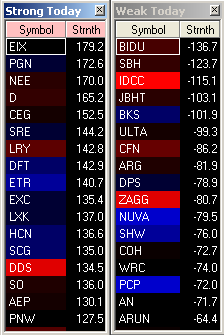

The Strong/Weak Today column ranks stocks based on the price change relative to the stock’s opening price. These stocks tend to have strong/weak opening drives and continuation moves. The idea here is to find opportunity in the strongest/weakest stocks in the market. When looking through the column, we always take note at how In Play the stock is to gauge … Read More

Beating the Grind – $SPY $IWM $QQQ

The recent volatility has brought the major indices In Play, this broad market movement tends to have the “lift all boats (stocks)” effect, making the ETF’s like $SPY $IWM $TNA $TZA great trading vehicles. However they aren’t always going to be the best option at every point in the day, especially since the market has started to base (albeit a … Read More

SMB Radar – Trade Reviews

This month SMB will be reviewing Radar generated trades that are sent in by users. The purpose of this is two-fold. First, it will give Radar users the chance to really understand how to use the tool properly. The Radar has a number of outputs, and changes throughout the day. Understanding how you could have better managed a Radar generated … Read More

SMB Radar Update for August 5, 2011

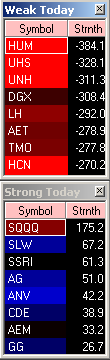

A little different today. A partial view of my favorite SMB Radar columns. Figured it’d be a good change of pace considering the 50 handle range in the market. Keep in mind these are moving at a much faster pace today. Good Trading

When Charts Don’t Tell the Truth – $HUM $AGP

Yesterday HUM was In Play on earnings. It traded lower, much lower – in fact it had about a 7 point down move from the open. A number of traders on the desk did well in HUM, I wasn’t one of them. Looking back at the chart I saw a lot of different trades that could or should have been … Read More

SMB Radar Update for August 1, 2011

The Strong/Weak Today column ranks stocks based on the price change relative to the stock’s opening price. These stocks tend to have strong/weak opening drives and continuation moves. The idea here is to find opportunity in the strongest/weakest stocks in the market. When looking through the column, we always take note at how In Play the stock is to gauge … Read More

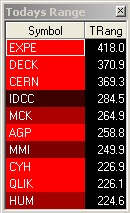

SMB Radar Update for July 29, 2011

Here is a quick snap-shot of the top stocks on the Today’s Range list on the SMB Radar. This is just one of 10 categories that the algo captures. @tarhini_smb

SMB Morning Rundown for July 29, 2011

Market showing some weakness this morning after end of day selloff ystdy. No vote in House ystdy on debt vote not helping. GDP numbers not good for Q2 but info is backward looking. Short bias but most of the downside has been realized prmkt. A pop to 129.40-129.60 would be a safe short area. SPY support 128.35ish Morning Idea: STEC … Read More