Traders,

I look forward to sharing some of my top ideas as we head into this week.

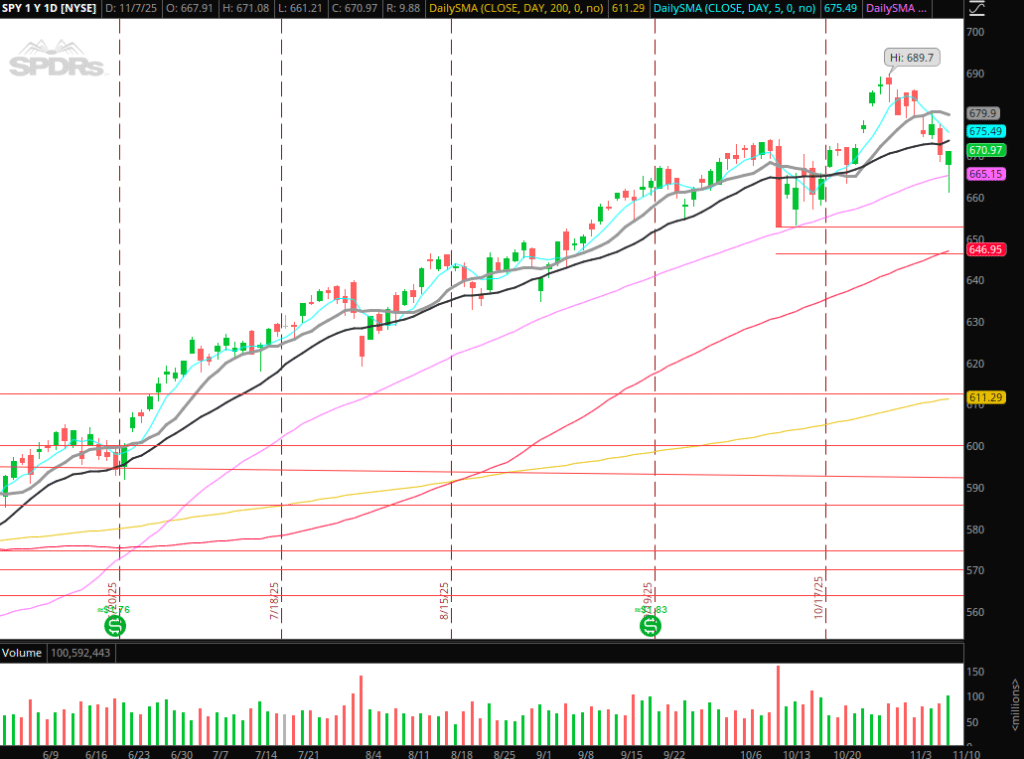

First, some general thoughts about the current market. It’s a trader’s market right now. By that, I mean the current tape is best suited for Move2Move trading rather than position/swing trading. That was the big adjustment I discussed in my recent IA meeting. Now, although the market found some support on Friday, I think it’s far too soon to say whether that’s it for the pullback. Friday’s low is the all-important level going forward in SPY. Now, let’s see if the bounce has legs toward the 10 – 20-day, and whether a move is sustained or puts in a lower high.

Given the uncertainty and change in action and tape, my watchlist is more reactive and focused on move2move trading:

Reactive Trades in the Market: Alright, concerning SPY / QQQ / TQQQ, I’m primarily interested in seeing how we act on a push toward the 20-day, initially near 673, and the 5-day, near 675. Should we hold above those levels, that could shift my mindset to greater preparation for stocks in bases and looking for a potential higher low and continuation in the market. Similarly, if we push toward the 50-day and confirm a higher low, I might look to scalp longs intraday. Alternatively, suppose we fail on a push toward the SMAs above and begin to hold in the lower end of Friday’s range. In that case, I’ll be primarily focused on short opportunities, both intraday and swing for another leg lower. It’s 50-50 right now, so I’m placing a ton of emphasis on Move2Move trading and on reduced size and risk until greater clarity emerges.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

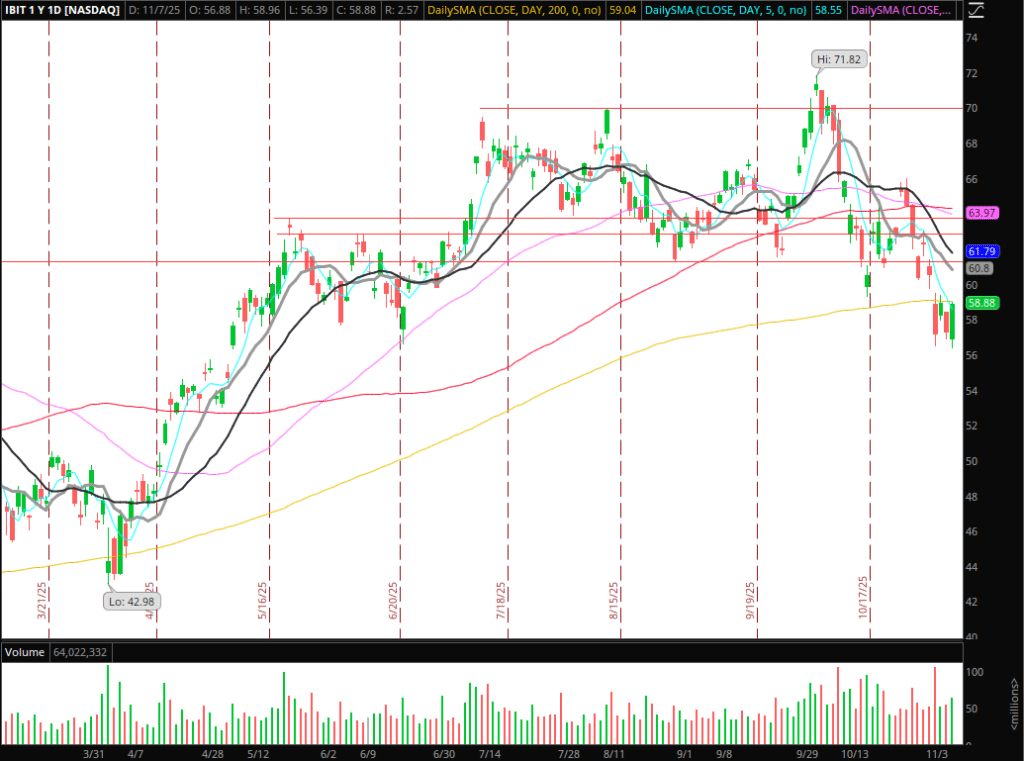

Relative Strength in Crypto: Similarly, in crypto, I’m open-minded. However, Friday’s bottom and relative strength across Ethereum and Bitcoin are noteworthy. That leads me first to be open to looking for a higher low against Friday and r/s. If that confirms, I’d look for intraday momentum long scalps. Thinking ahead, if we follow through toward the declining 10-day and fail, and show signs of relative weakness, I’d be looking for short positioning trades.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

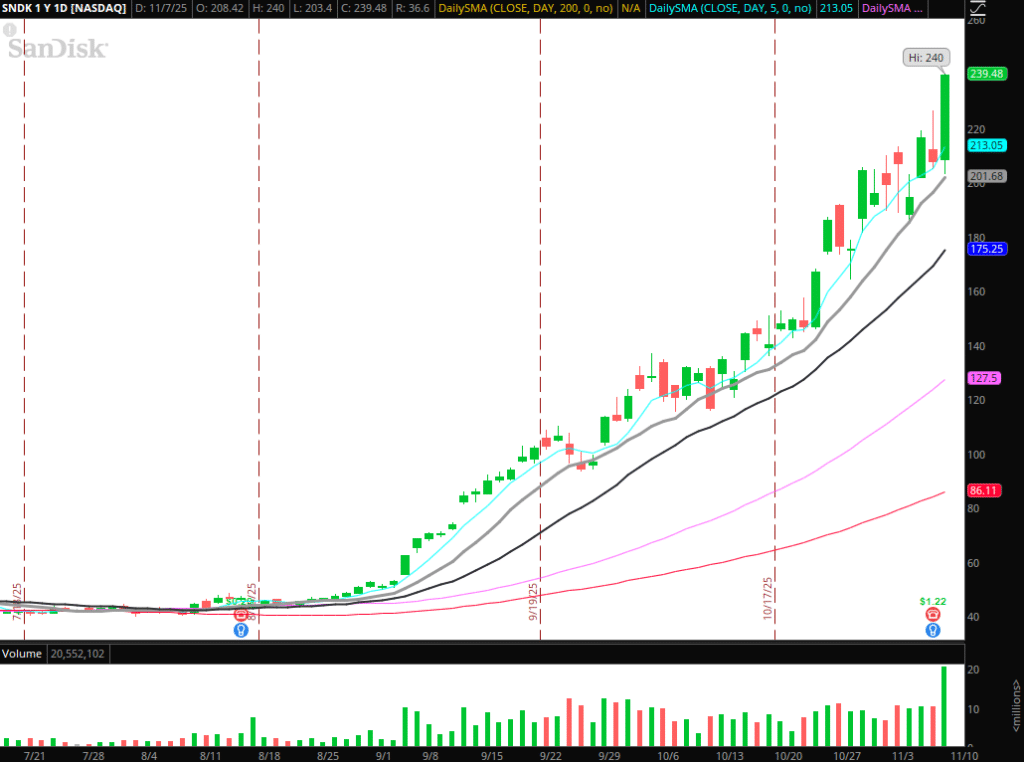

Mean Reversion in SNDK: Lovely trap and follow-through to the upside on Friday. A lot of shorts were caught off guard imo. I’d love another day or two of upside continuation and range + volume expansion to turn this into an A+ short opportunity. Alternatively, on market weakness and a gap down in SNDK, I’d be looking for a FRD setup and all-day short with a core position for a potential 10-day re-test.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

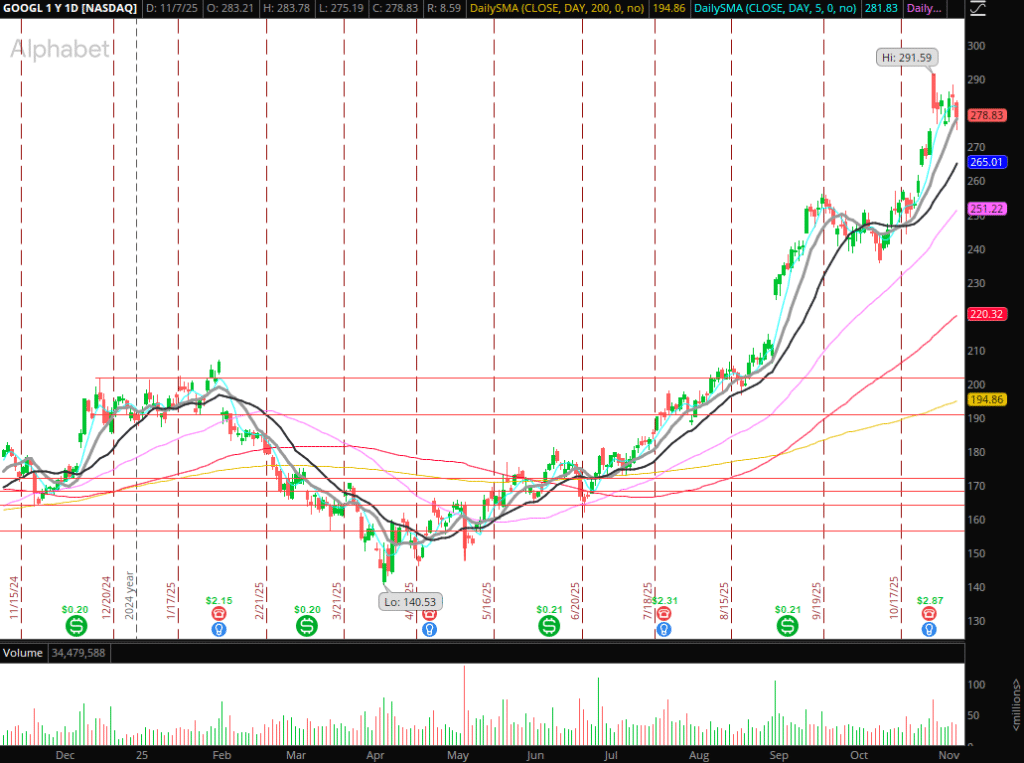

Relative Strength in GOOGL: No actionable trade yet, BUT the relative strength is certainly shining through. This is on watch in case the market confirms a higher low and breaks its mini-downtrend resistance. If so, I’d be looking for a long swing in GOOGL above its consolidation resistance.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

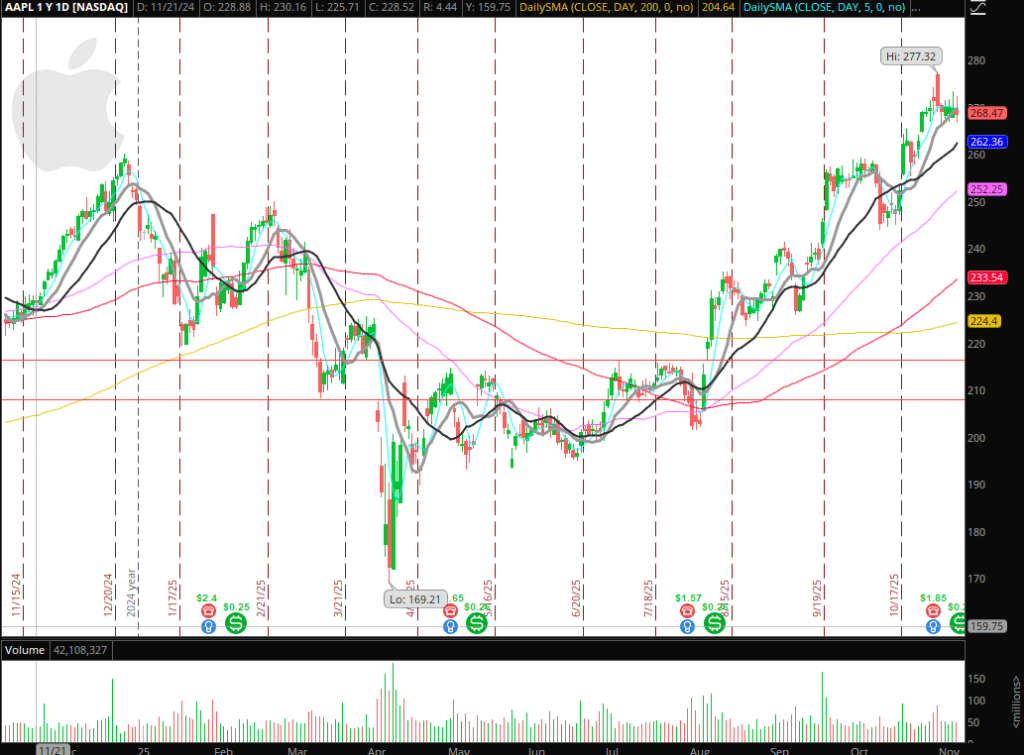

Relative Strength in AAPL: Almost identical to my thoughts on GOOGL, I’m just monitoring AAPL in case the market turns higher. Alternatively, if AAPL begins to take out last week’s support, I’d be open to shorts intraday as long as the relative weakness signs through. IF/THEN statements are emphasized here.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

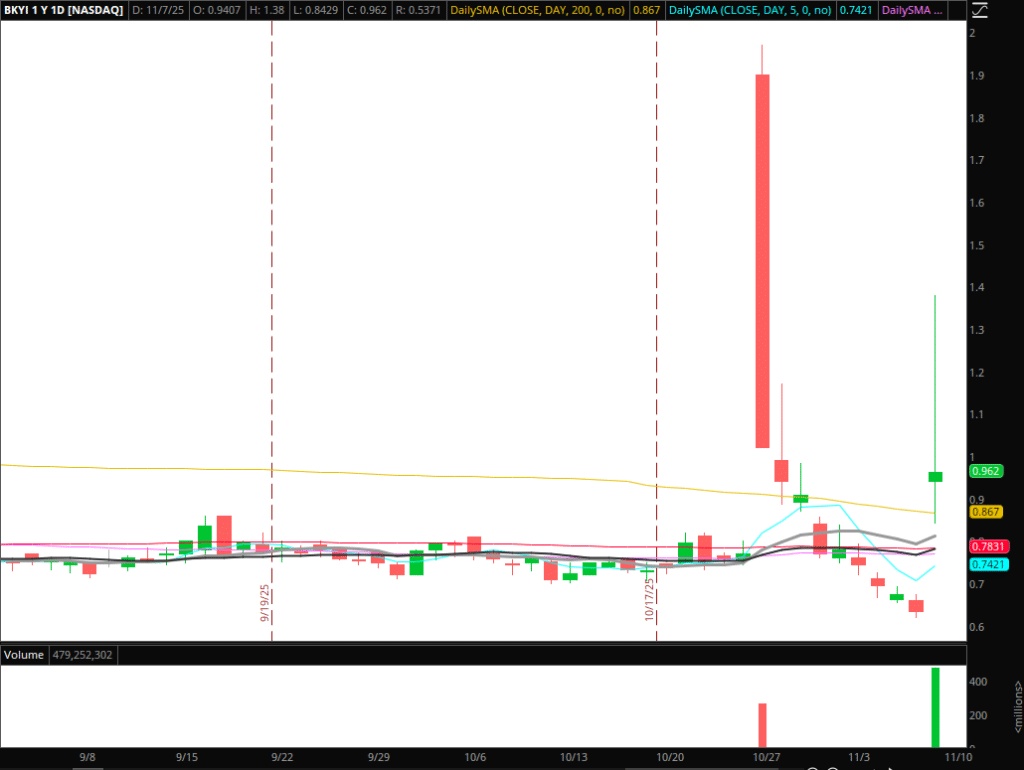

Pops to Short in BKYI: This one likely doesn’t materialize for me; however, it’s worth setting some alerts. Fantastic volume and trader on Friday. Therefore, with the overhead from Friday and the prior run, I’d love another opportunity to short if this were to pop back over 1 – 1.20 and fail convincingly. In that scenario, I would short against the intraday HOD for a trade back toward .80.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.