A quick note on an error I made this morning in our AM Meeting. We begin the meeting with an overview of the market and then discuss stocks with fresh news. During earnings season there are a ton of stocks with fresh news so I try to limit it to five names. Stock number six on my list was MMR. … Read More

Morning Thoughts for October 18, 2010

Good morning traders, we have a quiet morning with the major indexes flat to up small premarket. Focusing on the SPY, the market is in a clear uptrend making higher lows and higher highs. Until this changes there is no reason fight the trend in the market. Intraday I am focusing of trading specific stocks in play as these are … Read More

Back From Vegas

Gman, myself and Bella are back from Vegas. Fun time with Q, Alphatrends and a bunch of traders from the Tickerville community. I broke my “no gambling” rule by throwing down $20 on the roulette table at the end of the night. But that was balanced out by the $250 in chips Gman found on the seat of the limo. … Read More

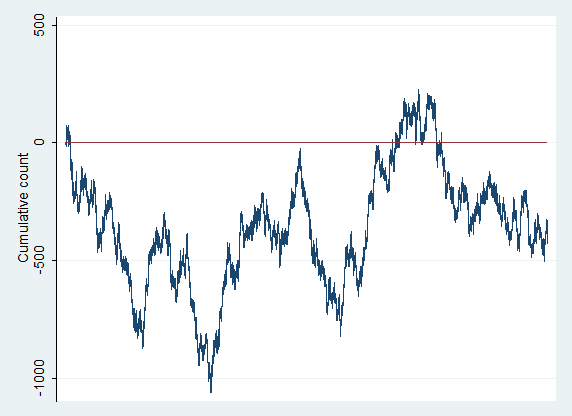

Another look at randomness

Another look at randomness in the market

SMB Trading Lesson of the Week – Combinatorial Explosion

Watch Mike Bellafiore, author of One Good Trade: Inside the Highly Competitive World of Proprietary Trading (Wiley), in our new video series SMB Trading Lesson of the Week for StockTwits U. This week we discuss: Combinatorial Explosion. You can watch here. We hope you enjoy! Don’t forget to follow us on Twitter!

Morning Thoughts on October 12, 2010

Good morning traders, Futures have us opening about .3% down. Well over their overnight lows. Bigger picture the market seems to be wedging up, a pattern that usually resolves itself to the downside. In the intermediate term if the market holds under SPY 115.20 we should expect to see a test of SPY113.20. On the upside SPY117.60 is the next … Read More

Traders Ask: Should I Have a Max Give-Back Rule?

Hey Bella, How is everything? I have a question for you. I have this one problem (amongst many others) that I am having a tough time overcoming. Whenever I make a few good trades on the open and I have a nice P&L for the day I sit there the rest of the day and force trades and give back … Read More

Exploring Randomness: Thought-Provoking Insights and Reflections

Thinking about randomness can be challenging, but there are some important lessons to be learned here.