I was chatting with Lock It In into the close about stock selection. He was chirping one stock (chart below). I was in another (chart below), looking to buy more and was getting out of his. I should note I was in my stock and looking to buy more because Amazing Andy called it out. So its 3:15PM today and … Read More

Sleeping In Shanghai

I returned from traveling in China a few days ago. My body hasn’t made the time adjustment yet. There is a 13 hour difference between NYC time and Shanghai time. Night is day and day is night. Yesterday I was reviewing the SMB Scans which are compiled after the close each day. They consist of stocks in our tradeable universe … Read More

My List: Some Ideas for Finding Tradable Edges

A wrap up to the series on randomness in markets, with some practical trading advice.

A Sea Of Blue

For the most part as expected the market has been quiet this holiday week. This is clearly demonstrated by this screenshot of theSMB Radar. We use color coding throughout each list to quickly assess how In Play any given name is. Red indicates “hot” and blue indicates “cold”. I know–we are so clever. Overall, when you see 90% of the … Read More

Morning thoughts 12/29

Good morning traders, I am traveling and away from the computer all day. (Driving 9 hours back to New York, a big Thank You to Continental Airlines for that one, but don’t get me started…). I don’t see a lot in terms of setups today. Everything I had said from past days applies here: focus on specific in play stocks … Read More

Randomness revisited: random levels?

Another look at randomness in markets… this time looking at random S/R levels drawn on real price charts.

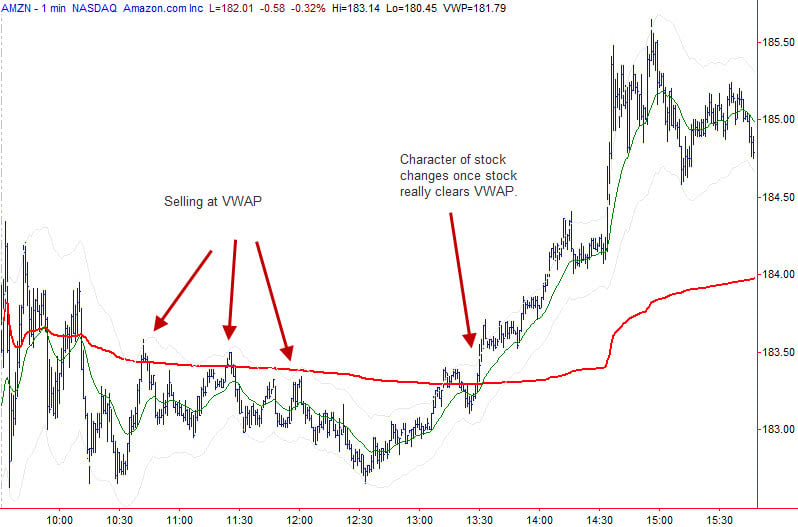

Traders ask: VWAP?

A brief look at VWAP: what it is, how to calculate it, and some ideas for how you might use it in your trading.

Evaluating your trading results (part 2/3)

Warning: very detailed and technical blog ahead, but if you are an active trader and not keeping really good records, maybe this post will help you.