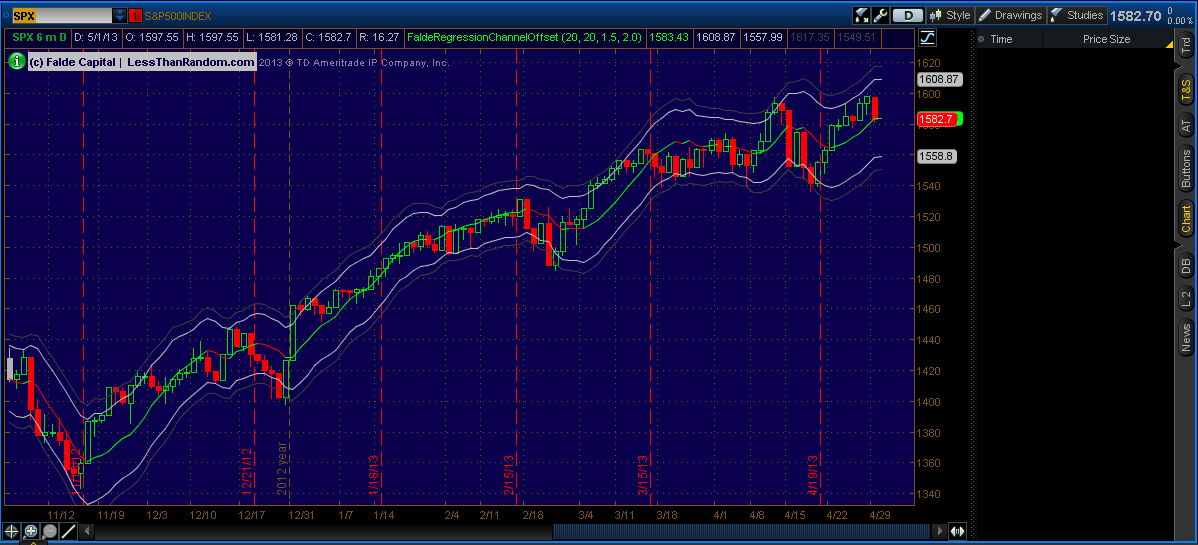

The LRC Channel has a twofold purpose. First, you can use it to leg into index credit spreads with higher statistical probability of success. Second, you can use the direction of the LRC (linear regression curve) to trade the trends in individual stocks. Here is a recent example:

The center line on $C (Citigroup Inc) indicated a long trend direction on April 9. On May 1, the curve turned down indicating a reversal in trend direction. The total run up on $C was 8.6% but the trend netted a 4.45% move. This type of “give back” is very common with trend following. To offset this give back we can hedge the position with $SPX which is much less likely to see the 5% to 10% moves that $C can generate.

Using the same LRC Channel indicator we can sell a Call Credit Spread when $SPX approaches the upper band of the channel which occurred on April 10. At the close of April 10, the 1600/1625 May Call Credit Spread was priced at $7.50 ($750 credit per contract) with a max loss of $1,250. As of market close yesterday, the credit spread was priced at $5.00 which is $250 profit per contract, or 20% of max loss.

As a general rule, I prefer to apply 1/3rd leverage to my options positions, so the nominal trades represent 4.45% in $C and 6.67% in $SPX. Theoretically, if the market really took off to the upside, then a trader may expect individual stocks that are in a bullish trend to outperform the broad based index. On the other hand, if the market had turned down quickly, a trader may experience losses while transitioning to short trend positions, but the $SPX credit spread would have helped offset that cost.

SMB is currently in production of a course to teach traders how to enter, manage, and exit $SPX credit spreads using the LRC Channel. In the meantime, you may watch the following video that explains the statistics and back testing results of this credit spread strategy.

Andrew Falde

Managing Director of Falde Capital Management, Founder of LessThanRandom.com, and a contributor to SMB Training

No relevant positions.

Please sign up below to learn more about the LRC Channel and to receive information about the upcoming course. You will also receive a pre-launch discount on our new video series.