In our SMBU Daily video Seth Freudberg discusses the impact of using market orders when executing complex orders. He discusses why you should never use market orders and why limit orders are the ideal order type when executing an options position. Enjoy the video. * no relevant positions

SMBU Trading Conversations – Episode 1

Merritt Black and Andrew Falde hosted the first ever “SMBU Trading Conversations” web event. Learn about the edges that professional traders focus on, why a high win-rate should be your least important trading goal, and some strategic trading ideas that you have never heard before. Enjoy the replay! * no relevant positions

SMBU’s Options Tribe Webinar: John Locke of Lockeinyoursuccess.com: Is my trade broken? How to know when it’s time to modify your trading strategy

This week John Locke returns to the Options Tribe to share his ideas on how to determine if and when it’s time for an options income trader to change or modify an options trading strategy.

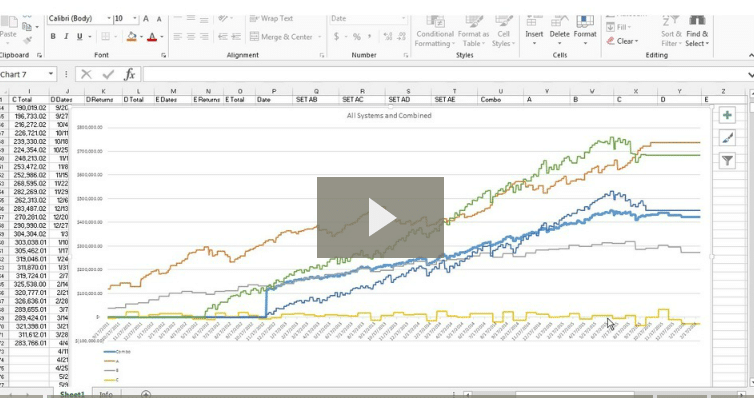

A Formula for Evaluating and Selecting a Set of Trading Systems

Here are the two main ideas to focus on while you watch this video: – A Small Positive Drift + Diversification = Smooth Returns – Smoothness is not the only goal. We want Smoother AND Steeper returns. Furthermore, I hope these concepts demonstrate that smoother and steeper results can be achieved without taking on excessive leverage. Share your thoughts with … Read More

Adapting to Changing Market Conditions

In our SMBU Daily Video, Steven Spencer discusses the range expansions occurring in today’s market. We take a close look at the ranges that have developed in the $SPY over the past months. We hope this video helps you improve your trading skills. Subscribe to SMB’s YouTube to keep updated on new videos! * no relevant positions

SMB will be presenting at the Traders Expo New York

Mike Bellafiore will be speaking at the TradersExpo Tuesday, February 23, 2016, 2:30pm-3:30pm at the Marriot Marquis Hotel in New York City. His Topic: A Study of 5 Successful Professional Traders During this discussion you will learn: • How 5 of the best traders at SMB went from zero to High Performing Trader • The 5 best practices that made … Read More

Losing Money On A Trade Is Not The Same As Failing

In our SMBU Daily Video, Seth Freudberg discusses why losses are inevitable in this kind of market. Options traders struggle in volatile markets like we are experiencing. It’s important to keep a proper perspective in these circumstances–losing on trades is expected–as long as you stayed disciplined through the trading process then you didn’t fail–you simply lost money on a trade. … Read More

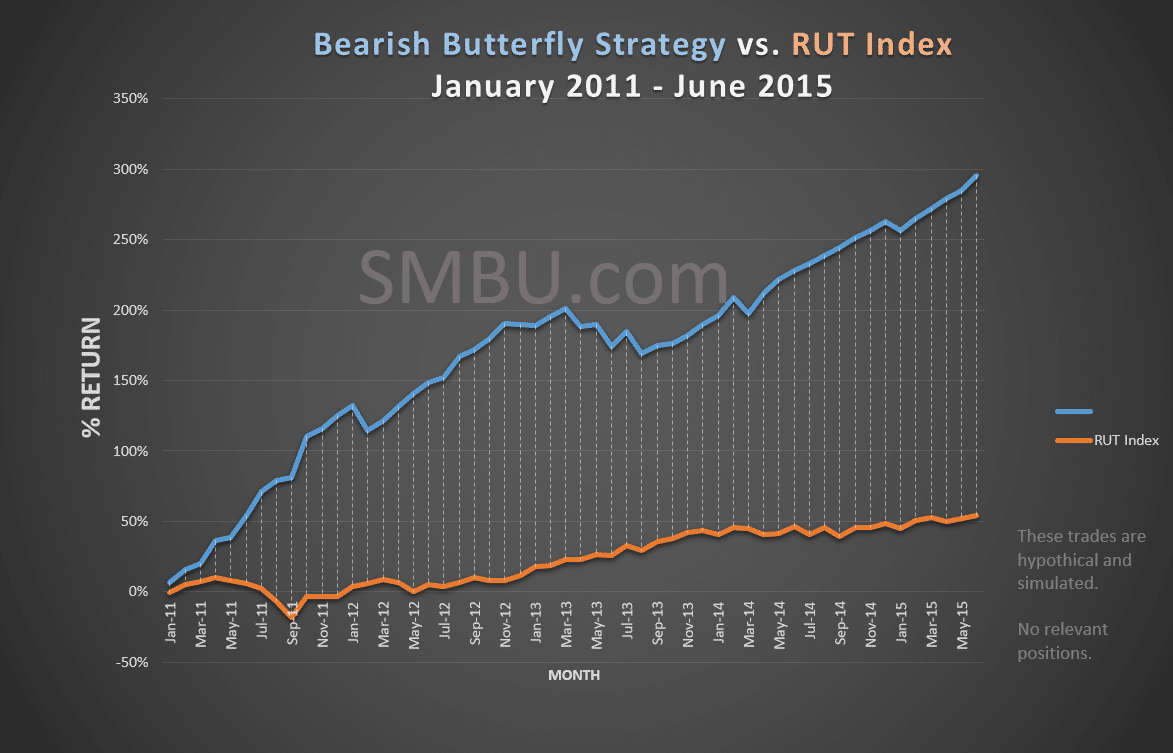

How this Bearish Strategy Beat the Index by 288%… Even in a Bull Market

Please note: Trades discussed below are hypothetical and simulated for educational purposes only. Review the options risk disclosure. The graph below compares the Bearish Butterfly vs. the S&P 500 index. If you had traded the rule-based Bearish Butterfly Strategy for the past 5 years, you could have outperformed the index by 288% — even though the market was bullish during … Read More