One thing I always try and remember when running a firm is this: trading is not very easy. The margin of error can be slight between great trade and stopped out. The trade below is a spot on example. I love how this trader keeps a PlayBook and then has taken the time to ferret out A+ trades from his … Read More

Forex: The Professional Trader is the Prepared Trader

When you turn on your computer each morning and you look at your favorite forex pairs, can you tell me exactly what levels you are most interested in taking action on? Can you give me a good argument as to why you would be looking for longs or shorts at these particular prices? If you can’t answer these two questions … Read More

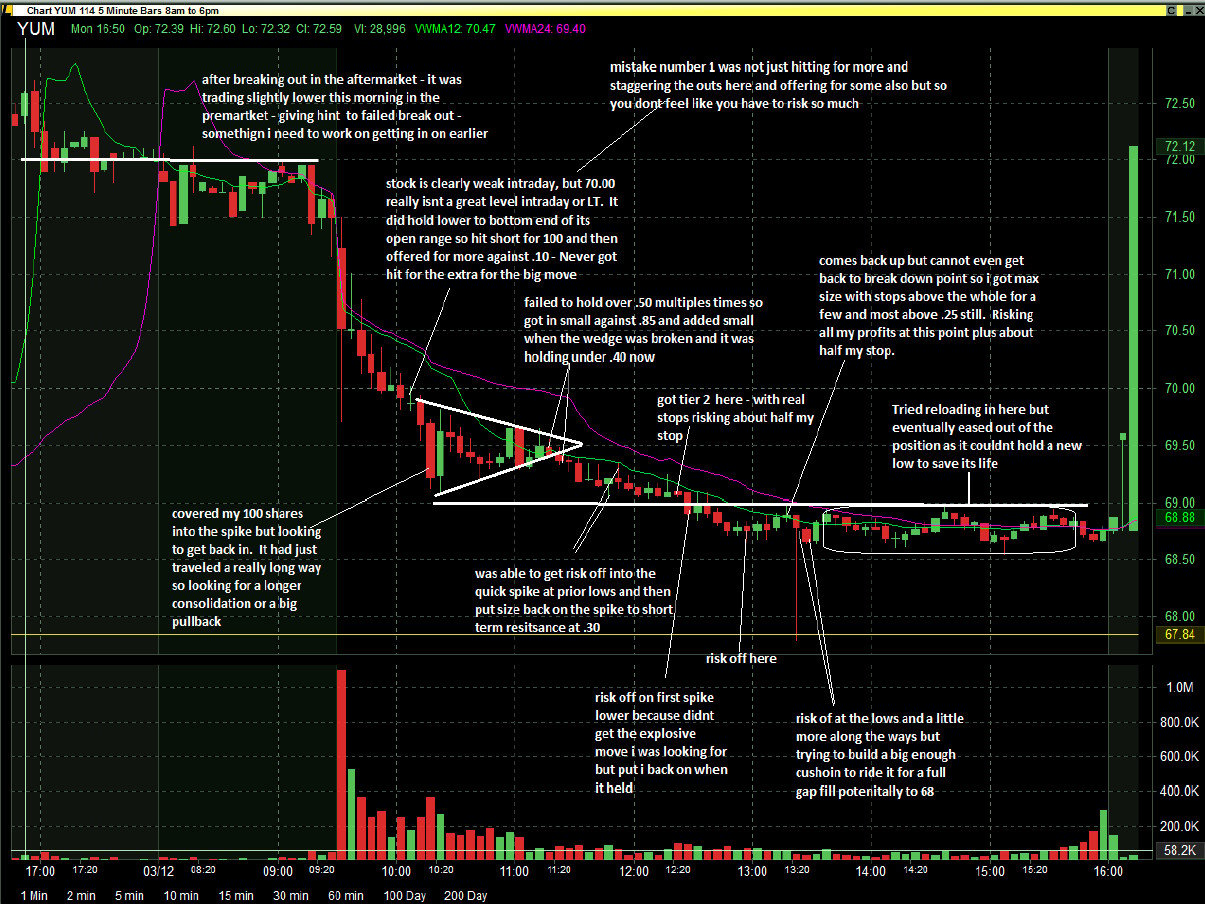

The Time Stop (an Example in $YUM)

On our prop desk I encourage our traders to look for stocks that are trending, enter a Trade2Hold, and stay in the position if it is working until there is a Reason2Sell. SMBU offered a free Webinar on Reasons2Sell here. I discuss them in great detail in my latest book, The PlayBook. Below is an example of a Reason2Sell, a … Read More

Finding a Jungle Guide

It can be a rough and cruel world out there in the markets. The competition is high, people are cutthroat, and the markets are never easy. Sometimes it can feel like a feral jungle, with danger lurking everywhere. You want to give yourself every edge and extra chances to succeed, but what really makes the difference? Simple: A mentor. In … Read More

Tricky Dicky

It was a very quiet morning in the world of “In Play” stocks. The only two tickers showing signs of life in the pre-market were DKS and GNW. After reporting earnings DKS lowered guidance which was causing a large gap to a major support area around 46.50. We were prepared for a bounce from this level given the strong underlying … Read More

When Should I Sell?

Hi Bella, I just have to start off as I always do and thank you and SMB for providing excellent trading education and training. Alright now to my question(s). When trading the open, when do you decide that you should hold a core position especially since there isn’t trend in the first 30 mins of the day? Do you decide … Read More

Are You Still Focusing on Longer Term Intraday Trades?

Hi Bella, I just finished reading your book One Good Trade and I wanted to thank you for writing it. I am trying to learn the craft of trading, and I found it to be entertaining and educational. Toward the end of the book you mention how in 2009 and 2010 you started moving toward longer term intraday positions and even … Read More

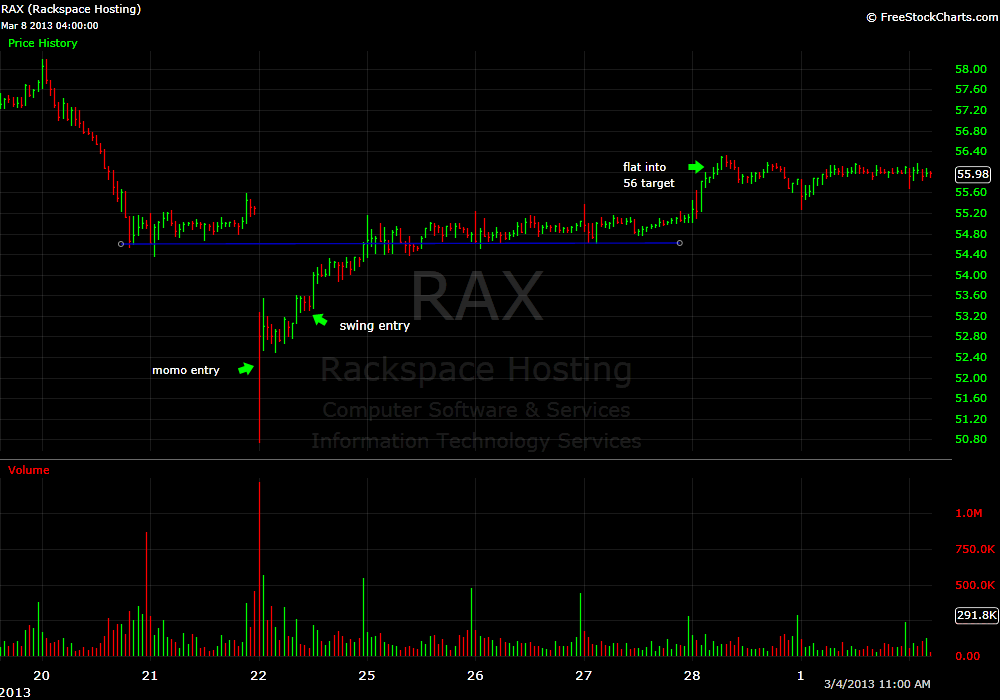

The Intraday Swing Entry

In October 2009 I began talking to our desk about “Intraday Swing Trading”. This discussion was preceded by about six months of mounting frustration from a large group of traders. Our desk at the time consisted largely of traders we trained in 2007-2008 a time of extreme volatility in the market that favored a very aggressive style of momentum trading. … Read More