Here are two comments made from two SMB traders in their daily review sent to me after the close. Both harm their results by trying too hard. Do you do this? I am slowly becoming less and less content with just making $$$$ (note: SMB cannot talk our PnL because of compliance reasons) and calling it a decent day. I … Read More

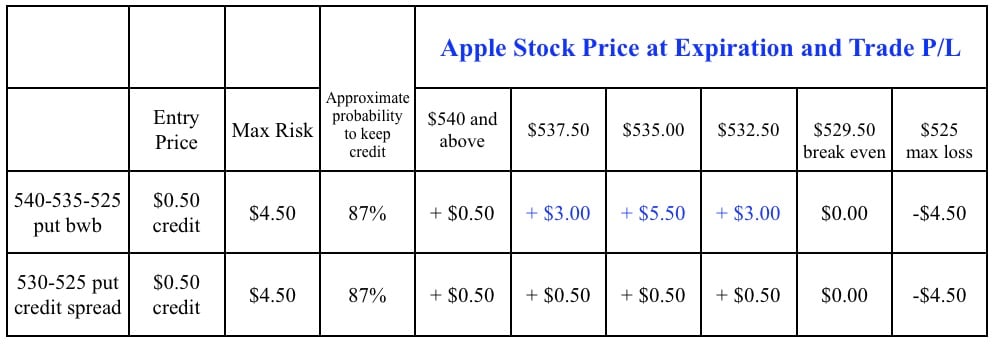

A Different Look at AAPL Credit Spreads

This post is another in a series that we will be publishing over the next month , tracking the hypothetical performance of broken wing butterfly trades selected by Greg Loehr of Optionsbuzz.com. A week doesn’t go by when I’m not asked a question about selling a put spread (credit spread) on a particular stock, especially before earnings when the implied … Read More

The SPX fly makes it 5 for 5.

This post is another in a series that we will be publishing over the next month , tracking the hypothetical performance of broken wing butterfly trades selected by Greg Loehr of Optionsbuzz.com. Over the past several weeks I’ve been selecting broken wing butterfly trades on AAPL and the SPX using weekly options and then tracking the hypothetical P/L of those … Read More

Learning Some More–Day 2 SXCI

I spent some time yesterday writing how exciting it was to see some traders on the desk add to their game a new trade. Instead of only looking for the quick profit taking a scalp short in a stock gapping higher they looked to capture the larger move to the upside. Here is what I wrote: We urge our desk … Read More

Learning

This morning it was announced that SXCI was buying CHSI in a cash and stock deal (story from Benzinga). Both stocks were gapping up significantly. It is unusual for the acquirer to gap higher in a merger that involves stock as a major component of the transaction. There is usually a huge amount of selling pressure from the “merger arb” … Read More

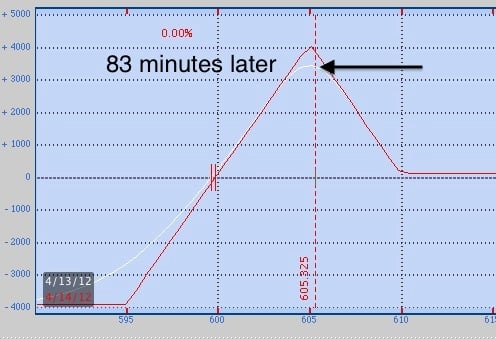

What a difference 83 minutes can make.

This post is another in a series that we will be publishing over the next month , tracking the hypothetical performance of broken wing butterfly trades selected by Greg Loehr of Optionsbuzz.com. If you were following along last week with the hypothetical AAPL 610-605-595 put broken wing butterfly, then you saw how that example returned a profit of 31% (calculated … Read More

Buy, sell, move on

Below is an argument from a trader on our desk not to hold stocks during this earnings season. The trader suggests to get in and out and not expect much follow through with stocks to the upside. Kind of a frustrating market day because the market is slowly grinding higher throughout the day but individual stocks don’t really make hods. … Read More

A hint to make more this earnings season

After the close SMB met in its training room for a talk led by me. I haven’t given many talks of late but I thought the desk was due for one after my observations of their trading. It is earnings season. There are tricks to scoring. And there are things traders do to harm their results. Trying to hard is … Read More