Every morning when I arrive at SMB’s office in midtown Manhattan I have a pre-market routine. The routine serves two purposes: 1) To get me in the proper frame of mind to attack the markets and 2) Ensure that I’m in the best risk/reward stocks and setups.

Here is a brief outline of my pre-market process:

- Login to trading platform

- Open charting software and link to trading platform

- Open SMB Trading Tools

- Open SMB Scanner (finds Stocks In Play)

- Open SMB Game Plan Template (where I input ideas)

- Sort Scanner by pre-market volume

- Read news of stocks that have unusual pre-market trading activity

- Enter 3-5 ideas in Game Plan Template

- Enter 2nd Day Plays into Game Plan Template

- Discuss market and ideas in AM meeting (15-20 minutes)

- Enter alerts and trading scripts for all trading ideas

This process allows me to settle in and get focused for the Opening Bell. When I crunch the data my win rate is significantly higher for the stocks that I pre plan versus breaking news or market plays that occur during the day.

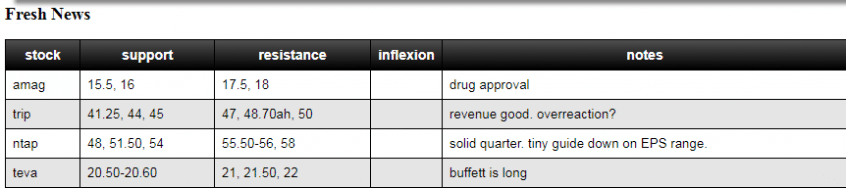

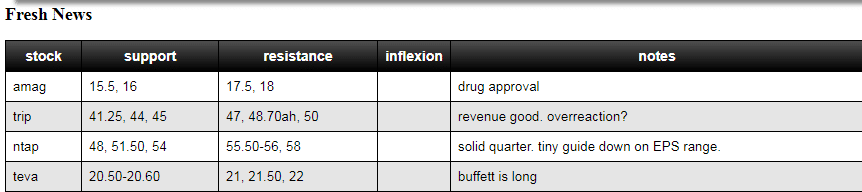

Here is an example of the In Play names I selected from February 15th.

As mentioned above I discuss these ideas in our pre-market meeting and after its conclusion I will enter price alerts and trading scripts based on my bias and the above price levels. Sometimes I will have a strong directional bias based on my view of the bigger picture technical setup, the pre-market reaction to the catalyst and the content of the news. This approach works for me. I believe this “combination approach” as opposed to only looking at a single item increases my win rate. Let’s look at each of the above ideas with some of my notes.

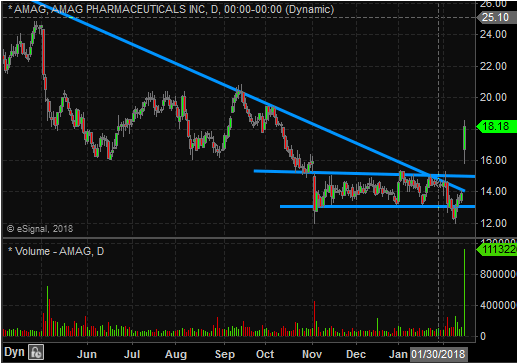

- AMAG (L)–made trade on Open. long against S1. Target R1. Risk 30 cents.

- My general rule on drug approvals is if it is a treatment that would be understood by the general public if discussed on TV there is some upside. Drug was approved to prevent premature births. I did quick research to see what % of mothers this applies to. Roughly 10%.

- On the long term technical side AMAG had been consolidating between 13-15 for a few months so it was setup well as a long on the break of this range

- Support levels were from consolidation range high and gap down area that had established the range.

Entered trade via limit order at 16.10. Scaled out of position into R1. Eventually traded to R2 before settling in between R1-R2 for afternoon. Initial long bias confirmed.

- TRIP (S)–good numbers but gap seems extreme and many people accumulated 50% lower recently.

- Failed in pre-market 48.70 which would be a very good entry

- 47 R1 from GP sheet OK entry. After dropping to S1 on Open popped to R1. i didn’t have alert so missed trade.

- Failed at R1 and trended $4 lower.

On Open bounced from S1 to R1 where it failed twice. Then trended down to S2. Eventually in afternoon almost reached S3. Initial short bias confirmed.

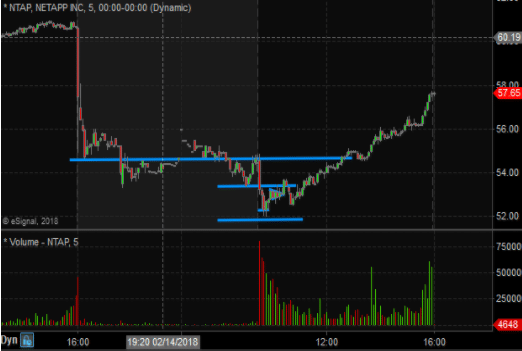

- NTAP (L)--this seemed like a large overreaction on the downside w/ a 1% guide lower on EPS

- It was gapping down to long term support from last quarter’s earnings report. Being close to 20% from ATH seemed like dip buyers likely to emerge

- This was a good example of a stock that was not acting well on the Open. it was trading between S1 and S2. there was a pretty strong argument to dump it based on the price action. But I wanted to give it a chance based on my big picture analysis. Also, the opening print of 54.50 for 750K shares led me to believe that it had a good chance of getting back to this level, which was $2 off the low.

- The buyers didn’t start to take control until midday and it trended another $2 higher to 56 R1. Into the close it almost hit R2. The best spot to press a long trade was around 2PM when volume surged and it had a tight consolidation at 54.50.

This is one of my favorite big picture setups and thus was my main focus for the Open. A stock in a longer term uptrend gaps lower to long term support on news that isn’t that bad. This setup is further bolstered by the longer term bull market. As mentioned above on a micro level it was little tricky on the Open as it was below S1. Notice that initial low was never breached and buyers continued to step up throughout the day never threatening an intraday reversal. Initial long bias confirmed.

- TEVA (N)–it was gapping higher on Warren Buffett taking a position last quarter

- It was gapping into longer term resistance so although i expected some people might get long today on the news it wasn’t a strong enough catalyst for a breakout so plan was to play range from S1 to R1 in either direction

- It opened above R1 so R2 was the spot to look for failure and a trade to S1

TEVA failed at R2 and then traded to pre-market support. It spent the rest of the day in this range. Neutral bias confirmed.

The purpose of reviewing your trades each day is to gather data that will allow you to understand which ideas are working and how you can increase risk taking on those ideas. If at the end of the week less than 50% of my morning ideas didn’t offer excellent risk/reward trades I need to determine what went wrong: Has the market changed? Was my analysis faulty? Are only a certain subset of my trading ideas working currently? Conversely, has a certain type of setup been offering better risk/reward than others? Then this setup should receive more risk allocation and more of my attention.

Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, options, forex and futures. He has traded professionally for 21 years. His email address is: [email protected].

Ne relevant positions