The market has settled quite nicely into the range of our position. Currently the trade is up $775 and looking good. The position is shown below: If $RUT actually settles down for a change we just might get the opportunity to close this next week at our $3000 profit target and round off an excellent year for this trade. If … Read More

The Continuing Saga of December’s $RUT Bearish Butterfly Trade: Insights and Analysis

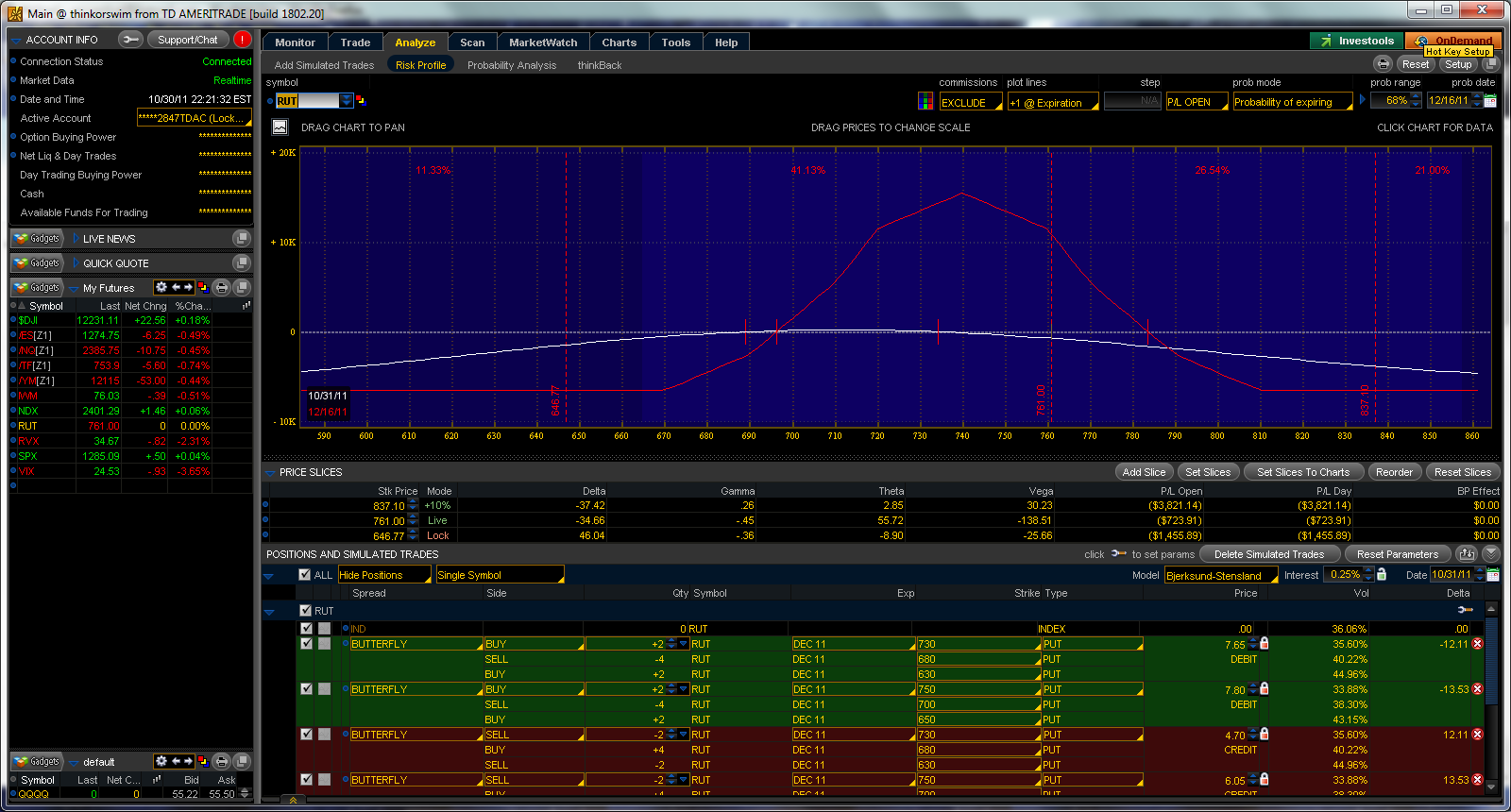

Last Thursday’s rally, probably a dim memory at the moment, was so strong that our trade methodology called for us to add a third butterfly and roll the original two butterflies up 60 points each such that the new position is comprised of three 50 point wide butterflies centered at 720,740 and 760. As of last Thursday, the position was … Read More

SMB Welcomes a New Blogger–John Locke

SMB is proud to announce the addition of a new options trader and success coach to our blog, John Locke, of Locke In Your Success, LLC. John is an outstanding options trader and success coach and has worked extensively with traders all over the world to help them improve their game. John has also been a frequent guest on … Read More

Working on your weaknesses may be your biggest weakness.

The time you spend on bringing a weakness up from below average to average will diminish the time you could be spending improving your strengths. I find that people who spend lots of time working on their weaknesses are those who do not know what they want and therefore they feel the need to be good at “everything”. The reality … Read More

How Great Ideas Can Emerge From Trading Communities

I was on the phone over the last couple of days with two of our active Options Tribe members–Nagaraj Ramakrishna, who has developed an outstanding butterfly trade in the $RUT index and Charlie Ferguson–a remarkable weekly credit spread trader. They are each active members of our Options Tribe community, having both presented their trades recently on tribe meetings over the … Read More

Some cool things about working at a prop firm

Yesterday was a really interesting day. Since we launched the options training program, I’ve been driving up to SMB from my home in Philadelphia almost every Wednesday. I certainly have valid business reasons to be up there each week but honestly, my main motivation, is that I just love the environment. I really enjoy hanging out with other traders and … Read More

Traders Ask: Is it better to buy options for swing trading profits, or sell options for time decay?

Trader Sam asks: “Dear Sir: Allow me to ask a question about options, as I am a new trader: I have heard that delta neutral strategies are the best approach to trading options but I have less than $6,000. in my trading account and my broker’s margin requirements make it impossible for me to trade iron condors, butterflies and other … Read More

Free Options Webinar Today at 5PM EDT. The Options Tribe: Iron Condors using SPX Index Options

September 6, 2011 at 5:00 pm Eastern Daylight Time SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by outstanding veteran options traders and experts in the world of options … Read More