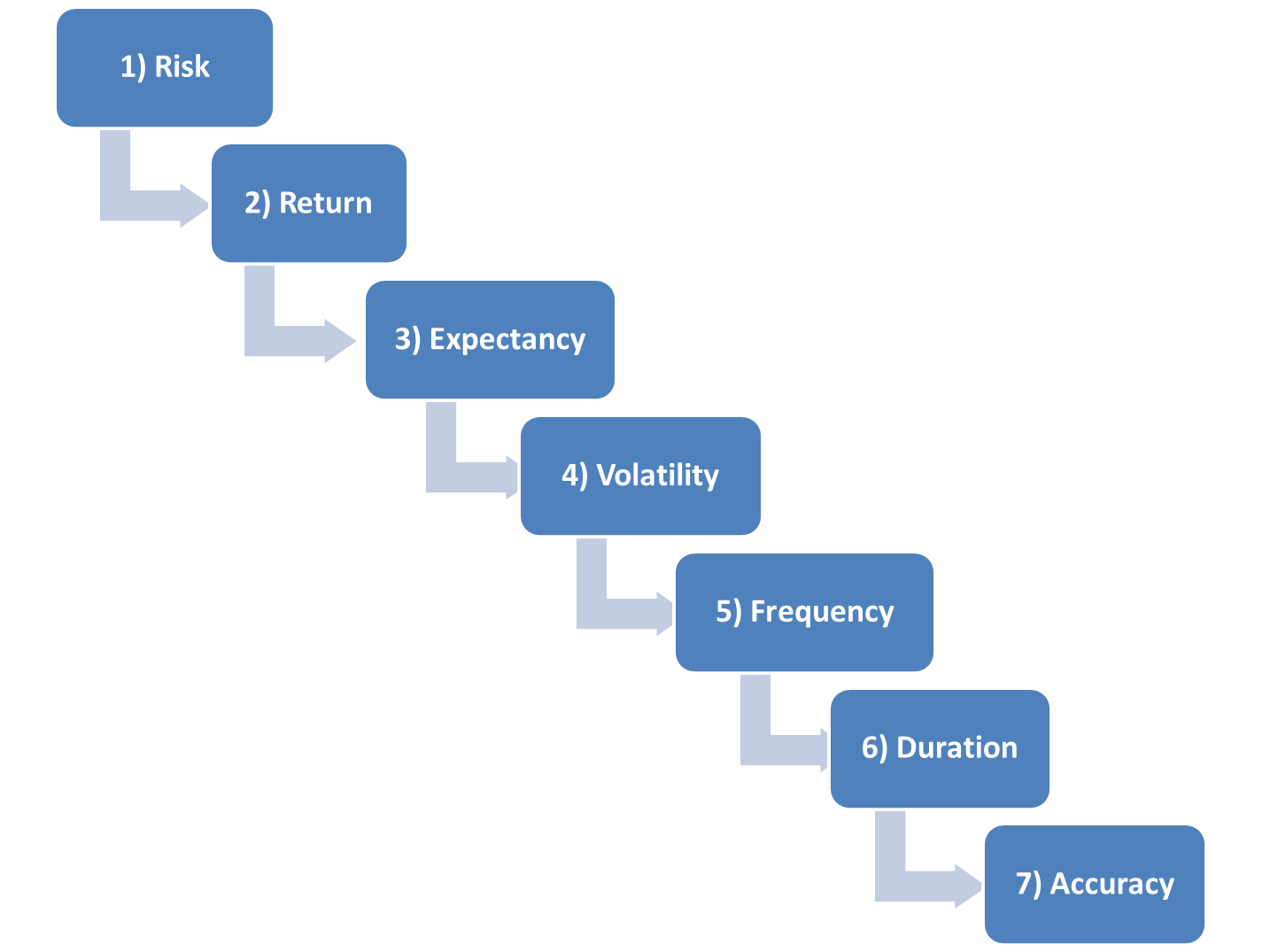

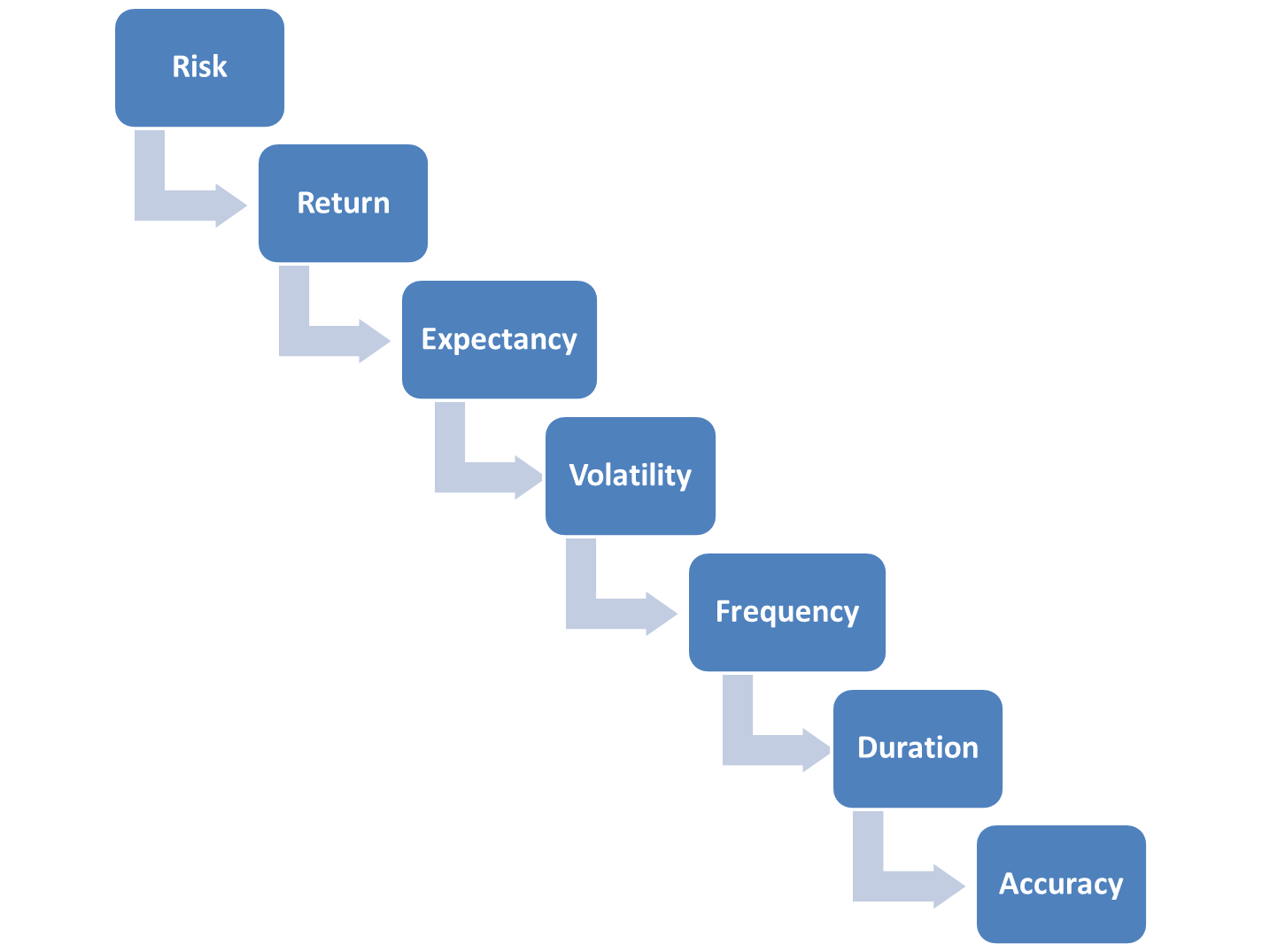

Seven Steps to Systems Success

Most platforms that run automated back testing and trading systems have extensive reporting capabilities to analyze performance. In these reports the software developers have included seemingly every possible statistical metric they could find. Reading these line by line quickly becomes information overload and can often leave the systems developer with more questions than answers. So we have narrowed down the … Read More

Turn Your Ideas Into Statistics

The trading world is littered with anecdotal evidence of cause and effect from various technical indicators and signals. I cringe when I hear something like the following: “As you can see, last time the 19-week moving average crossed the 52-week moving average, this stock moved 18.5%.” This statement has absolutely nothing to do with anything. It’s an observation of a … Read More

Avoid This Back Testing Pitfall

This video takes a quick look at a strategy that appears to have a smooth performance in a back test but wouldn’t perform the same way in the real world. Rick and I will be filming a live course in February to introduce the tools that we use to find strategies that are working. If you would like to receive … Read More

Stop Predicting

New traders are trained by the financial media to believe that accurately predicting the market is the only way to gain an edge. Meanwhile professional traders and prop firms around the world successfully navigate the market without forward-looking analysis. Here are three over-simplified components to a portfolio strategy that do not require predictive trading: 1) Buy (long) instruments that are … Read More

All Hedging is Not Created Equal

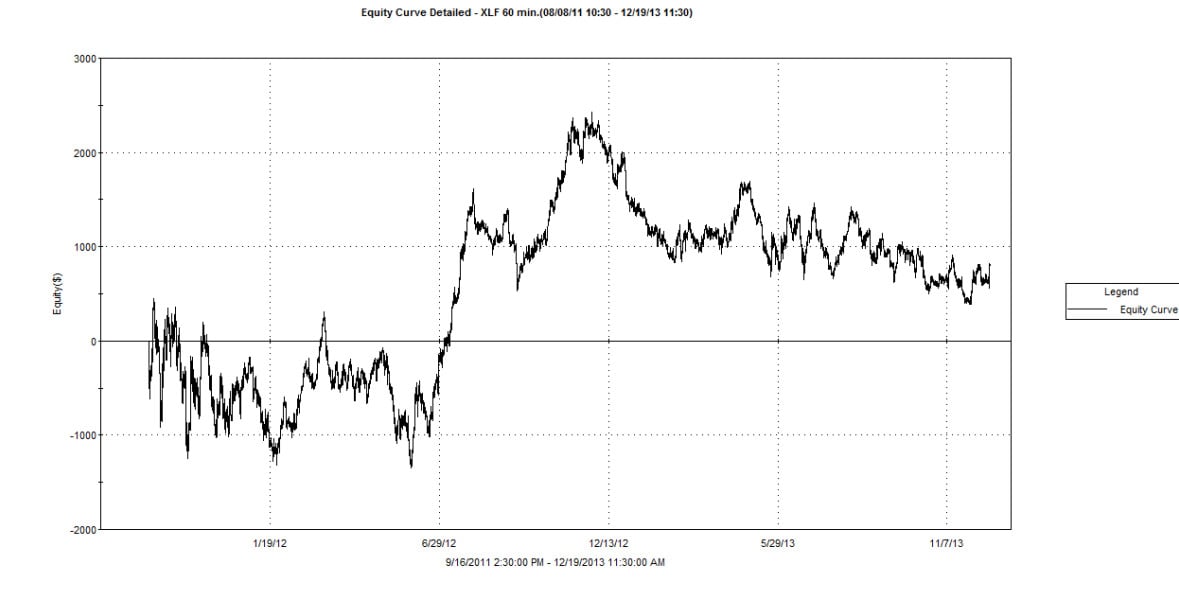

In this post I will show you a strategy that can be long and short financials at the same time and end profitably. The concept is based on pairing instruments that have different natures. The nature of leveraged instruments is to increase the impact of one-way movements. The nature of unlevered broad-based indexes/funds tends to have more reversion and overlapping … Read More