In our SMBU Daily Video, Seth Freudberg explains how SMB’s Options Trading Desk tweaked its portfolio of monthly trades to adjust to this market environment. Traders need to realize that the market has changed–2016 is much more volatile In these environments, tweaking your portfolio of trades is recommended for retail traders * no relevant positions

SMBU’s Options Tribe Webinar: Doc Severson of Tradingconceptsinc.com: The Top Ten Lessons for Trading a Small Options Account

This week Doc Severson of Tradingconeptsinc.com returns to the Options Tribe to discuss his tips for traders who are managing smaller options trading accounts.

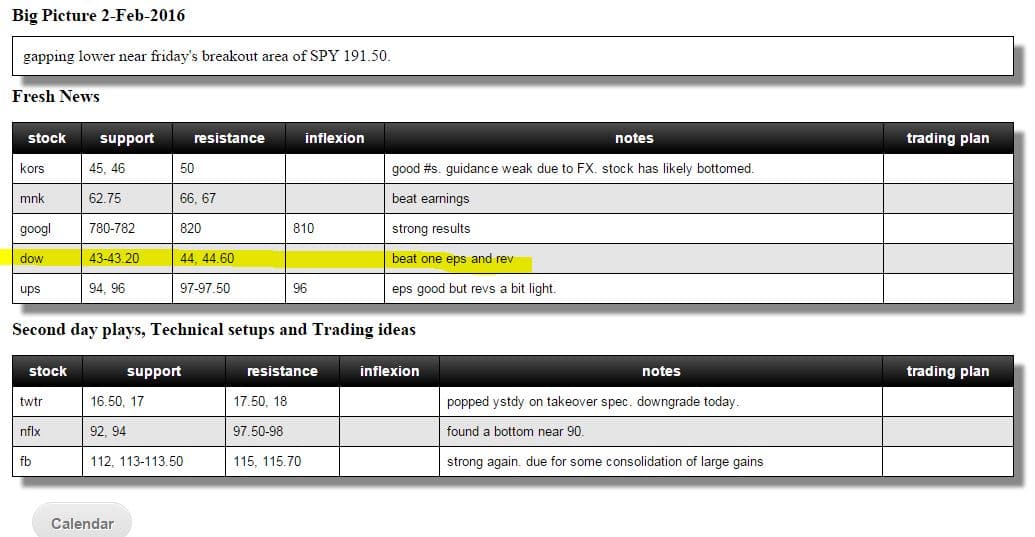

A Tale of Two DOWs

Yesterday, the Dow Jones Industrial Average declined over 250 points while DOW chemical rose over 5%. This was a textbook “stock in-play”. It was gapping higher, the desk identified clear levels to buy from (as mentioned in Trader90 AM meeting and Big Picture Game Plan), and the potential trade back to resistance was greater than the potential risk below support. … Read More

A Perfectly Ineffective Hedge

In our SMBU Daily Video, Seth Freudberg explains a perfectly ineffective hedge. Many options traders buy puts in a panic thinking they will control downside risk in their trades We did a study on weekly options and found that they were incredibly ineffective at controlling downside risk over the last year In fact, traders would have made much more money SELLING … Read More

SMBU’s Options Tribe Webinar: Frank Fahey, Optionvue Systems, International: Trading Volatility Events—building a recurring earnings event portfolio

This week, Frank Fahey returns to the Options Tribe to discuss his approach to trading earnings events.

The Market Pays You For Volatility

In our SMBU Daily Video, Seth Freudberg discusses how market volatility can pay you. Everyone knows that the market has been selling off hard since the turn of the year. Many traders of market neutral options strategies are struggling in this environment However, initiating trades in this environment historically provides the trader with an edge. This video discusses one of … Read More

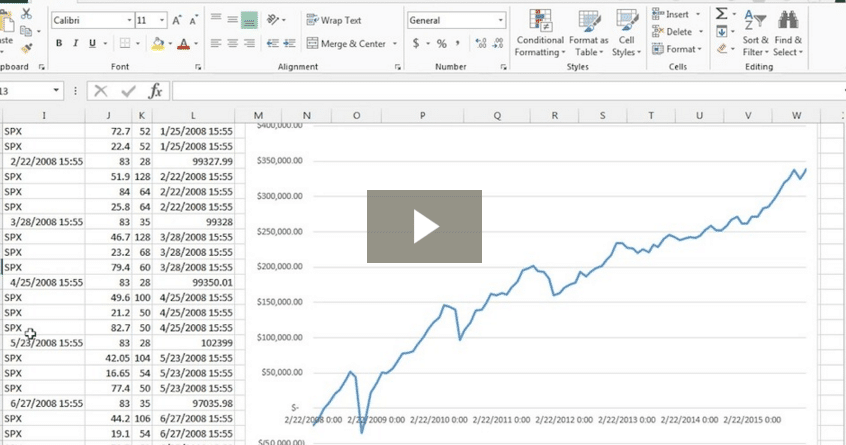

Building a Once Per Month Trade Plan

In our SMBU Daily Video, Andrew shows you how a simple, once per month, trade plan on the SPX could have generated a 43% annual return over the past 8 years (when the market averaged less than 5%) Andrew discusses the importance of finding the key (and simple) elements that provide edge. He shows you how to systematically eliminate the complexity that may … Read More

Which Options Strategies Is SMB Invested Into?

A few years ago, we partnered with a hedge fund, The Kershner Trading Group, to expand our resources and capital for trading. At about the same time, the partners were noticing that John Locke’s options strategies had been showing great results for several years. The natural next step for SMB was to connect these great strategies (and great traders) with the capital … Read More