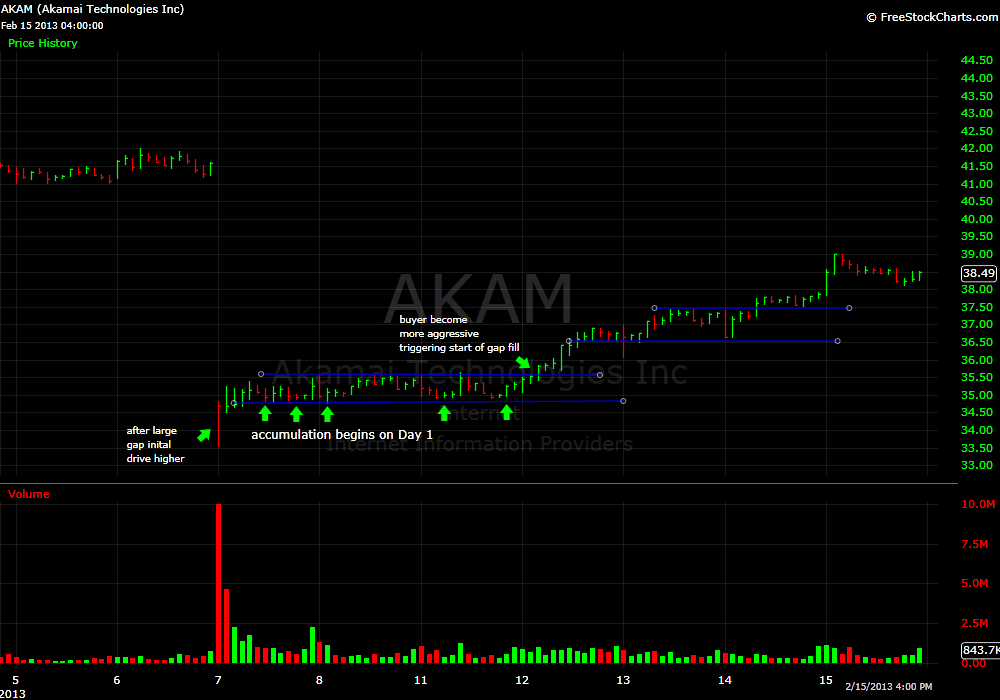

One of the more common patterns seen in a strong market are longer term players buying stocks that have gapped lower after earnings. Sometimes this plays out on Day 1 with momentum buyers aggressively buying the stock leading to a gap fill. But many times a gap fill will play out in the days following the earnings release once the … Read More

Learn To Take A Loss

I was trading GMCR this morning. I consider it to be a Top 8 “momo” stock. It would probably be #2 behind NFLX if it hadn’t done a dopey 3/1 stock split a couple of years ago. “Momo” stocks are stocks that “fast money” hedge funds are constantly pushing around. GMCR gapped lower on earnings last week and had a … Read More

Should Short Term Traders Consider Fundamentals–Part II

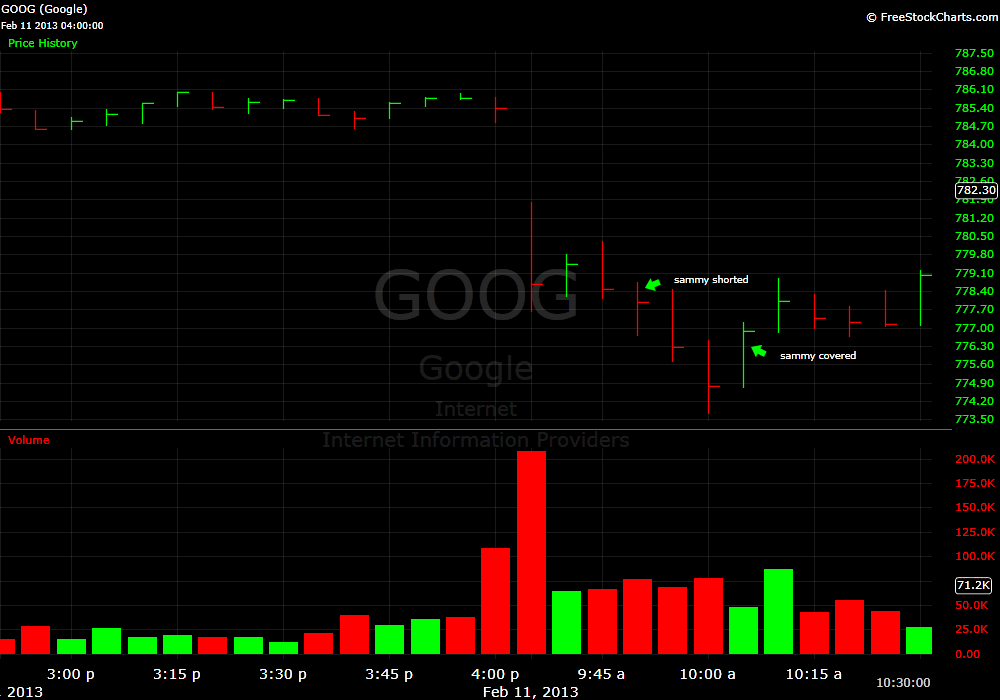

In Part I of this series I discussed whether understanding the news could help short term traders limit their risk on overnight positions. Today’s post discusses whether understanding the news gives a short term trader a possible edge in determining profit targets and when to exit an intraday position. As examples I will use two trades that Sammy, an SMB … Read More

My Thought Process: $MCO

I shared this because it moved above INTU into the #1 spot on SMB Radar “weak today”, while it was also #4 for “in play”. Stocks that appear across the top of multiple lists in the SMB Radar usually offer the best risk/rewards setups. A quick look the daily chart shows the next possible support area which had been resistance … Read More

Should Short Term Traders Consider Fundamentals? Part I

I believe the majority of market participants agree over longer time horizons fundamentals will influence the price of a stock. But what about in the short or medium term? Should intra-day traders or swing traders be evaluating fundamental news related to the stocks they are trading? Or should they simply focus on price action in relation to news? I have … Read More

Placing Your Stops Correctly

If you become skilled at stop placements your win rate increases. It’s a skill that we teach traders on our desk but it is something that takes live trading experience to ingrain in a trader’s brain. Newb traders are all over the place in this area. You have some who will risk a few cents, which is awful in an … Read More

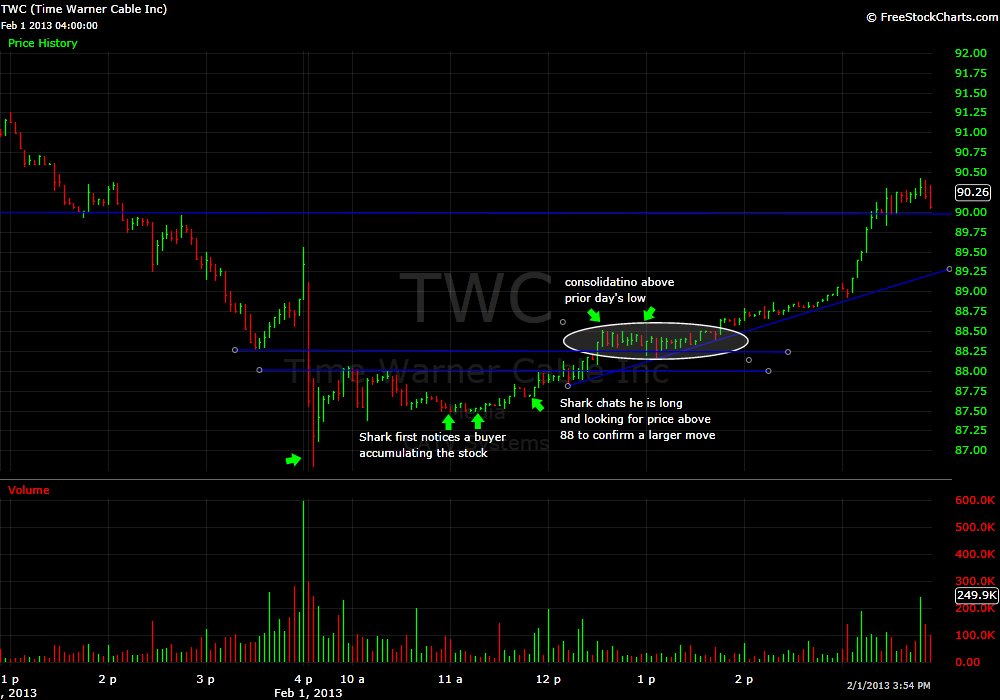

A Trading Conversation

When I began trading in 1996 the lifeblood of the trading floor was the chatter that was exchanged loudly between traders. If a trader was making money in a ticker that information was shared. If a trader found a favorable entry price that information was shared. If a large buyer or seller was identified that information was shared. I made … Read More

Are Traders Masochists?

The question open for discussion is this: are traders by and large masochists? Bella and I had a brief chat today regarding the breakout trade in KERX that occurred on January 28th. He asked me to do a Webinar on it as he thought I might offer some more nuance on how to manage the trade where his trade management … Read More