Every morning before the market opens I review the list of my top trading ideas. Recently, they have mainly been long ideas as the market is a raging bull. But I’m always armed with a few shorts in case the market decides to come in. One of the great pluses of being a short term trader is that you can … Read More

How To Get Back In

A very talented experienced trader joined our desk about five months ago. Let’s call him Trader Dan. He decided SMB was a better fit for his personality than his original trading firm. His first trading job entailed shorting very strong stocks intraday and getting long very weak stocks intraday. Somehow he was able to earn a living with that strategy … Read More

SMB Morning Rundown – April 20, 2010

The SMB Morning Rundown highlights the key levels in the Market and the best trading setup that we have identified for the Open.

Discover Your New Trading Home: Assent and eTrade

I heard from a friend yesterday that one of the largest prop trading firms was closing up shop. For those of you scrambling to find a new trading home, I have been there. My understanding is that Sungard Financial, a large financial services firm, that owns Assent is no longer interested in being in the prop trading business. … Read More

Trading versus Investing

This was gonna be a blog post on why I came in today with a long bias in RIMM. But there is so much chatter right now on StockTwits with respect to ABK that I thought I would throw in my two cents. Let me start with a few preliminaries before I get into the meat of the post. #1 … Read More

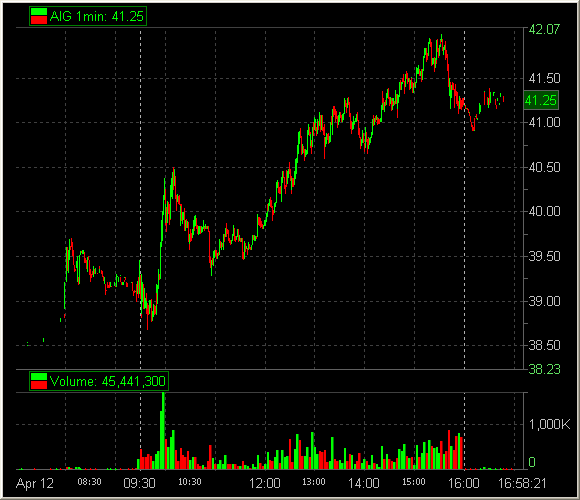

PLAYING AIG FOR A BIGGER MOVE

Wednesday AIG broke about an important resistance level of 36. If for some reason you have been trapped under a rock for the past two months you might have missed that most things breaking out head for higher ground. Boss Lindzon has labeled the recent market upmove as the “inconceivable rally.” One of the original trading bloggers, Rev Shark, on … Read More

Don’t Let An “Idea” End Your Trading Career

In today’s AM Meeting I mentioned that AMZN has been unusually weak the past couple of days. If it got below 130.50 I thought there would be a lot of momentum longs who would panic and the stock would drop to 128. That trade never materialized. The first move in AMZN was up. The second move in AMZN was up. … Read More

OPENING DAY

Tomorrow is Opening Day! All the statistics from last year are thrown out and we start anew. Spring has arrived with its warmer weather, flowers blossoming and sunlight extended. All those fans of non playoff teams gain a great gift- hope. No matter that the Tampa Rays failed to make the playoffs in 2009 as most predicted- this could be … Read More