The theme for Steve Spencer’s 2012 Webinar Series will be “Do The Right Thing”. The first Webinar of the year will break down several recent trading setups and how following a higher time frame trend can make you more money and cause you less heartache. As short term traders it is easy to flip back and forth betwen 1, 5 … Read More

Free Options Webinar: SMB’s Options Tribe: Today, February 14, 2012 at 5pm EST: Using Regression Analysis for Higher Probability Credit Spreads.

Today, February 14, 2011 at 5:00 pm Eastern Standard Time SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by veteran options traders and experts in the world of options … Read More

Nasty Is As Nasty Does

On February 7th we discussed CSTR in the AM Meeting. It was gapping higher on a better than expected earnings announcement. But the price action in the pre-market was erratic. There were no clear pre-market trends and when it moved above/below s/r levels it would quickly reverse. This is a stock that I will not touch on the Open. Stocks … Read More

I Deserved To Lose More

(post originally written February 10th 2012) We identified FSLR as an In Play stock this morning (link to story from Benzinga Pro). It was gapping lower in the pre-market to a recent support level. As a trader part of my job is to figure out what other traders and investors will do in any given situation. In the case of … Read More

PEP refreshing on the open trade

PEP (Pepsico, Inc.) offered an easy momentum trade on the open. INTRADAY FUNDAMENTALS PepsiCo fell 4.3 percent to $63.87 at 9:57 a.m. in New York. The shares rose 1.6 percent last year, while Coca-Cola gained 6.4 percent. Fourth-quarter net income advanced to $1.42 billion, or 89 cents a share, from $1.37 billion, or 85 cents, a year earlier, PepsiCo said … Read More

Free Options Webinar: SMB’s Options Tribe: Tuesday, February 14, 2012 at 5pm EST: Using Regression Analysis for Higher Probability Credit Spreads.

Tuesday February 14, 2011 at 5:00 pm Eastern Standard Time SMB’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each week the community will meet online for the primary purpose of watching live presentations made by veteran options traders and experts in the world of options … Read More

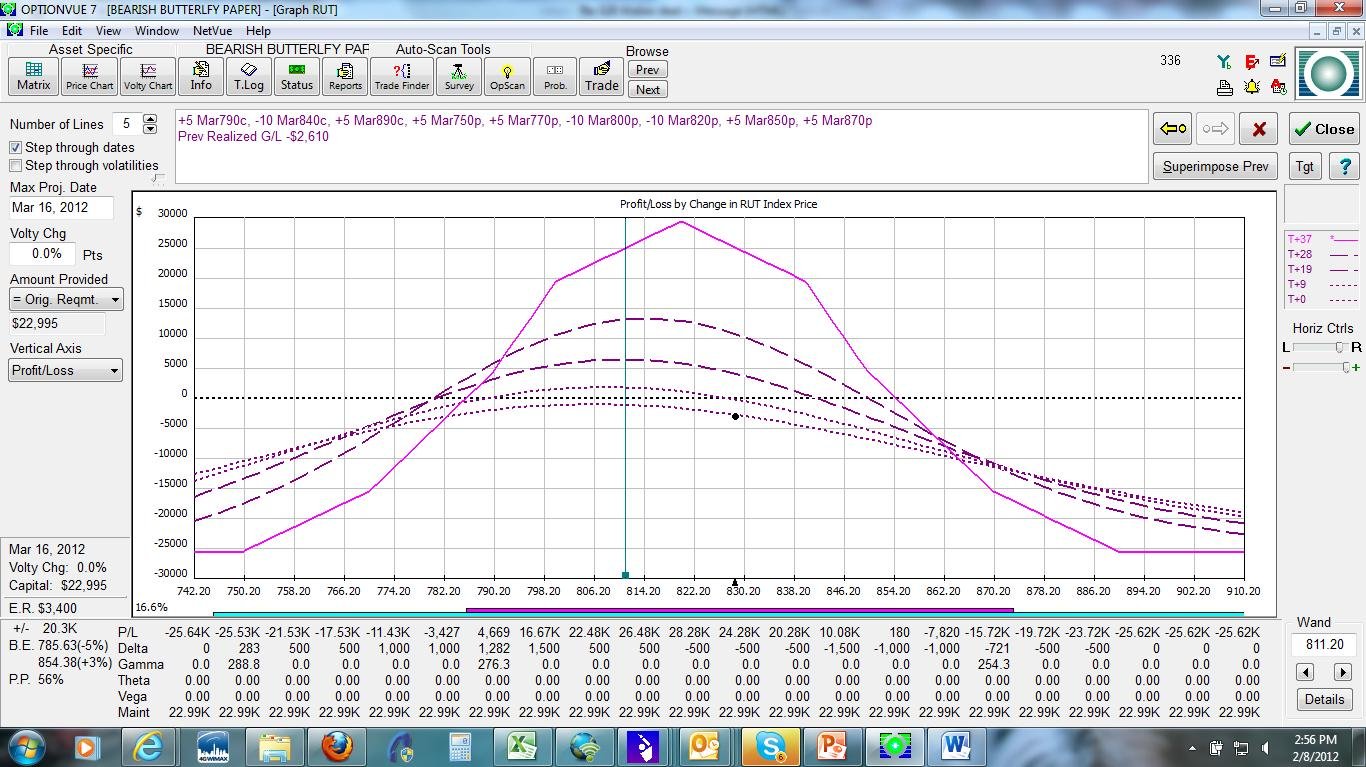

The March Bearish Butterfly–the wheels of the $RUT grinds slowly upwards

This post is the second in a series that we will be publishing over the next several weeks, tracking the hypothetical performance of the bearish butterfly trade as it would have been handled according to our guidelines contained in SMB’s Bearish Butterfly Video Series. In the law there is an expression, “the wheels of justice grind slowly”. To bearish butterfly … Read More

Make this losing trade (YUM)

Yesterday in YUM I made One Good Trade which was One Losing Trading. On the open YUM settled in a battle 64.80 by 65. Young Leo called out the fight and I took notice. Also YUM was In Play showing premarket strength and gapping up. YUM broke above the opening range battle and shot up to 65.70. This was a … Read More