I was off the desk today travelling and visiting with family, but checked in several times to see how our traders were doing. It was an exciting day in the market. It is the type of day you typically see only a handful of times each year and as a short term trader you dream about being able to “crush it” … Read More

My Thought Process: $BHP

BHP was gapping lower and trading very actively in the pre-market. This message was to highlight it would be one of the best stocks to trade on the Open and my bias would be informed on which side of 78.50 it started the day. I initiated a short right on the Open against a 78.36 seller. This was the first … Read More

Did The SEC Overreach in Freezing HNZ Account?

I read an interesting piece on the CNBC website by John Carney regarding the SEC freezing the assets of a Goldman trading account that made a very suspicious trade in HNZ options right before the takeover was announced. John raised the idea that the SEC is overreaching by freezing the assets of the account without any evidence beyond the suspicious … Read More

Should Short Term Traders Consider News–Part III

On Friday I was chatting with a non-SMB prop trader that I trained several years ago. He was long DLTR when the WMT “news” broke around 2:00PM. From the chat messages you can see that we were in agreement that there was a short term “fading” opportunity in the retail names that had been quickly hammered based on a leaked … Read More

SMB Trade of the Week: Failed Breakout (CMCSA)

For the intraday trader we look for opportunities where stocks are: 1) Clean 2) Trend 3) Wound up to move 4) Controllable, meaning you can control your risk 5) Scaleable, meaning you can add significant size In our SMB Trade of the Week we had all of these. See the power point slides above. Would you have made this … Read More

What is a Counter-trend Trade?

The counter-trend trade has been the trade of the year thus far in the market. The trade is expressed via a long position in the SPY after a down move to recent support. The idea behind this trade is the market has a strong underlying bid and when it pulls back to a prior support level buyers will step into … Read More

How Are Those New Year’s Resolutions Going?

Maybe it’s the bubbles in champagne, or the sound of the cork popping, but New Year’s always brings out a rush of emotions. The end of one year naturally lends itself to reflection on the past. As the calendar turns over, people wax lyrical about another year passing. Taking stock of the past year, people figure out where they are … Read More

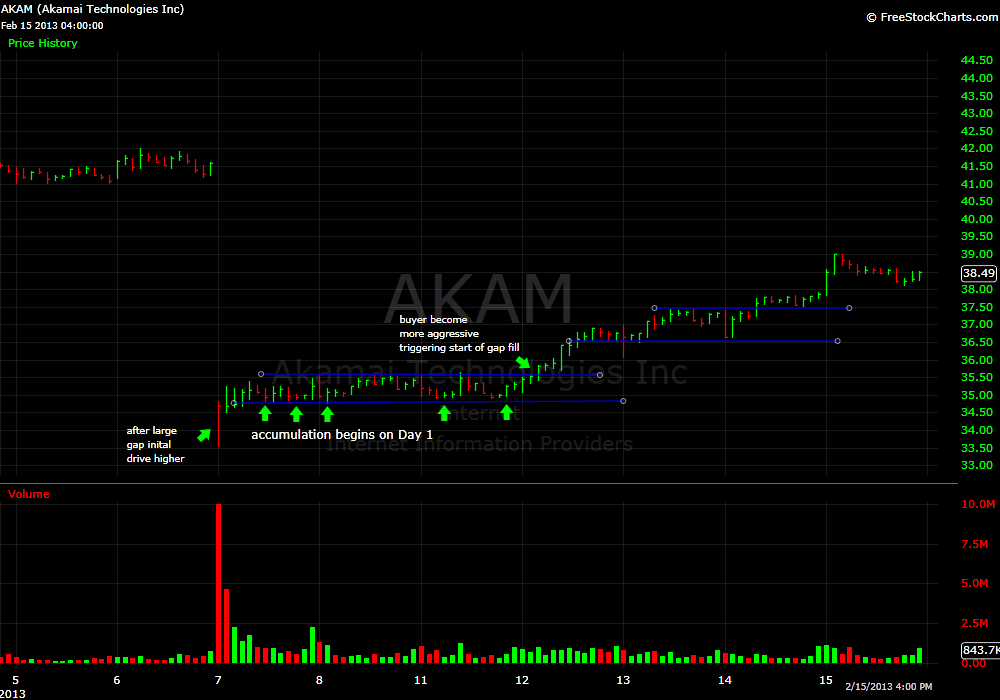

Not So Fast

One of the more common patterns seen in a strong market are longer term players buying stocks that have gapped lower after earnings. Sometimes this plays out on Day 1 with momentum buyers aggressively buying the stock leading to a gap fill. But many times a gap fill will play out in the days following the earnings release once the … Read More